Indonesia to Prepare Positive Investment List

- Indonesia’s government is preparing a draft Presidential Regulation on investment business fields — dubbed the positive investment list.

- The positive investment list will reduce the number of sectors restricted to foreign investors.

- This is part of the government’s latest omnibus law, which introduces sweeping reforms to improve Indonesia’s business and investment climate.

Indonesia’s government is preparing to issue Presidential Regulation (PR) on investment business fields — dubbed the positive investment list — which aims to reduce the number of business sectors restricted to foreign investors.

The positive investment list is part of the sweeping reforms introduced in Indonesia’s omnibus bill — currently being challenged at the Constitutional Court — is set to replace the negative investment list.

This latest regulation will promote investments in priority industries, simplify investment requirements, and provide greater protection to cooperatives and micro, small, and medium-sized enterprises (MSMEs).Foreign investors should note that the regulation is still being drafted and therefore further changes could be introduced.

What business fields are open to investment?

Under the PR draft regulation, most business fields are open to foreign investments unless they are declared closed by the government or are activities that can only be conducted by the central government.

The government will classify the business fields open to investments into four types:

- Priority business fields;

- Business fields that are for or require partnerships with cooperatives and SMEs;

- Business fields that stipulate specific requirements; and

- Business fields that do not fall under the above categories (this is open to all investors without restrictions).

Priority business fields

For a business field to be defined as a ‘priority’, it must meet the following criteria:

- Must be included as a strategic national project/program;

- Must be labor intensive;

- Must be capital intensive;

- Must be oriented towards research and development, and other innovative activities;

- Must be export-oriented;

- Must involve a pioneer industry (metals, oil refining, renewables, marine transportation, etc.); and

- Must utilize advanced technologies.

Businesses investing in priority business fields will be eligible to receive fiscal incentives, such as tax holidays, allowances, import duty exemptions, and/or non-fiscal incentives in the form of ease of attaining business licenses, work permits, and supporting infrastructure.

Business fields that are allocated to or require partnerships with SMEs

This category pertains to business fields either allocated to or requires partnerships with SMEs. The category is divided into two:

- Business fields that are allocated for cooperatives or SMEs; and

- Business fields that involve large-scale companies in mandatory partnerships with cooperatives or SMEs.

Point 1 is determined by the following criteria:

- The capital required for business activities must not exceed 10 billion rupiah (US$709,000). This excludes land and property;

- The business field must not utilize advanced technologies; and

- The business sector must be labor-intensive and is characterized by a special cultural heritage.

The criteria for point 2 are as follows:

- The business sector must be traditionally occupied by cooperatives or SMEs; and

- The sector has the potential to scale up to enter the larger supply chain.

The draft regulation stipulates that foreign investors can only carry out business activities in the form of a foreign investment company (PT PMA), and must be large-scale companies, willing to invest over 10 billion rupiah (US$709,000). This is excluding the value of land and property.

They, therefore, are obligated to establish partnerships with such SMEs under point 2. This can be in the form of human resources training, market growth endorsements, easing access to financing, and enhancing the competitiveness of the SME, among others.

Foreign investors that can invest below the 10 billion-rupiah (US$709,000) threshold are those with business activities in special economic zones or are engaging in technology-based startups.

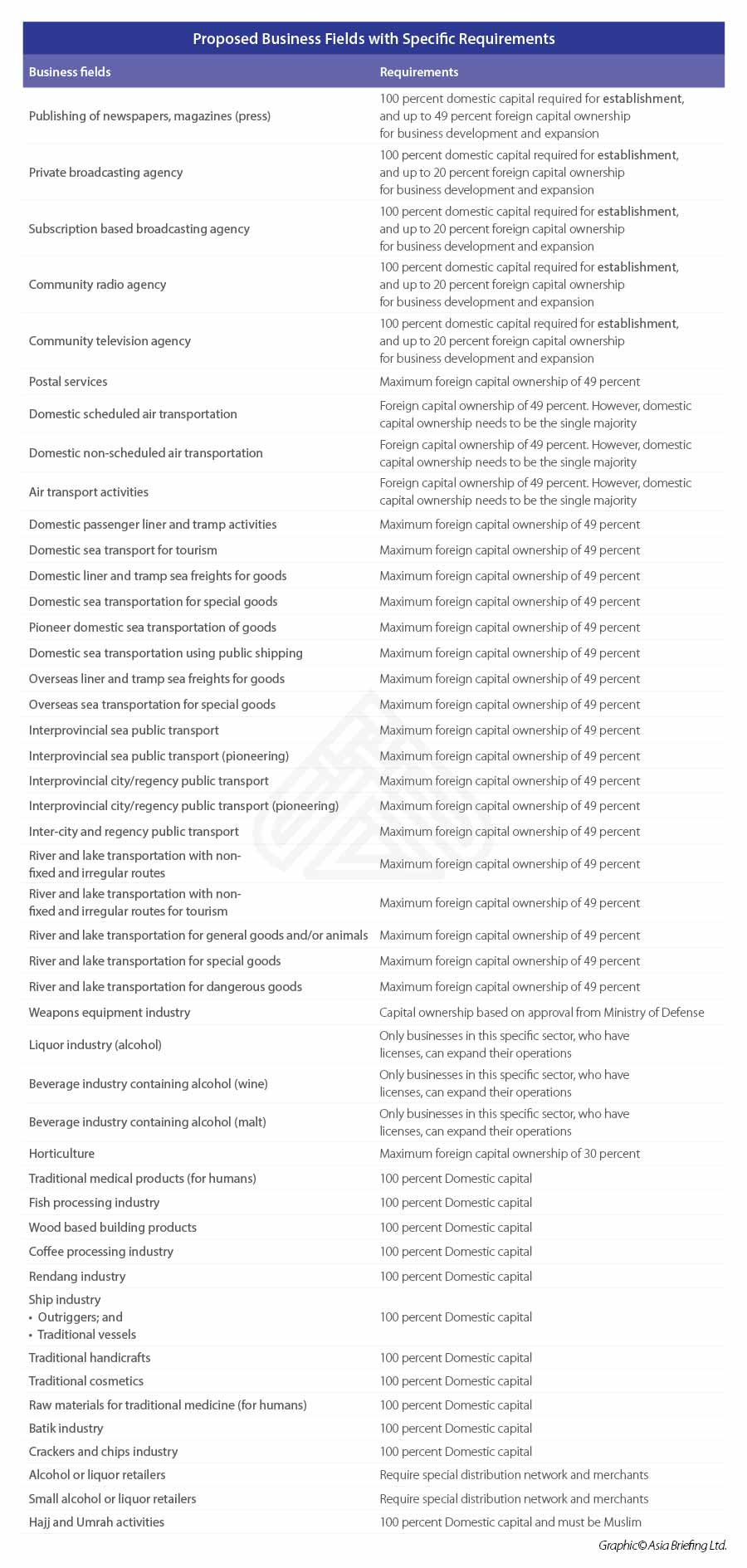

Business fields that require specific requirements

Business fields under this category are open to all investors but have the following requirements:

- Investment capital requirements for domestic investors; or

- Limited investment capital requirements for foreign investors. These said limitations may be exempt for the following

- Investments are in the form of non-direct investments taken through the Indonesian stock exchange;

- The investments are conducted in special economic zones;

- Investors who have been granted special rights based on agreements between their countries and Indonesia; and/or

- Investments carried out before the promulgation of the draft regulation.

- Investments that require special licenses.

What business activities are closed for investments?

Under the draft regulation, there are six business sectors closed for investments for both domestic and foreign companies. These are:

- Class-I narcotics and cultivation;

- All forms of gambling activities;

- Fishing of endangered species;

- Utilization of corals found in nature for the production of jewelry, souvenirs, building materials, etc.;

- Chemical weapons production; and

- Industrial ozone-depleting substances industries and industrial chemicals.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.