Indonesia Issues New Regulation on Investment Activity Reports

- Indonesia’s Investment Coordinating Board (BKPM) issued regulation (BKPM Reg 6/2020), which pertains to the submission of investment activity reports (LKPM) by foreign companies.

- Certain foreign companies are obligated to submit an LKPM report to the BKPM, which highlights the achievements and constraints experienced by foreign investors in Indonesia.

- The BKPM will compile and analyze these reports to better understand the challenges foreign companies face in Indonesia.

- The new regulation determines which companies are obligated to submit an LKPM report and the sanctions for not submitting one.

- Further, the whole process is now done via the Online Single Submission system managed by the BKPM.

Indonesia’s Investment Coordinating Board (BKPM) issued BKPM Regulation No. 6 of 2020 (BKPM Reg 6/2020), which provides the guidelines on the mechanisms and obligations for foreign businesses to submit their investment activity report (LKPM) to the BKPM.

An LKPM investment activity report is a report compiled by a foreign company highlighting any achievements and constraints of their business operations in Indonesia. The BKPM will compile and analyze these reports to provide solutions to the challenges foreign businesses face in Indonesia. Not all businesses are required to submit an LKPM report but for those that are obligated, there is a deadline for submissions based on the value of the businesses’ total investment.BKPM Reg 6/2020 introduces changes to the period for LKPM submission for foreign investment companies (PT PMA) in Indonesia, in addition to migrating the submission process to a new online system. Finally, there are stricter administrative sanctions for businesses that do not submit their LKPM report within the deadline.

Who is obligated to submit an LKPM report?

Most foreign investment companies, depending on the value of their investments, are obligated to submit an LKPM report. The table highlights below.

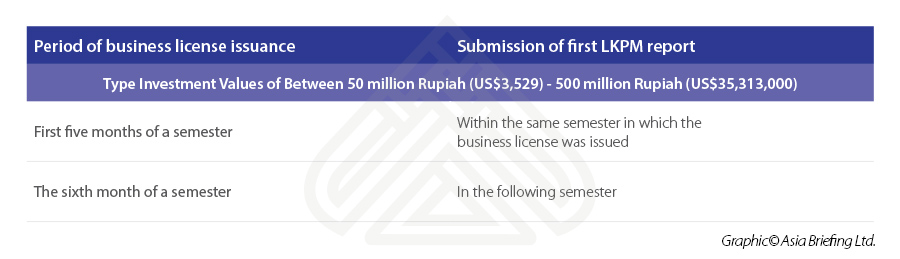

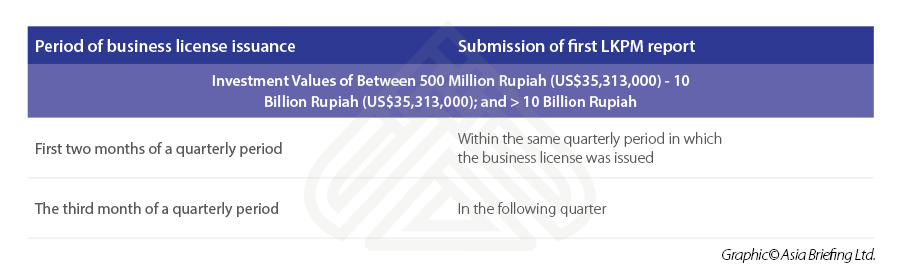

The first LKPM submission

The period of a company’s first submission of their LKPM report will depend on when they were first issued a business license by the BKPM as well as the value of their investments.

Who is not obligated to submit an LKPM report?

The new regulation also highlighted the criteria for businesses to not have to submit an LKPM report. These are as follows:

- Have an investment of less than 50 million rupiah (US$4,529);

- Businesses operating in the oil and gas industry;

- Businesses operating in the banking industry;

- Businesses operating in the non-banking financial industry; and

- Business operating in the insurance industry.

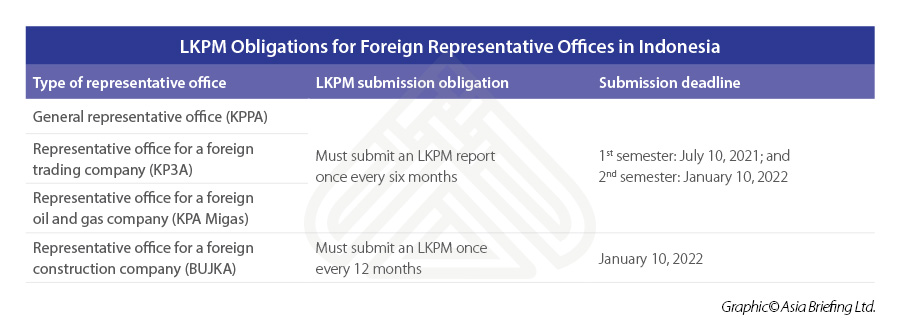

What about representative offices?

Foreign investors that have established representative offices are still obligated to submit their LKPM report.

What are the sanctions for not submitting an LKPM report?

Businesses that fail to submit an LKPM report are liable for the following sanctions:

- Cancellation or revocation of business licenses;

- Revocation of KPPA, KP3A, KPA Migas, KP-BUJKA, franchise registration certificates;

- Closure of administrative branch offices; and

- The imposition of administrative sanctions.

Submission of the LKPM report

Foreign companies can now submit their LKPM report from the new Online Single Submission (OSS) system. Companies looking to obtain a business license will also need to utilize the OSS system.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com