Indirect Tax and Stamp Duty Measures in Malaysia for 2021

- Malaysia has introduced a variety of indirect tax and stamp duty measures that businesses should be aware of in 2021.

- First time homeowners are now exempt from certain stamp duty charges on certain property prices and there is an extension on the sales tax exemption of locally assembled buses until December 2022.

As part of the 2021 national budget, Malaysia has issued various new incentives and measures in relation to indirect tax and stamp duty.

First time homeowners are now exempt from certain stamp duty charges if the property is valued at no more than 500,000 ringgit (US$123,724), and from July 2021, a tourism tax of 10 ringgit (US$2.47) per night will be levied on non-Malaysian tourists.

The government has allocated 322 billion ringgit (US$79.6 billion), or 20 percent of the GDP, in its latest national budget, considered to be the largest in the nation’s history. There are a variety of tax incentives for businesses and individuals in the form of reliefs and tax holidays aimed at mitigating the economic impact caused by the pandemic for the coming year.

Indirect tax

Increase of annual sales threshold for activities in the FIZ and LMW

At present, approval for any value-added/additional activities carried out in Free Industrial Zones (FIZ) and Licensed Manufacturing Warehouses (LMW) are subject to the condition that the value-added activities do not exceed 10 percent of the company’s annual sales turnover.

The government has increased the 10 percent annual sales value threshold to 40 percent of the company’s annual sales turnover. This relaxation gives companies more flexibility to diversify their operations and restructure their supply in response to the current dynamic business environment.

Expansion of tourism tax

From July 2021, tourism tax will be implemented and expanded to include accommodation reserved through online platforms. Under the PENJANA stimulus package, the tourism tax is fully exempt until June 2021.

The tax of 10 ringgit (US$2.47) per night usually levied on non-Malaysian and non-permanent resident tourists, staying in registered accommodation.

Proposal to broaden the AEO facility status

An Authorized Economic Operator (AEO) status is normally given to importers, exporters, manufacturers, and traders in Malaysia.

Obtaining this status means a business can enjoy the fast clearance of goods from customs control, deferred payment of import and export duties, and sales tax. The government has proposed broadening the AEO facility to include approved logistics service providers and warehouse operators.

This, in turn, will lower the cost of doing business for more sectors in the country. Investors should be aware that an implementation date has yet to be announced for this facility.

Exemption of sales tax on locally assembled buses

The government has extended the sales tax exemption of locally assembled buses until December 31, 2022.

The exemption also includes the purchase of bus components, such as air conditioners and chassis.

New excise duty on electronic and non-electronic smoking devices

Effective from January 1, 2021, there is a 10 percent excise duty on all electronic and non-electronic smoking devices, including vape. The liquid used in electronic cigarettes will be levied at the rate of 40 cents/ml (US$0.09)

Tougher controls on cigarette imports

With Malaysia annually losing some 5 billion ringgit (US$1.2 billion) in indirect taxes due to illegal imports, the government has decided to impose tougher controls for the import of cigarettes.

The new control measures, effective from January 1, 2021, are:

- All new import license applications to be frozen;

- Renewal of cigarette import licenses to be tightly reviewed, such as through the imposition of an import quota;

- Cigarettes imported for the purpose of transshipment to be subject to duties;

- Exports of cigarettes using local crafts are banned; and

- Cigarettes and tobacco products imported to duty free islands to be subject to duties.

Stamp duty

Exemptions on stamp duty for first residential property

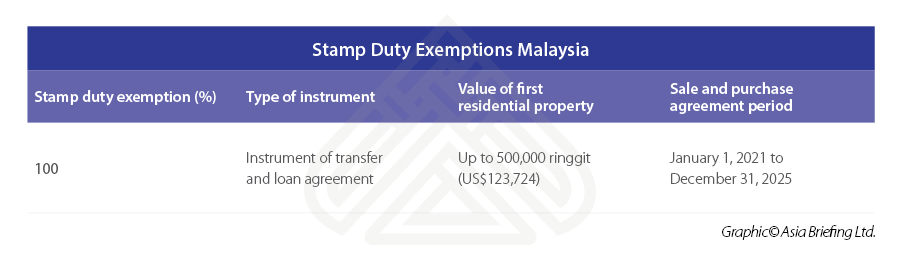

In order to receive full stamp duty exemption on the instrument of transfer and loan agreement for the purchase of a residential property in Malaysia, the property must be valued up to 500,000 ringgit (US$123,724).

This is only available for Malaysian citizens and is eligible on the purchase of the first residential property.

Extension of stamp duty exemptions for abandoned housing projects

Contractors and developers involved in reviving abandoned housing projects are eligible for stamp duty exemption on loan agreements and instruments of transfer. The abandoned housing project must be first approved by the Ministry of Housing and Local Government.

This incentive has been extended until December 31, 2025.

Stamp duty extension for Exchange Traded Fund

The stamp duty exemption for the Exchange Traded Fund (ETF) has been extended until December 31, 2025.

ETFs are securities traded on an exchange (in this case, Bursa Malaysia). Investors can buy or sell ETFs through licensed stockbrokers.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.