ASEAN Regulatory Brief: Philippines Disaster Coverage, Cambodia Tax Amendments, and Singapore-Laos DTAA

In this week’s ASEAN Regulatory Brief, we highlight Philippines’ Disaster Insurance Cover proposals, upcoming amendments to Cambodia’s tax regime, and details of the recently concluded Singapore-Laos Double Taxation Avoidance Agreement.

ASEAN Market Watch: Philippines Manufacturing, Cambodia Agriculture, and Indonesia’s Textile Industry

In this week’s ASEAN Market Watch, we discuss the continued growth of Philippines’ manufacturing sector, highlight Cambodia’s agricultural cooperation with China, and analyze the Indonesian government’s recent moves to boost the country’s textile industry.

ASEAN Regulatory Brief: Singapore GST Audits, Philippines Dormant Bank Accounts, and Malaysia-China Bilateral Ties

In this week’s ASEAN Regulatory Brief, we highlight Singapore’s GST audits, rules on dormant deposits in the Philippines and Malaysia’s bilateral relations with China.

ASEAN Regulatory Brief: Money Laundering Regulations in Thailand, Philippine Monetary Allowances, and Private Jets in Indonesia

In this week’s ASEAN Regulatory Brief we discuss Thai money laundering legislation, analyze increased Philippine monetary allowances, and highlight and private jet flights in Indonesia

Philippine Tax Amnesty Proposed in a Bid to Increase Revenue Collection

A Philippine tax amnesty has been proposed in an effort to increase state collections and mitigate reduced revenues projected in the wake of planned corporate tax reductions. Understand the terms of the amnesty and how you may qualify for relief.

ASEAN Market Watch: Fintech in Singapore, Declining Philippine Exports, and Google’s Tax Troubles in Indonesia

In this week’s ASEAN Market Watch we discuss fintech in Singapore, analyze declining Philippine exports, and highlight Google’s tax troubles in Indonesia

ASEAN Regulatory Brief: Tax Evasion in Singapore, Business Registration in the Philippines, and Indonesian Banking Rules

In this week’s ASEAN Regulatory Brief we highlight Singapore’s recent tax evasion agreement with Australia, discuss streamlined business registration in the Philippines and Indonesian banking rules

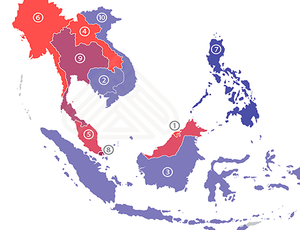

Indirect Taxation Across ASEAN

VAT and GST rates within ASEAN vary widely between member states – from 12 percent in the Philippines to countries which do not currently levy these taxes at all, such as Laos and Myanmar. For those considering investment, GST, VAT, and other taxation tied to the purchase of specific goods should be watched closely.

The Philippines Resumes Tax Audits Following Internal Review

The Philippines has announced the resumption of field audits from the Philippine Bureau of Internal revenue. Understand how the functions of the BIR have changed and what field audits will mean for your Investments.

ASEAN Market Watch: Indian SEZs in Myanmar, US Increasing Engagement in Cambodia, and Innovation in the Philippines

In this week’s ASEAN Market Watch we look at Indian sponsored SEZs in Myanmar, highlight Increasing US engagement in Cambodia, and discuss recent moves up the Global Innovation Index by the Philippines