Case Study: Routing Chilean Investments Through Singapore

By: David Lee, Manager Dezan Shira & Associates Singapore

For many companies, profits generated within ASEAN will need to be remitted to parent companies across the globe. Although remitting profits directly from centers of production can be accomplished, the cost of these transfers is often elevated in the absence of up to date DTAs. Singapore is a significant asset in this respect. With many DTAs in place and a 0 percent withholdings tax of its own on dividends, Singapore allows companies to remit profits from production centers at a lowered rate than would be normally possible and then pass profits on to a parent company without further reduction.

RELATED: International Tax Planning Services from Dezan Shira & Associates

RELATED: International Tax Planning Services from Dezan Shira & Associates

Indonesia to Chile

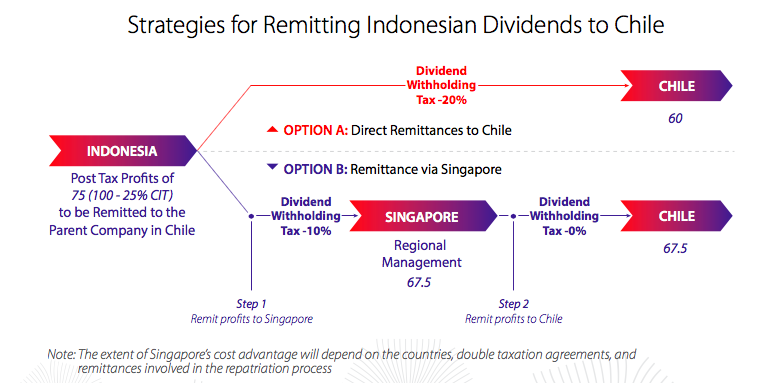

To illustrate the benefits of routing investments through Singapore, take the example of a Chilean investment in Indonesia. Under normal circumstances, Chilean investors would be subject to Indonesia’s corporate income tax of 25 percent in addition to Indonesia’s non treaty withholding rate of 20 percent – applied to dividends, interest and royalties. This would result in a realized profit of just 60 percent of the company’s gross total upon repatriation of these funds to the Chilean parent company.

Routing through Singapore

When routing the same investment through Singapore, investors would be subject to the same CIT rate but benefit from Singapore’s DTA with Indonesia which reduces withholdings on all fronts. Depending on the combination of remittances employed, up to a 12 percent increase in realized profit can be achieved as a result of the withholdings differential between an Indonesia – Chile remittance and an Indonesia – Singapore – Chile remittance. Sending dividends from Indonesia to Singapore would result in a 67.5 percent retention rate which, without a withholding on the part of Singapore, can be carried over to Chile.

|

|

Annual Audit and Compliance in ASEAN

For the first issue of our ASEAN Briefing Magazine, we look at the different audit and compliance regulations of five of the main economies in ASEAN. We firstly focus on the accounting standards, filing processes, and requirements for Indonesia, Malaysia, Thailand and the Philippines. We then provide similar information on Singapore, and offer a closer examination of the city-state’s generous audit exemptions for small-and-medium sized enterprises.

The Trans-Pacific Partnership and its Impact on Asian Markets

The Trans-Pacific Partnership and its Impact on Asian Markets

The United States backed Trans-Pacific Partnership Agreement (TPP) includes six Asian economies – Australia, Brunei, Japan, Malaysia, Singapore and Vietnam, while Indonesia has expressed a keen willingness to join. However, the agreement’s potential impact will affect many others, not least of all China. In this issue of Asia Briefing magazine, we examine where the TPP agreement stands right now, look at the potential impact of the participating nations, as well as examine how it will affect Asian economies that have not been included.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

- Previous Article ASEAN Market Watch: Thai Startups, Indonesian FDI, and BMW’s Malaysian Expansion

- Next Article The State of ASEAN Aviation in 2016

This article is an excerpt from the March & April issue of ASEAN Briefing Magazine, titled “

This article is an excerpt from the March & April issue of ASEAN Briefing Magazine, titled “