Bukalapak Becomes Indonesia’s First Listed Tech Unicorn

Indonesian e-commerce platform Bukalapak, became the country’s first listed tech unicorn as well as its largest as the company made its debut on the Indonesian Stock Exchange on August 6, 2021.

The company raised some US$1.5 billion in what is Indonesia’s biggest initial public offering (IPO), valuing the company at US$7.5 billion and placing them among the country’s 15 biggest companies. Bukalapak’s IPO showcases Indonesia’s vibrant market for tech unicorns and those homegrown companies can achieve a premium valuation.

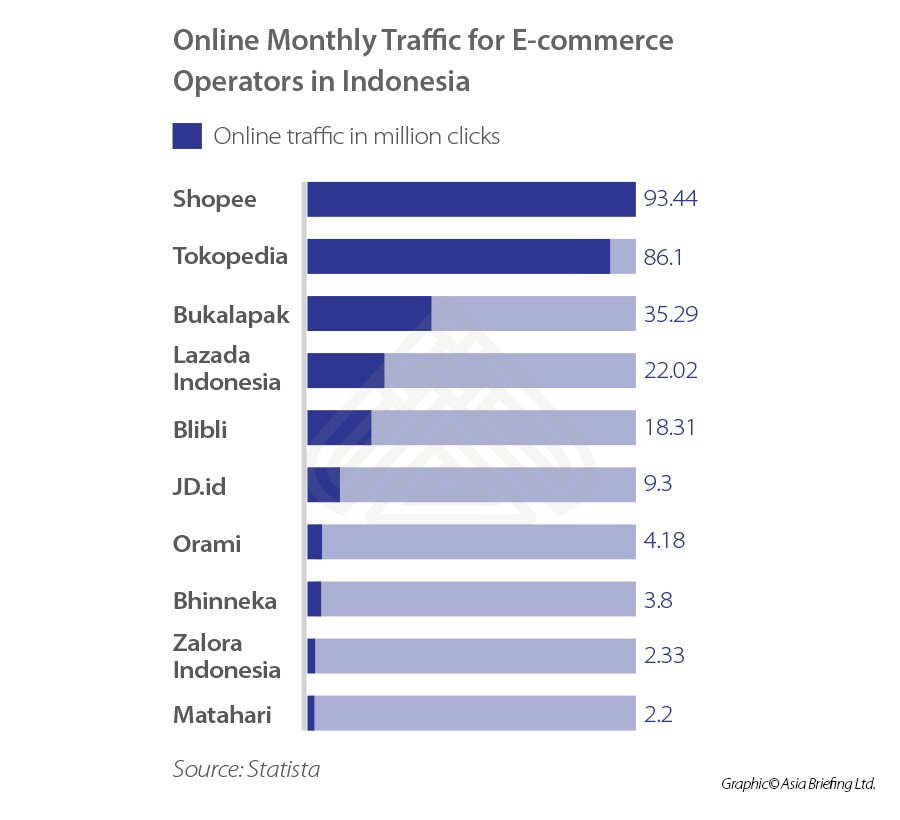

Founded in 2010, Bukalapak, which counts Microsoft and Ant Group among its backers, is benefitting from the rapid digitization of Indonesia’s economy during the pandemic. The company’s strategy has been to avoid competing with its larger rivals Tokopedia and Shopee in Indonesia’s metropolitan areas and instead has expanded in the country’s hinterlands.Bukalapak has partnered with some 500,000 shopkeepers who take cash from customers who are not connected to the internet and order their products online while taking a commission from Bukalapak.

How will the IPO impact Indonesia’s burgeoning digital economy?

The IPO sets the tone for another domestic tech IPOs. GoTo, created through the merger of Indonesia’s ride-hailing giant Gojek and Tokopedia in a US$18 billion deal, is also expected to go public in late 2021, in what is expected will be Indonesia’s biggest-ever IPO. GoTo has an estimated market valuation of between US$30 billion and US$40 billion.

Another Indonesian tech unicorn, Traveloka, which provides online airline and hotel booking services and Singapore’s Grab are looking to go public by merging with US special purpose acquisition companies (SPAC).

Indonesia is Southeast Asia’s largest and fastest-growing internet economy with more than 170 million accessing the internet in 2020.

The country’s home-grown major technology unicorns have seen exceptional growth in recent years, with some such as GoJek claiming to process 8 million orders per day.

- Gojek — an on-demand multi-service platform and digital payment company, valued at US$10 billion;

- Tokopedia — a technology company specializing in e-commerce, valued between US$8 to US$10 billion;

- Bukalapak — an e-commerce platform, valued between US$2.5 to US$3 billion;

- OVO — a digital payment and financial services platform, valued at US$2.9 billion;

- Traveloka — a company providing airline ticketing and hotel booking services, valued at US$2.75 billion; and

- ID — an e-commerce platform valued at US$1 billion.

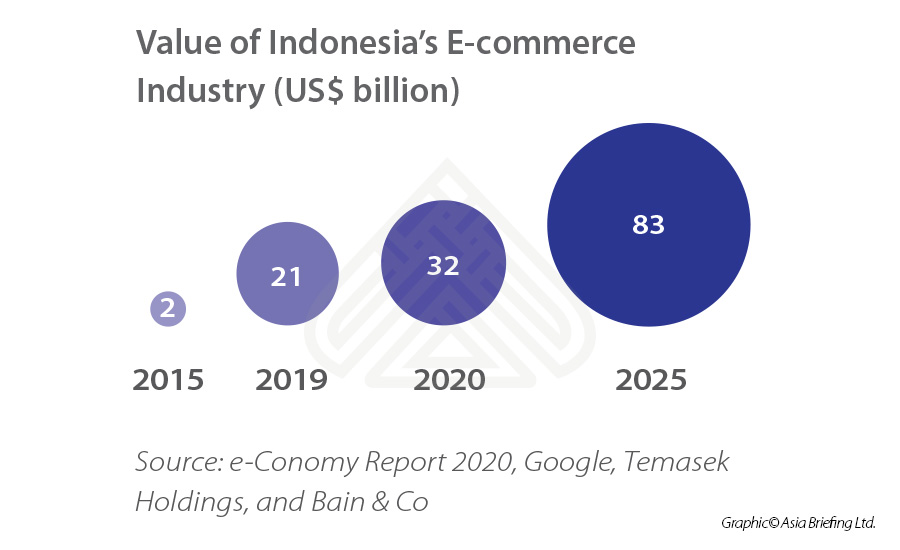

E-commerce has been the main driving force of Indonesia’s digital economy, and more than 10 percent of the country’s population of 270 million engages in online shopping. According to a 2020 report by Google, Temasek Holdings, and Bain & Company, Indonesia’s digital economy is expected to be valued at US$125 billion by 2025, largely powered by e-commerce, online travel, ride-hailing, and online media. The e-commerce sector is projected to grow to US$83 billion by 2025.

Collaborating with local platforms, such as Tokopedia and Bukalapak, could provide a route for international e-commerce brands or retailers to penetrate Indonesia’s retail market.

Opportunities in Indonesia’s financial technology sector

In addition to e-commerce, there are scalable opportunities in Indonesia’s financial technology (fintech) industry, particularly in e-wallets and peer-to-peer (P2P) lending.

The country saw a 173 percent increase in e-wallet transactions in 2020 and there are now more than 30 companies competing for the Indonesian market. Local players, such as GoPay, OVO, DANA, and LinkAja, are some of the frontrunners in the industry. GoPay (owned by Gojek) saw a gross transactional value of US$12 billion in 2020, whereas its regional rival Grab owns shares in OVO, which is used in over 115 million devices across over 300 cities nationwide.

Meanwhile, P2P businesses are providing financial access to many local micro, small and medium-sized enterprises, whose business models often are not compatible with the characteristics of traditional banking products. This includes aspects such as forms of collateral, credit quality, and payment terms for loans.

P2P lenders offer microloans, which, because of their convenience can be disbursed within 24 hours, and the terms are usually short and small — not more than $100. Through this financing model, P2P lenders can tap into the underbanked and unbanked population, which stands at approximately 47 million and 92 million, respectively. Indonesia’s Financial Services Authority has officially listed some 160 fintech companies.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.