An Overview of IFRS Adoption in ASEAN – Part Three

By: Dezan Shira & Associates

Editor: Maxfield Brown

In this final installment on the Association of South East Asian Nation’s (ASEAN) adoption of International financial reporting standards, ASEAN Briefing touches on the state of harmonization in the Philippines as well as the regional bloc’s frontier economies.

In this final installment on the Association of South East Asian Nation’s (ASEAN) adoption of International financial reporting standards, ASEAN Briefing touches on the state of harmonization in the Philippines as well as the regional bloc’s frontier economies.

Unlike previous installments, nations covered herein present divergent opportunities for investment. The Philippines – an original member of ASEAN 6 – has a long history of financial reporting requirements, and its transition from national GAAP to IFRS is largely representative of previously covered member states.

ASEAN’s frontier economies on the other hand offer investors a relatively blank slate. The absence of preexisting regulatory infrastructure has enhanced and – in several instances – allowed swift and uncompromised convergence with international standards to take place. Although implementation of IFRS promises to reduce compliance costs for wholly owned foreign investment projects, lagging local penetration of accounting practices among other issues mandates a careful selection of local partners.

Philippines

Following the passage of the Philippine Accountancy Act of 2004, regulation of financial reporting has been tasked to the Board of Accountancy (BOA), carried out by the Philippine Financial Reporting Standards Council (FRSC) – an organ of the BOA, and codified in Philippine Financial Reporting Standards (PFRS). Jointly responsible for upholding the regulations of its predecessor – the Accounting Standards Council (ASC) – and updating national GAAP, the FRSC is the most important actor to watch with regard to regulation of financial reporting within the Philippines.

While the FRSC acts as the guiding body for the creation and maintenance of PFRS, it is also important to note that The Philippine Securities and Exchange Commission (SEC) implements a separate accountancy framework – applied to listed and limited liability companies. This does allow for some degree independence from the FRSC and should therefore be considered when conducting due diligence.

Although opportunities for divergence between the SEC and FRSC do exist, SEC Rule 68 – 1(B) compels the Commission to mirror the FRSC whenever possible. Under this rule, the SEC is obligated to implement FRSC or IASB standards and is only permitted to deviate from this mandate in the event of a conflict between the aforementioned bodies. As a result PFRS and the SEC’s framework for accounting are nearly identical.

RELATED: Accounting and Reporting Services from Dezan Shira & Associates

RELATED: Accounting and Reporting Services from Dezan Shira & Associates

Convergence with IFRS

Culminating a process of convergence initiated in 1996 under the ASC, financial reporting standards in the Philippines have achieved full compliance with current effective IFRS.

Despite such a high degree of harmonization, limited changes to IFRS have been made in the past by Philippine authorities. The vast majority of these alterations regard changes to IAS effective dates and were implemented to optimize domestic industries’ transition to IFRS. As of 2015, companies seeking to comply with PFRS should not be effected by any such alterations.

Alternatively, those seeking to comply with the SEC’s accountancy framework should note limited changes to effective dates and guidance resulting from the commissions limited independence from the FRSC. As of 2015, the SEC has indefinitely deferred the mandatory effective date for the following international standards pending an evaluation by the FRSC:

- IFRIC 15 – Agreements for the Construction of Real Estate (introduced by the ISAB in 2014)

In addition to deferring effective dates, the SEC has also provided some implementation guidance that is not entirely consistent with that issued by the IASB. Companies involved in the following industries should note that reporting guidance in the Philippines may differ from that of international standards:

- Insurance (pre-need)

- Banks

- Mining

- Recipients of government grants

RELATED: An Overview of IFRS Adoption in ASEAN – Part One

RELATED: An Overview of IFRS Adoption in ASEAN – Part One

Continuing Convergence

As the IASB updates its standards to meet the world’s evolving needs, subsequent alterations and additions will be systematically introduced to the Philippines under the following set of steps:

- FRSC creates plan to adopt new standards as PFRS, with minor amendments to effective date or transition provisions when necessary.

- FRSC submits plan for adoption to the Board of Accountancy (BOA) for approval.

- Upon approval, BOA publishes PFRS updates – or resolution to approve adoption of new international standards – in the official gazette

- The SEC adopts PFRS updates as part of its rules and regulations on financial reporting.

IFRS for SMEs

As of 2015, The Philippines has adopted the IFRS for SMEs without modifications. These standards are codified in Philippines Financial Reporting Standard for SMEs (PFRS for SMEs) which became optional in 2009 and mandatory as of January 1st, 2010.

Frontier Economies

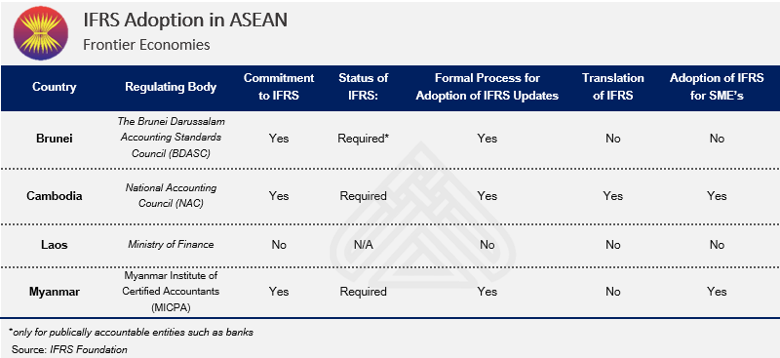

The state of IFRS harmonization in ASEAN’s frontier economies ranges widely. Some nations such as Laos have yet to establish a clear means of implementing International standards, while others have achieved full compliance with IFRS as well as IFRS for SMEs.

With the exception of Brunei, frontier economies in ASEAN are largely still undeveloped – both in terms of their regulatory infrastructure and firm complexity. This can present a number of challenges to potential investors. With regard to financial regulation, the following issues should be noted when considering investment:

Translation of IFRS

As nearly all of ASEAN’s national business languages are not formally used by the ISAB – which utilizes English – a substantial burden is placed on national authorities. The time, resources, and expertise required to effectively translate IFRS into local dialects has led to delayed effective dates in ASEAN members such as Thailand, and presents an even larger burden for cash strapped frontier economies.

As of 2015, Cambodia is the only frontier economy with a framework in place to create comparable translations between its National Accounting Council’s (NAC) regulations and IFRS.

Without official translations, foreign investors are exposed to substantial regulatory uncertainty and or increased compliance costs. In conjunction with other environmental factors, and without effective legal guidance, this uncertainty can present a significant challenge to investment.

SME Support

In addition to translation, the underdeveloped nature of businesses within frontier economies, coupled with lagging adoption of IFRS for SMEs, greatly increases the burden placed on small and medium sized enterprises. As a result, SMEs throughout frontier economies have been slow to implement standardized accounting practices and thus present challenges for companies seeking to find investment opportunities.

While SMEs comprise the majority of firms found within frontier economies, the conditions within individual markets are widely divergent. Cambodia in particular, is among the best positioned to increase the use of standardized accounting within its borders. In recent years, full adoption of IFRS for SMEs has been achieved – allowing greater accommodations for small and medium sized enterprises. Coupled with the introduction of SME accommodations on Cambodia’s securities exchange, there is every indication that an investment facilitating uptake in standardized accounting may be around the corner.

RELATED: An Overview of IFRS Adoption in ASEAN – Part Two

RELATED: An Overview of IFRS Adoption in ASEAN – Part Two

IFRS Compliance in ASEAN

With a diverse range of financial reporting standards, all at varying stages of cohesion with IFRS, it is recommended that those interested in establishing operations in ASEAN or expanding throughout the region fully comprehend relevant compliance requirements.

With over two decades experience in specialist tax and accounting guidance to help foreign companies do business throughout Asia, the experts at Dezan Shira & Associates are in a unique position of strength to advise companies on accounting standards as they pertain to their business interests in ASEAN. For a free consultation, please get in touch with our ASEAN specialists at asean@dezshira.com.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.