A Guide to Taxation in Indonesia

Indonesia’s parliament approved the Harmonized Tax Law (HTL) or Law No. 7/2021, which overhauls the country’s existing tax structure. Changes include an increase in the value-added tax (VAT) rate, a new carbon tax, scrapped plans to reduce the corporate income tax (CIT), and changes to the topline personal income tax (PIT) rate.

The new law aims to optimize tax revenue collection and compliance amid state revenues already battered to cover the costs caused by the pandemic, although some business groups have questioned the timing of the tax hikes, considering that economic recovery is still fragile. The bill could generate up to 250 trillion rupiah (US$17.5 billion) in tax revenue, equivalent to 1.5 percent of GDP.

Corporate taxation

Corporate income tax in Indonesia is set at a basic rate of 22 percent for the 2022 fiscal year. There are several facilities given to businesses regarding the CIT if they fulfill the following conditions:

- Companies that are listed on the stock exchange that offer the minimum requirement of 40 percent of total share capital are subjected to a three percent tax cut from the standard rate;

- Companies that have an annual turnover of 50 billion rupiah (US$3.5 million) are eligible for a 50 percent tax cut from the standard rate, which is imposed proportionally on the part of the gross turnover of up to 4.8 billion rupiah (US$336,000); and

- Companies with gross turnover of no more than 4.8 billion rupiah (US$336,000) are subject to a 0.5 percent tax on total turnover.

Value-added tax

Value-added tax in Indonesia is imposed on the provision of services or the transfer of taxable goods. VAT rates are set out below:

- 11 percent imposed on most manufacturers, retailers, wholesalers, and importers from April 2022 and 12 percent by 2025;

- Export of tangible and intangible goods is subject to zero percent VAT; and

- The export of services is subject to zero percent VAT.

The government’s negative list sets out all the goods and services that are non-taxable. These include among others – mining or drilling products, basic food commodities, food and drink served in hotels, restaurants, restaurant, stalls, and money, gold bullion and securities. insurance services, religious services, arts and entertainment services, non-advertising broadcasting services, medical health services, financial services, and educational services.

Personal income tax

Expatriate workers need to know that personal income tax (PIT) in Indonesia is determined through a self-assessment scheme.

The country has adopted a worldwide income taxation system, meaning that individuals considered Indonesian tax residents pay tax to the government on the income they earned in Indonesia, and also on income, they earned from abroad, unless there is an applicable double tax agreement.

Non-resident taxpayers will only be liable to pay PIT for the income they earn in Indonesia unless the country in which they are a tax resident has an applicable tax treaty with Indonesia. In these cases, the taxpayer might not pay any tax in Indonesia or pay a reduced amount.

Given these tax treatments, it is important for expatriate workers to understand their tax liabilities in Indonesia. It is advisable to use the services of registered local tax advisors to help determine which tax law regime will be applicable along with any exemptions that may bring.

Eligibility to pay income tax

Under Indonesia’s previous income tax law, an individual is considered a domestic tax subject if they were present in the country for more than 183 days during a 12-month period, or if they have the intention to stay in Indonesia.

Through PMK 18/2021, the government has provided further clarification on the definition of ‘residing in Indonesia’ and the ‘intention to stay in Indonesia’.

‘Residing in Indonesia’ is defined as an individual who:

- Lives at a place of residence in Indonesia that is at their disposal and can be accessed at all times, which they own, rent, and is not a place of transit;

- Have their vital interests in Indonesia; and

- Have their habitual abode in Indonesia.

An ‘intention to stay in Indonesia’ needs to be substantiated with the following documents:

- A permanent stay permit;

- A limited stay visa;

- A limited stay permit; or

- Other documents support their stay of more than 183 days in Indonesia.

Territorial taxation for foreigners

Foreigners who have become domestic tax subjects will only be taxed on Indonesian-sourced income. This is only applicable if they meet the expertise requirements from Appendix II of PMK-18.

Their expertise, however, must be supported by:

- A certificate issued by a government-authorized institution, or have a minimum of five years’ work experience in the field of science, technology, and math; and

- An obligation for knowledge transfer to an Indonesian citizen.

The territorial tax treatment is available for four years of residency. If the foreign individual leaves Indonesia and re-enters Indonesia within the four-year period, the territorial taxation will begin from the time they first became a domestic tax subject.

Foreigners looking to apply for territorial tax treatment must do so through the Directorate General of Taxes (DGS). Those who were already domestic tax subjects prior to the issuance of PMK-18/2021 can also apply to the DGS for this tax treatment. Certain foreign expatriates, because of their special legal status, are not considered Indonesian tax residents and are exempted from paying PIT, even if they stay for more than 183 days per year or reside and intend to stay in Indonesia.

These exemptions apply for:

- Foreign diplomatic and consular personnel;

- Military personnel and civilian employees of foreign armed services; and

- Representatives of international organizations specified by the Minister of Finance.

When it comes to tax rates, residents and non-residents are taxed differently:

- Residents are subject to a withholding progressive tax (their net taxable income is set at graduated rates, with current rates ranging from five percent up to a maximum of 30 percent, depending on an individual’s income); and

- Non-residents are subject to a final withholding flat tax of 20 percent on gross income.

|

Annual income |

Rate (%) |

|

Up to 60 million rupiah (US$4,220) |

5 |

|

Above 60 million rupiah (US$4,220) to 250 million rupiah (US$17,500) |

15 |

|

Above 250 million (US$17,500) to 500 million rupiah (US$35,170) |

25 |

|

Above 500 million rupiah (US$35,170) to 5 billion rupiah (US$351, 000) |

30 |

|

Above 5 billion rupiah (US$351, 000) |

35 |

Deductions and relief

There are several elements that can be deduced from the gross income when determining the annual taxable income of an individual.

It is worth noting that a family is regarded as a single tax reporting unit with a single tax identity number (NPWP) in the name of the head of the family. The head of the family needs to report the income of their dependent spouse and children on their tax return.

The following personal deductions are available for resident taxpayers.

|

Basic of deduction |

Deductible amount per year |

|

Individual taxpayer |

54 million rupiah (US$3,739) |

|

Spouse |

Additional 4.5 million rupiah (US$311) |

|

Each dependent (max 3) |

Additional 4.5 million rupiah (US$311) |

Employer compliance obligations

Income tax in Indonesia is mostly paid by withholding by the employer. The tax withheld by employers must be remitted to the government body on a monthly basis.

Employee compliance obligations

Expatriate employees are required to complete an annual tax return and compute their tax liability by March 31 of the following tax year.

The majority of PIT is paid through statutory employer withholdings on earned income. However, for any other income that a taxpayer in Indonesia earns on a regular basis, they must make monthly provisional tax payments to the tax department based on the income earned in the previous year.

Filing a tax return

In order to file a tax return in Indonesia, an individual must register as a taxpayer in order to obtain a tax identification number (NPWP). Expatriates must obtain an NPWP if they are tax residents.

While employers are responsible for deducting tax from their employees’ salaries, it is the individual employee’s responsibility to register as a taxpayer and file their tax returns.

Tax deregistration when leaving Indonesia

It is highly recommended that expatriates leaving Indonesia permanently cancel their tax registration to avoid any misunderstandings, and thus avoid being continuously considered a tax resident of Indonesia.

To do so, expatriates should submit an application to the local tax office, which will then perform a tax audit on the taxpayer’s returns and supporting documents prior to granting approval to deregister.

The individual should ensure that all tax-related documents are readily available in anticipation of a tax audit (including bank statements, salary slips, foreign tax documentation if applicable, work contracts, etc.).

Dividends and offshore income exempted from income tax

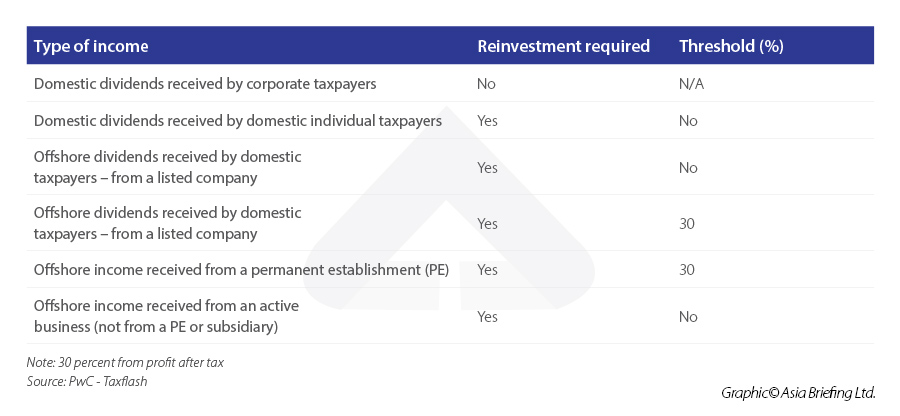

To increase investments in Indonesia’s financial markets and the real sector, the government has provided income tax exemptions for foreign dividends received by domestic taxpayers. The reinvestment requirements are not required for domestic dividends received by domestic corporate taxpayers.

Such concessions will require reinvestment for a certain period from when the dividend is received. PMK-18/2021 provides details on these reinvestment requirements:

Qualifying reinvestments are as follows:

- Investment in financial market instruments such as:

- Government bonds, including shariah instruments;

- Bonds or Sukuk issued by a state-owned enterprise, private companies;

- Financial investments in perception banks including shariah banks; or

- Other legal forms of investments.

Investments in financial instruments outside the money market include:

- Investment in the real sector;

- Investment in infrastructure through a private-public partnership;

- Equity cooperation in an already existing company domiciled in Indonesia;

- Cooperation with the Indonesian Sovereign Wealth Fund; or

- Lending to small and medium-sized businesses in Indonesia.

The investment must be held for a minimum of three years from when the dividend or offshore income is received. The taxpayer must also invest the dividend or offshore income in the qualifying investments by the end of the third or fourth month after the end of the fiscal year. Finally, the investment cannot be transferred except to another qualifying investment.

If the reinvestment requirement provides a 30 percent threshold, the taxpayer can enjoy the full exemption if this threshold is fulfilled. However, if the reinvestment is less than the 30 percent threshold, the taxpayer must pay income tax on the spread between the investment amount and the 30 percent threshold to enjoy the exemption.

Investors should note that the exemption does not apply to foreign citizens who utilize the double tax avoidance agreement (DTA) between Indonesia and the partner country/jurisdiction of the DTA.

Withholding tax

Withholding tax applies to both resident and non-resident companies in Indonesia. The tax rate on dividends is 15 percent for residents and 20 percent for non-residents (unless they have an applicable tax treaty). The withholding tax rate on interest and royalties is also set at 15 percent for residents and 20 percent for non-residents.

Withholding Tax Rates for Resident and Non-Resident Companies in Indonesia

|

Nature of income |

Tax rate (%) |

|

|

Residents |

Non-residents |

|

|

Dividends |

15 |

20 |

|

Interest |

15 |

20 |

|

Royalties |

15 |

20 |

Stamp duty

Individuals, companies, and other organizations in Indonesia must pay stamp duties on certain legal documents. As of January 2021, the standard stamp duty tax rate is 10,000 rupiah (US$0.70).

Previously, stamp duty was either 3,000 rupiah (US$0.20), 6,000 rupiah (US$0.40), or a combination of these rates.

Indonesia requires stamp duties on two main types of documents: documents created to explain events of a civil nature and documents to be used as evidence in a court of law.

Documents of a civil nature include the following:

- Agreements, certificates, statement letters, and similar documents and their copies;

- Notarial deeds and executorial deeds (gross) and their copies;

- Deeds made before a land deed officer (also known as a land conveyance officer) and their copies;

- Securities in any form and name; and

- Documents stating a sum of money above 5,000,000 rupiah (US$350), which describe the receipt of money or contain an acknowledgment of debt payment or settlement, either entirely or partially.

In addition to these documents, the Law also applies to the following civil documents:

- Securities transaction documents, including futures contract transactions in any name or form;

- Auction documents in the form of excerpts, minutes, copies, and minutes of auction executorial deeds (gross); and

- Other documents stipulated by Government Regulation.

The Law exempts the following documents from stamp duty:

- Land transfer and building rights documents used for handling and restoring social conditions following natural disasters;

- Land transfer and building rights documents used solely for religious or non-commercial activities;

- Documents relating to the implementation of government programs and monetary or financial policies; and

- Documents relating to the implementation of international agreements under binding international treaties or reciprocal laws.

Electronic stamp duty

Electronic stamps, which carry a unique code and description, will apply to electronic transaction documents with a value above 5,000,000 rupiah (US$350).

The Indonesian government, however, is still building the infrastructure to manage electronic stamp duties.

Webinar – Doing Business in Indonesia 2024: Elections, Industry Trends & Capital City Relocation

Live Session for Asia: March 27, 2024

10 AM Brussels / 4 PM Jakarta / 5 PM China

Rebroadcast for North America: March 27, 2024

9 AM Los Angeles / 12 PM New York / 6 PM Brussels

Join us for a recap of Indonesia’s economic performance in 2023, key industry trends in 2024, implications of the 2024 general election results for businesses and updates, and Indonesia’s new capital city, Nusantara.

This webinar is FREE of charge.

Register now for Indonesia’s Live Session

Register now for North America’s Rebroadcast

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, in addition to Jakarta, in Indonesia. We also have partner firms in Malaysia, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asean@dezshira.com or visit our website at www.dezshira.com.

- Previous Article The European Union and Malaysia Sign Partnership and Cooperation Agreement

- Next Article An Overview of Swiss Investments in Indonesia