The Minimum Wage in Indonesia: Increased by 8.5% for 2020

- By January 2020, Indonesia will increase its minimum wage by 8.51 percent from the current 2019 rate.

- As the minimum wage differs for every province, foreign investors should seek help from registered local advisors.

On October 15, 2019, the Minister of Labor issued circular B-M 308, 2019, which mandates provincial governors throughout Indonesia to increase their provinces’ minimum wage by 8.51 percent, starting from January 1, 2020.

Companies are prohibited from paying their workers – which includes those that are hired for less than one year – below the prescribed minimum wage.

Businesses that are unable to comply can submit a letter to the governor of the province from which their company is registered and ask for a postponement of payment. The letter must be sent a minimum of 10 days before the new minimum wage rates come into force.

As the minimum wage for each province differs, foreign investors should seek the help of registered local advisors to help understand how these latest changes will affect their operations.

How is minimum wage calculated?

Minimum wage is implemented through Government Regulation 78 of 2015 (GR,2015), which provides a formula to calculate how much the percentage increase of the minimum wage should be. The formula is as follows:

National Inflation + National Economic Growth = percentage increase of minimum wage

For 2020, the government calculated the minimum wage rate by using data from October 2019, which is as follows:

National Inflation (3.39 percent) + National Economic Growth (5.12 percent) = 8.51 percent in minimum wage increase.

With this data, the governor of every province, in cooperation with the provincial Wage Councils, will then calculate the minimum wage rate (taking into account the living wage) through the following formula:

New minimum wage = current minimum wage + (current minimum wage x percentage of minimum wage increase (8.51%)).

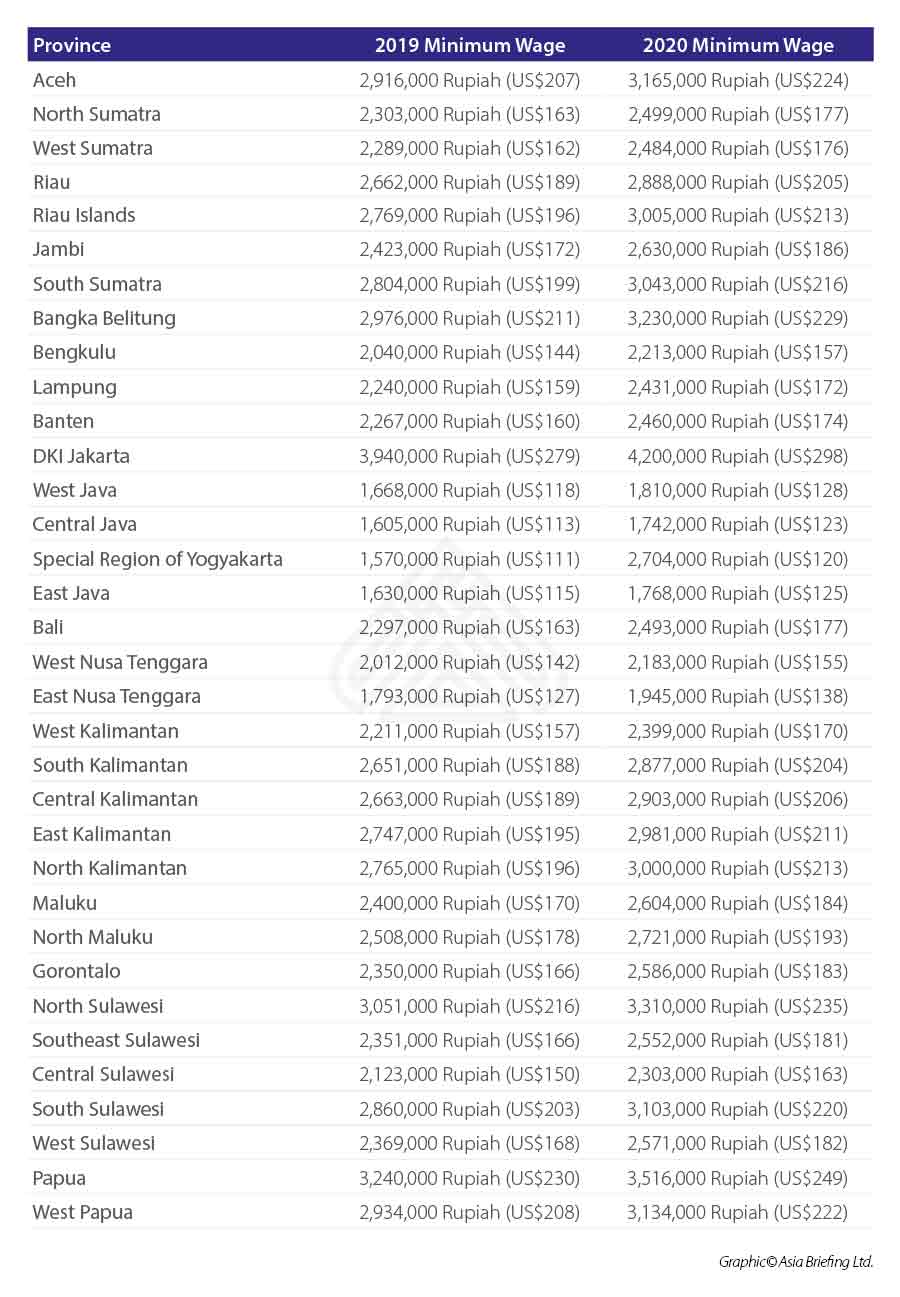

The minimum wage for each province for 2020 is expected to be:

Minimum wage based on sector

Based on Minister of Labor Regulation No 7 of 2013 (Reg 7, 2013), ‘leading sectors or industries’ in a province, can determine their own minimum wage rate, also known as UMSP.

To be considered a leading sector or industry, the provincial Wage Council will undertake research and data collection regarding the specific industry to see if it fulfills the following criteria:

- The specific industry can generate added-value to the local economy;

- The proposed UMSP must be higher than the provincial minimum wage (usually by 5 percent and above);

- Involves a large number of businesses;

- The industry requires significant manpower;

- The industry is export-orientated; and

- The related trade and labor unions are in agreement with the proposal.

The industries that have been covered by the UMSP have included:

- Public works;

- Automotive manufacturing;

- Tourism;

- Telecommunications;

- Retail;

- Food and beverages;

- Pharmaceutical and healthcare;

- Finance and banking;

- Textile manufacturing;

- Chemicals, energy and mining; and

- Electronics and machinery.

Investors should note that these industries vary from province to province as does the UMSP rate.

What does it mean for business?

Despite the yearly increases in the minimum wage, productivity amongst Indonesia’s workforce continues to remain low. Less than half of the country’s workforce can be classified as ‘skilled’, resulting in the slow advancement of vital business sectors such as manufacturing.

This is an ongoing concern for local companies who are looking to expand their business operations internationally or are seeking foreign investments. Additionally, analysts have pointed out that the formula used for calculating the minimum wage rate does not take into account labor productivity or sector-level productivity.

Small and medium-sized business owners, that are registered with the government, have traditionally been hit the hardest with the yearly increases. Businesses in leading sectors will also have to increase their UMSP rate, which in turn can increase their overall costs and make their exports less competitive.

These formal businesses have long complained of the lack of enforcement in implementing the minimum wage regulation on businesses in the informal sector – some 57 percent of Indonesia’s 120 million workforce is in the informal sector – who often pay employees below the standard rate.

Formal businesses will also have to face the burden of an increase – by more than double – in healthcare premiums from January 2020. Private employees are obligated to pay five percent of their monthly salary (up to a salary cap of 12 million Rupiah (US$852)) towards the premium. From this five percent, employers are responsible for four percent and the employee the one percent. This is in addition to paying for pensions which are also split by the employee and the employer.

Labor unions, particularly those in the manufacturing sector, have rejected the 8.51 percent increase with some stating an increase by as much as 10-20 percent is more befitting. They highlighted the rising cost of living, especially for staple foods, fuel, and electricity as the main factors for struggling household consumption.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.