Personal Income Tax in Indonesia for Expatriate Workers Explained

- Personal income tax in Indonesia is determined through a self-assessment system, meaning resident tax payers need to file individual income tax returns.

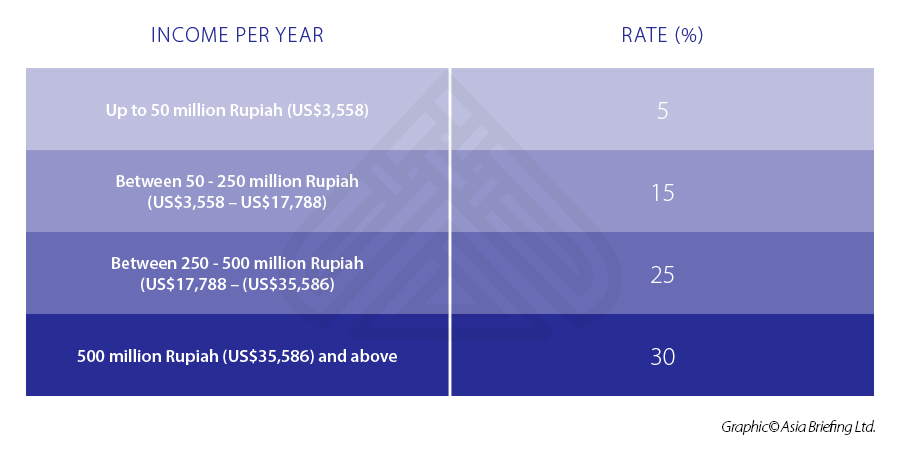

- Resident tax payers are subject to progressive tax rates ranging from 5 percent to 30 percent.

- Given the consequences of non-compliance, foreign workers should seek help from registered local tax advisors to better understand their tax liabilities.

Expatriate workers need to know that personal income tax (PIT) in Indonesia is determined through a self-assessment scheme.

The country has adopted a worldwide income taxation system, meaning that individuals considered as Indonesia tax residents pay tax to the government on the income they earned in Indonesia, and also on income, they earned from abroad unless there is an applicable double tax agreement.

Non-resident tax payers will only be liable to pay PIT for the income they earn in Indonesia, unless the country in which they are a tax resident has an applicable tax treaty with Indonesia. In these cases, the tax payer might not pay any tax in Indonesia or pay a reduced amount.

Given these tax treatments, it is important for expatriate workers to understand their tax liabilities in Indonesia. It is advisable to use the services of registered local tax advisors to help determine which tax law regime will be applicable along with any exemptions that may bring.Who is eligible to pay personal income tax in Indonesia?

Foreign workers that are designated as tax residents in Indonesia must pay PIT. The key criteria to determine whether or not an individual must be considered as an Indonesian tax resident isn’t nationality, but rather the length of stay (or intended stay).

A foreign individual is considered a tax resident of Indonesia when they meet the following conditions:

- In-country for more than 183 days during a 12-month period in Indonesia (anyone who has spent that length of time in the country, regardless of the type of visa they are using to visit the country, will be considered as a tax resident in Indonesia);

- Intends to reside in the country for more than 183 days even if they have spent less than 183 days in the country (for instance, in cases where the individual’s dependents have moved to Indonesia and it was clear they are staying in the country for a reasonable length of time); and

- Individuals who work abroad for more than 183 days within a 12-month period, but are still earning any form of income in Indonesia, must pay PIT on the Indonesian income.

Individuals that work overseas for more than 183 days within a 12-month period and do not earn any income in Indonesia are not eligible to pay Indonesian PIT.

Notably, an expatriate will be considered a tax resident in Indonesia until the date of their final departure from the country.

Individuals exempted from personal individual tax

Certain foreign expatriates, because of their special legal status, are not considered as Indonesian tax residents and are exempted from paying PIT, even if they stay for more than 183 days per year or reside and intend to stay in Indonesia.

These exemptions apply for:

- Foreign diplomatic and consular personnel;

- Military personnel and civilian employees of foreign armed services; and

- Representatives of international organizations specified by the Minister of Finance.

Scope of taxable income in Indonesia

According to the Personal Income Tax Law, income must be defined as an increase in economic capacity. It can consist of, among others, employment income, and personal investment income.

According to article 4 of chapter 3 of the Law, income includes:

- Employment income;

- Income from the exercise of an independent profession or business;

- Passive income (dividends, royalties, interest, insurance gains);

- Capital gains (from the sale or transfer of property); and

- Rents and other income from the use of property

Tax rates

When it comes to tax rates, residents and non-residents are taxed differently:

- Residents are subject to a withholding progressive tax (their net taxable income is set at graduated rates, with current rates ranging from 5 percent up to a maximum of 30 percent, depending on an individual’s income);

- Non-residents are subject to a final withholding flat tax of 20 percent on gross income.

The progressive tax rate is currently structured around four income bands, with rates that apply to the fractional income within each band.

Deductions and reliefs

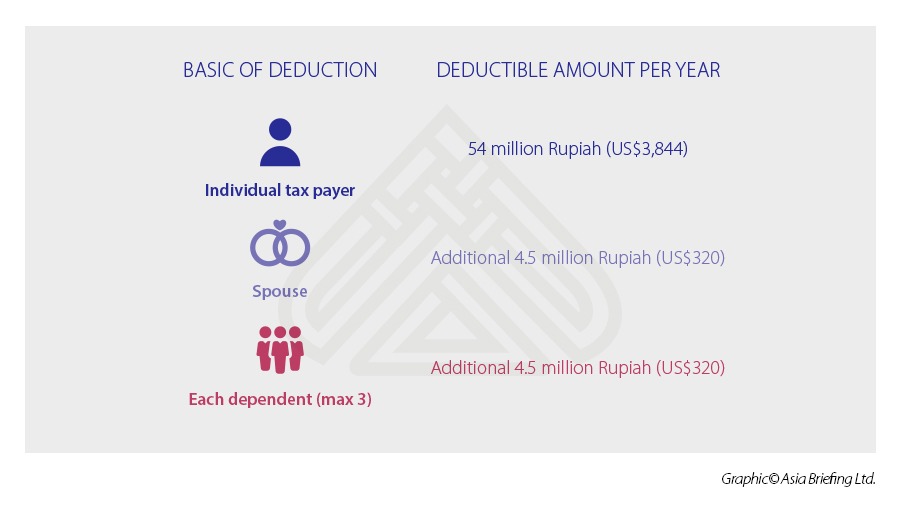

There are several elements that can be deduced from the gross income when determining the annual taxable income of an individual.

It is worth noting that a family is regarded as a single tax reporting unit with a single tax identity number (NPWP) in the name of the head of the family. The head of the family needs to report the income of their dependent spouse and children their tax return.

The following personal deductions are available for resident taxpayers.

Employer compliance obligations

Income tax in Indonesia is mostly paid by withholding by the employer. The tax withheld by employers must be remitted to the government body on a monthly basis.

Employee compliance obligations

Expatriate employees are required to complete an annual tax return and compute their tax liability by March 31 of the following tax year.

The majority of PIT is paid through statutory employer withholdings on earned income. However, for any other income that a taxpayer in Indonesia earns on a regular basis, they must make monthly provisional tax payments to the tax department based on the income earned in the previous year.

Filing a tax return

In order to file a tax return, an individual must register as a taxpayer in order to obtain a tax identification number (NPWP). Expatriates must obtain an NPWP if they are a tax resident.

While employers are responsible for deducting tax off their employees’ salaries, but it is the individual employee’s responsibility to register as a taxpayer and file their tax returns.

When leaving Indonesia

It is highly recommended that expatriates leaving Indonesia permanently cancel their tax registration to avoid any misunderstandings, and thus avoid being continuously considered a tax resident of Indonesia.

To do so, expatriates should submit an application to the local tax office, which will then perform a tax audit on the taxpayer’s returns and supporting documents prior to granting approval to deregister.

The individual should ensure that all tax-related documents are readily available in anticipation of a tax audit (including bank statements, salary slips, foreign tax documentation if applicable, work contracts, etc.).

This article was first published on December 11, 2015, and was updated on October 30, 2019.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Tax Incentives for Developing Talent in Indonesia

- Next Article Singapore’s DTA Network: What is Covered and How to Claim Relief