ASEAN Trade in Goods Agreement: Local Content Requirements

In light of significant reductions in tariffs between ASEAN members and the steady harmonization of regulation through the ASEAN Economic Community, regionally oriented value chains have risen significantly in terms of profitability. For those considering investments of this nature, it’s important to understand not only the tariff reduction schedules that have been negotiated, but more importantly, the conditions under which exports and imports may benefit from reduced rates.

Within the vast majority of trade agreements, rules of origin are included to prevent third parties from freeriding on the sacrifices made by those party to the agreements. These rules set out who may qualify for benefits of a given agreement and under which circumstances these parties may do so.

The ASEAN Trade in Goods Agreement (ATIGA)

Currently, the ASEAN Trade in Goods Agreement (ATIGA) – ASEAN’s primary agreement concerning the reduction of regional tariffs – contains a set of criteria used to determine the country of origin of a good as well as guidelines to determine if specific goods are eligible to benefit from preferential tariff treatment.

Guidelines established under ATIGA utilize the Harmonized System (HS) of Tariff Classification as a means of clarifying the differences between goods and setting out standards that certain goods must meet. Under the HS system, products are divided into:

- One to two-digit chapters: HS85 – Electrical Machinery and parts thereof

- Four-digit headers: HS8501 – Electric Motors and Generators

- Six-digit sub headers: HS31 – Other DC Motors; DC Generators of an output not exceeding 750W

- Eight-digit tariff classifications: HS31.20 – Exceeding 37.5W but not exceeding 74.6W

Origin Criteria

Under the ATIGA, goods classified as “originating” are qualified to receive the benefits of tariff reductions.

The agreement indicates that a good imported into the territory of a Member State from another Member State shall be treated as an originating good if it is wholly obtained or in compliance with requirements set out for goods that are not wholly obtained.Wholly Obtained or Produced Goods

The following shall be considered as wholly obtained or produced in the exporting Member State:

- Plant and plant products, including fruit, flowers, vegetables, trees, seaweed, fungi and live plants, grown and harvested, picked or gathered in the exporting Member State

- Live animals, including mammals, birds, fish, crustaceans, mollusks, reptiles, bacteria and viruses, born and raised in the exporting Member State

- Goods obtained from live animals in the exporting Member State

- Goods obtained from hunting, trapping, fishing, farming, aquaculture, gathering or capturing conducted in the exporting Member State

- Minerals and other naturally occurring substances, not included in (a) to (d), extracted or taken from its soil, waters, seabed or beneath its seabed

- Products of sea-fishing taken by vessels registered with a Member State and entitled to fly its flag and other products taken from the waters, seabed or beneath the seabed outside the territorial waters of that Member State, provided that that Member State has the rights to exploit such waters, seabed and beneath the seabed in accordance with international law

- Products of sea-fishing and other marine products taken from the high seas by vessels registered with a Member State and entitled to fly the flag of that Member State

- Products processed and/or made on board factory ships registered with a Member State and entitled to fly the flag of that Member State, exclusively from products referred to in (g)

- Articles collected there which can no longer perform their original purpose nor are capable of being restored or repaired and are fit only for disposal or recovery of parts of raw materials, or for recycling purposes

- Waste and scrap derived from production in the exporting Member State; or used goods collected in the exporting Member State, provided that such goods are fit only for the recovery of raw materials

- Goods obtained or produced in the exporting Member State from products referred to in (a) to (j)

Not Wholly Obtained or Produced Goods

Provided that a good isn’t part of ATIGA’s list of 2000 goods with specific requirements, exporters and manufacturers have the option to apply either the regional value content criterion or the change in tariff classification criterion:

According to ATIGA, goods shall be deemed originating in the Member State where working or processing of the goods has taken place. This is determined by meeting at least one of the following conditions:

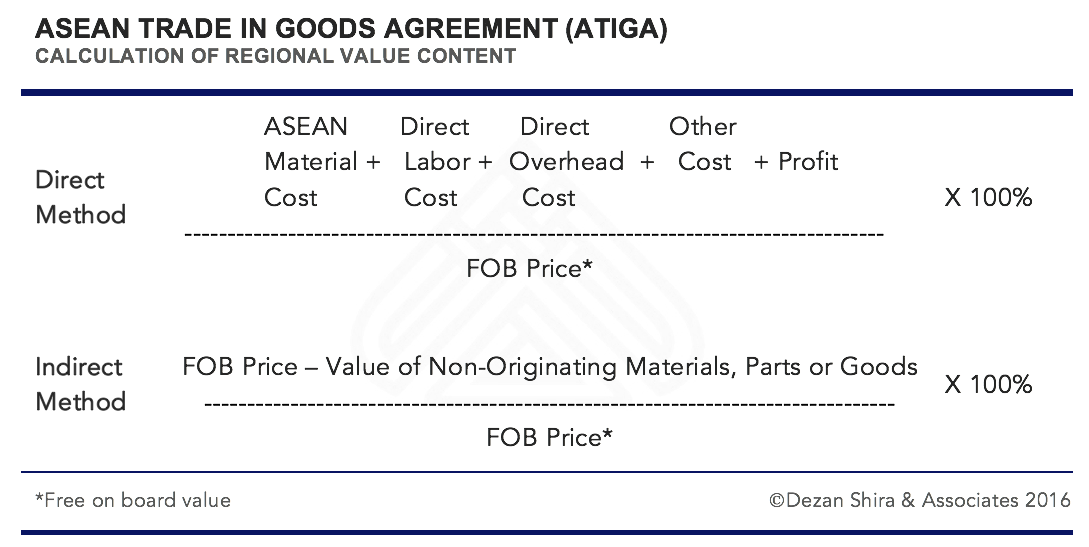

(i) if the goods have a regional value content of not less than 40% – determined using one of the two methods outlined in the infographic below.

(ii) if all non-originating materials used in the production of the goods have undergone a change in tariff classification at four-digit level (HS header) – see introduction for more information.

Cumulation

Within ATIGA, the concept of cumulation is applied to the agreement’s rules of origin.

Generally speaking, this concept allows countries party to a trade agreement to share production and jointly comply with the relevant rules of origin provisions. For producers within ASEAN, this concept allows materials to be sourced from all ASEAN member states without forgoing tariff reductions.De Minimis

The de minimis principle allows goods which have non-originating materials and are unable to meet their relevant change in tariff classification requirements to enjoy preferential tariff treatment given special conditions. Certain goods can be considered originating under the ATIGA if:

- the value of all non-originating materials used in its production do not undergo the required change in tariff classification does not exceed 10% of the FOB value of the good, and the good meets all other applicable criteria for qualifying as an originating good.

- The value of non-originating materials shall be included in the value of non-originating materials for any applicable regional value content requirement for the good.

Further Support from Dezan Shira and Associates

With the AEC launched and harmonization of regional standards growing, the importance of regional supply chains cannot be overstated. Continued progress towards regional integration is likely to continue these trends, further reducing barriers to trade and decreasing the impact of regulatory compliance for firms throughout the region. Although ASEAN’s prospects are bright, success will ultimately hinge on the ability of entrants to understand and leverage opportunities within agreements such as the ASEAN Trade in Goods Agreement. Employing qualified professionals with years of experience in market entry and corporate establishment, Dezan Shira & Associates is perfectly positioned to assist companies in their efforts to maximize operations and expand throughout the region.

Editor’s Note: This article was first published on March 7, 2016 and is updated on October 2, 2018, as per latest developments.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article L’ASEAN rencontre la Russie et la Chine : discussions sur l’OCS et l’UEEA

- Next Article 进入印度尼西亚的模式:设立有限责任公司