Import and Export Procedures in Myanmar – Best Practices

By Bradley Dunseith

As Myanmar continues to liberalize its regulatory landscape, new opportunities are emerging for cross-border trade. Myanmar borders India and China – the world’s most populous countries – and is a member of the Association of Southeast Asian Nations (ASEAN). Political reforms in Myanmar has spurred world powers to lift trade sanctions against the South East Asian nation formerly called Burma.

Import and export operations in Myanmar have become easier and more profitable. In the financial year (FY) 2016-17 (ending 31 March) private players have exported US$4.8 billion and by sea and US$3.2 billion over land; private players have imported US$1.3 billion by sea and US$2.8 billion over land. In this article we explain best practices for importing into and exporting out of Myanmar. As Myanmar continues to undergo economic reforms, we advise all businesses to monitor new and upcoming legislations closely.

![]() RELATED: Pre-Investment and Market Entry Advisory from Dezan Shira & Associates

RELATED: Pre-Investment and Market Entry Advisory from Dezan Shira & Associates

Registering as an exporter or importer

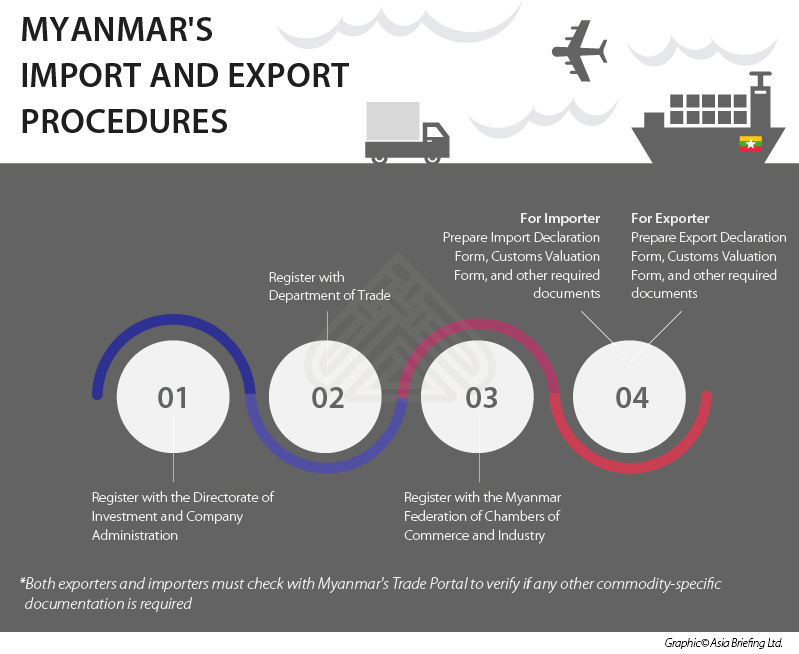

The procedure for registering as an exporter or importer in Myanmar follows the same trajectory, though the respective licences are different.

To either export or import goods from Myanmar, a company must register itself with the Directorate of Investment and Company Administration (DICA). Fortunately for overseas companies, the DICA recently created a digital single clearance window for registration called the One Stop Service (OSS). Companies can register themselves with the DICA for up to five years.

Once registered with the DICA, a company must then register themselves with Myanmar’s Department of Trade (under the Ministry of Commerce). Registrations with the Department of Trade are limited to three year periods and cost Kyat 50,000 (US$36.50) per year. All exporters and importers are also required to join the Myanmar Federation of Chambers of Commerce and Industry.

There are four types of entities which may apply for export licences:

- Limited Companies;

- Joint Venture Corporations;

- Co-operatives (registered under the Co-operative Societies Law)

- Foreign firms registered under the Myanmar Investment Law, 2016

The Myanmar Special Companies Act, 1950, permits foreign companies to be registered in the country as limited companies or in a joint venture. Otherwise, foreign firms may apply for permission to register as importers or exporters under the Myanmar Investment Law, 2016.

Necessary Documents for Importers and Exporters

The vast majority of imported and exported commodities require a licence in Myanmar. Certain commodities require additional documentation (i.e. that a product conforms to technical standards) and sometimes even permission from certain ministries. Importing live animals, for instance, requires approval from the Ministry of Commerce.

It is the responsibility of the importer or exporter to ensure that all commodities being brought in or out of Myanmar have the necessary documents and are correctly processed based on the World Customs Organization’s 8-digit Harmonized System (HS). An exhaustive list of commodities and their necessary documents and HS codes can be found on Myanmar’s Trade Portal.

To import goods into Myanmar, a company must provide an import declaration form called CUSDEC—1 Import Declaration Form as well as the CUSDEC—4 Customs Valuation Form. Importers require these additional documents:

- Import Licence;

- Invoice;

- Bill of lading, air consignment note, or truck note;

- Cargo release order;

- Terminal handling report;

- Packing list;

- Technical standard and health certificate (when required) and;

- Recommendation from concerned ministry (when required).

The importer must present these documents to customs officials when imported goods arrive in Myanmar.

To export goods from Myanmar, a company must provide an export declaration form called CUSDEC—2 as well as the CUSDEC—4 Customs Valuation Form. Exporters require these additional documents:

- Export license;

- Invoice;

- Bill of lading;

- Packing list;

- Sales contract;

- Shipping instructions;

- Letter of credit or general Remittance or Exemption Certificate;

- Sample of goods;

- Fumigation certificate (when required);

- Phytosanitary certificate (when required)

- Recommendation from concerned ministry (when required).

The exporter must present these documents to customs officials before exported goods leave Myanmar.

Tariffs and Taxes

Tariffs

Myanmar calculates tariffs on imported items based on (1) the classification of the imported goods; (2) the valuation of the imported goods and; (3) the origin of the imported goods.

Tariffs on imported goods in Myanmar range from 0 to 40 percent. The tariffs on agricultural imports averages at 8.7 percent and 5.1 percent on non-agricultural goods.

The Myanmar government’s Trade Portal (mentioned above) provides an in depth list of commodity-specific tariffs.

Myanmar is a member of the ASEAN Free Trade Area (AFTA) and has thus committed to the Common Effective Preferential Tariff Scheme (CEPT). CEPT aims to reduce import tariffs on 100 percent of the total tariff lines by 2018. A country of origin (COO) document may be necessary to avail reduced tariffs under specific FTAs.

Commodities exported out of Myanmar do not incur tariff charges.

Special Goods Tax

In April, 2016, the Myanmar government enacted a special goods tax (SGT) to replace commercial taxes on imported and exported goods. The SGT covers goods considered either luxurious, injurious to health, or harmful to the environment such as precious gems, cigarettes, and diesel. Customs officials tax imported goods which fall under the SGT between 5 percent and 80 percent with an additional 5 percent commercial tax.

Only five exported items fall under the radar of the SGT: natural gas, taxed at 8 percent; wood logs and wood cuttings taxed at 5 percent; raw jade, taxed at 15 percent; other raw gemstones, taxed at 10 percent; and finished goods and jewelry made of precious gems, tax at 5 percent.

As of June, 2013, Myanmar charges a 2 percent income tax on all imported and exported goods. Customs officials consider this tax an advanced payment of an importer’s or exporter’s income tax.

Importers and exporters should diligently monitor any changes in Myanmar’s FTAs and trade regulations as the regulatory landscape is changing rapidly.

Special Economic Zones

In 2014, Myanmar revised its legislation to encourage foreign direct investment (FDI) through special economic zones (SEZs). Under the Special Economic Zone Law, 2014, businesses operating in SEZs can take advantage of a five year tax exemption on custom duties on approved exported goods.

The 2014 Law also exempts businesses operating in SEZs from customs duties and taxes when importing material and equipment which services their own production. This includes:

- Raw material;

- Machinery and spare parts;

- Construction materials and motor vehicles for building a factory, warehouse, or office and;

- Trading goods and materials necessary in wholesale trading.

Myanmar currently has three SEZs in Dawei, Kyaukphyu, and Thilawa. The government continues to improve infrastructure and logistics in all three regional SEZs.

RELATED: Thailand’s Eastern Economic Corridor – What You Need to Know

RELATED: Thailand’s Eastern Economic Corridor – What You Need to Know

Import and export procedures in Myanmar’s changing regulatory landscape

Myanmar has made leaps in the liberalization of its economy: setting up SEZs and easing its regulations on FDI. But, logistic, infrastructural, and regulatory impediments to trade still remain. According to the World Bank’s Ease of Doing Business 2017 report it takes exporters 144 hours and US$432 to export goods out of Myanmar and 232 hours and US$457 to import goods into the country. The Myanmar government is making strides to improve this. A Japanese designed, automated customs management system has been implemented in Myanmar’s SEZs with long-term goals of transforming the automated system into a single window for all import and export procedures.

As the Myanmar government attempts to improve its business climate, rules governing import and export procedures will continue to change. New rules are not always publicly announced and businesses should closely follow all new developments. Local experts at Dezan Shira & Associates possess years of experience supporting the establishment and growth of businesses across ASEAN, and are well situated to guide companies through Myanmar’s confusing and rapidly changing regulatory landscape.

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in ASEAN 2017

An Introduction to Doing Business in ASEAN 2017

An Introduction to Doing Business in ASEAN 2017 introduces the fundamentals of investing in the 10-nation ASEAN bloc, concentrating on economics, trade, corporate establishment, and taxation. We also include the latest development news for each country, with the intent to provide an executive assessment of the varying component parts of ASEAN, assessing each member state and providing the most up-to-date economic and demographic data on each.

Payroll Processing and Compliance in Singapore

Payroll Processing and Compliance in Singapore

In this issue of ASEAN Briefing, we discuss payroll processing and reporting in Singapore as well as analyze the options available for foreign companies looking to centralize their ASEAN payroll processes.We begin by discussing the various regulations that impact salary computation, and tax and social security calculation in Singapore. We then explore the potential for Singapore to emerge as a premier payroll processing center in ASEAN. Finally we consider the benefits of outsourcing payroll – both Singapore-based and ASEAN-wide – to a reliable third-party payroll processing provider.

- Previous Article Payroll Processing and Compliance in Singapore – New Issue of ASEAN Briefing Magazine

- Next Article Labuan: opportunità offshore in Malesia