Malaysia’s FDI Outlook for 2017: Trends and Opportunities

By Harry Handley

Malaysia, ASEAN’s third largest economy (after Indonesia and Thailand), is well on track to achieve its goal of becoming a high income economy by 2020. Despite modest GDP growth of 4.1 percent in 2016 (below the ASEAN average of 4.5 percent), Malaysia is one of the top performing economies in the region in terms of efficiency and business regulations. This competitive edge has been maintained by continuous reform efforts by the government.

Firms setting up companies in Malaysia are likely to experience higher business costs than in a number of other ASEAN states, caused by the country’s minimum wage, its newly implemented Goods and Services Tax (GST) and paid vacation allowances. However, an advanced infrastructure, highly educated and growing workforce and strong regulatory environment allow Malaysia to service high value add industries effectively and continue to entice overseas investors.

For incumbent firms and potential entrants alike, understanding Malaysia’s current investment trends as well as the factors which will shape its future are of utmost importance.

![]() RELATED: Pre-Investment and Market Entry Advisory from Dezan Shira & Associates

RELATED: Pre-Investment and Market Entry Advisory from Dezan Shira & Associates

2016 FDI and trade data

Malaysia is a net recipient of FDI, which accounts for the majority of inflows into the economy. Inward FDI is projected to have grown by 40 percent year-on-year in 2016 to reach MYR 50 billion, with the 2015 total (MYR 36 billion) having been surpassed by the end of September. Manufacturing accounted for the majority (51.2 percent) of investment, followed closely by services (47 percent). Primary industries received the final 1.8 percent.

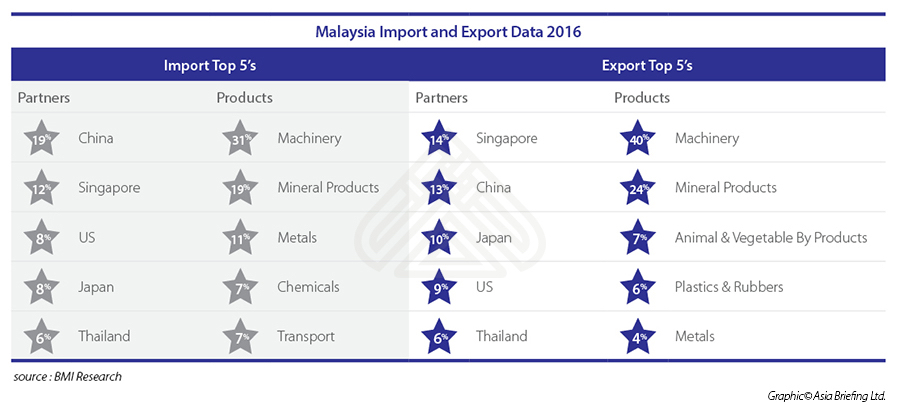

The table below highlights Malaysia’s key import and export partners and products from 2016. Total trade, the sum of imports and exports, exceeded the GDP of Malaysia in 2016, as has been the case in recent years. This leaves Malaysia particularly vulnerable to external outside conditions. BMI Research noted in their 2017 Malaysia Risk Report that a trade reliance on Japan and China, whose economic growth is slowing, and the US, with President Trump’s protectionist views, may be a cause for concern going forward.

Malaysia – PESTLE Analysis

Politics

BMI ranked Malaysia 12th in Asia and 39th in the world in terms of political stability. A number of investigations remain ongoing into allegations of embezzlement from a state-run investment fund by Prime Minister Najib Razak. A negative outcome from these investigations could leave Malaysia in a state of political turmoil. Although a general election is scheduled for 2018, it is unlikely any party will be able to challenge the position of the incumbent government.

In order to maintain pace with their rapidly growing neighbors, the Malaysian government has adopted an FDI-friendly stance. The Malaysian Investment Development Authority’s (MIDA) i-incentives portal lists 144 incentives to foreign investors. These include tax incentives and non-tax incentives, for example, grants and ‘soft loans’. MIDA has made it clear that it has no intention to withdraw these incentives, or toughen foreign investment policy in the coming year.

Economy

Predictions for 2017 GDP growth range between 4.3 percent and 4.7 percent, indicating faster growth than in 2016. GDP per capita is also set to increase significantly in 2017, bringing with it an increase in consumption. Hence, this will present opportunities to firms in industries such as retail and foodservice. As mentioned, Malaysia’s reliance on external trade may be something to watch out for, should the global economic environment worsen.

The Malaysian Digital Economy Corporation (MDEC) are defining 2017 as ‘the year of the Internet Economy’. Hence, e-commerce is the key industry to watch in Malaysia in 2017. The appointment of Alibaba’s Jack Ma as Digital Economy Advisor is hoped to boost growth in the industry above the 11 percent it achieved in 2016. MDEC believe that the planned digital infrastructural spending, by both the government and private players, is going to cause a serious boom in the e-commerce market.

Other key industries in Malaysia include tourism; the industry is estimated to have contributed around 15 percent of GDP in 2016. The rubber and palm oil industries are also significant with 63 percent of the world’s rubber gloves coming from Malaysia in 2016. Investment in Malaysia’s higher education market continues to see growth; currently, there are 10 international branch campuses in Malaysia, the most in Asia. Finally, the large number of highly educated graduates make Malaysia an attractive place for high-tech businesses.

Society

Malaysia’s active working-age population is expected to grow by 1.6 percent in the next decade, one of the highest in the region. With a literacy rate of 95 percent, widely spoken English and an ever increasing number of higher education graduates, Malaysia offers a significant pool of talent for potential investors. As such, Malaysia is increasingly being chosen by newcomers to Asia as their ASEAN hub.

However, ‘affirmative action policies’ that favor the ethnic Malay population are causing a ‘brain drain’ where talented minorities are moving abroad to seek opportunities. It is also thought that these policies have contributed to corruption, with non-Malay’s having to take extra measures to level the playing field. For those seeking to hire foreign workers to fill gaps that may airse, it is important to consider the individual income tax associated with such hires as well as to ensure that any and all foreign workers are able to obtain the proper visas and work permits.

Technology

As mentioned, e-commerce is being pushed as one of the major drivers of economic growth to lift Malaysia to high income status. To facilitate this, the government, along with a number of private enterprises, are investing heavily in technological and digital infrastructure. For example, the world’s first ‘digital free trade zone’ is set to open in March 2017. However, just a month before the project is due to be launched, details about the specifics of it are still few and far between.

The ‘Communications Content and Infrastructure’ element of the ETP contains 11 key projects, ranging from launching e-healthcare to ensuring broadband for all. To undertake these projects, the Performance Management and Delivery Unit (PEMANDU) are constantly on the search for potential partner firms. Four related business opportunities, available to both Malaysian and foreign firms, have been identified by PEMANDU:

- Fixed Services – Shift to digital will increase demand for high-speed broadband, which requires fixed-line services

- Mobile Services – Biggest opportunity is the introduction of LTE (4G) networks across the country. Related opportunities include application development, tower-related maintenance and integration work

- Courier, Post and Broadcast – e-commerce related opportunities, including transaction fulfillment, warehousing and inventory management

- Regional Operations – ASEAN integration requires service syndication across countries

Legislation

On 31st January 2017 the Companies Act 2016 came into force and applies to all companies in Malaysia, including those that are foreign-owned. The new regulations have been introduced in order to reduce the costs of doing business, increase the flexibility of managing affairs of companies and further protect key stakeholders of companies registered in Malaysia. The act also introduces a new online portal, MyCoID 2016, with the intention of easing corporate establishment and registration.

There are no changes specifically aimed at foreign firms in the new Companies Act 2016. However, the changes made further strengthen the regulatory environment in Malaysia and in turn increase the attractiveness of the market to potential entrants.

Environment

The Malaysian government has earmarked MYR 2.1 billion of funds for infrastructural development in five key economic corridors: Iskandar Malaysia, Northern Corridor Economic Region (NCER), East Coast Economic Region (ECER), Sabah Development Corridor (SDC) and Sarawak Corridor of Renewable Energy (SCORE).

The most prominent of these projects is Iskandar Malaysia, located at the tip of the Malaysian peninsula in close proximity to Singapore. The aim is to build a ‘strong and sustainable metropolis of international standing’ with an expected population of three million by 2025. The total cost of the project, funded by a combination of private enterprises and government organizations, is expected to reach MYR 485 billion. The development of this metropolis offers opportunities to foreign firms in a range of industries, from construction to smart city solutions, and also an alternative, less costly location to Singapore for firms looking to operate in this region.

![]() RELATED: Thailand in 2017: a Changing Investment Landscape

RELATED: Thailand in 2017: a Changing Investment Landscape

Outlook

According to BMI Research, Malaysia is one of the most stable countries in Asia in terms of economic and operational risk. The outlook for 2017 remains positive with infrastructural spending and increased consumption expected to drive the economy on to further growth. The Economic Transformation Plan also continues to create opportunities in burgeoning industries such as e-commerce and communications.

Similarly, the prospects for foreign firms, both incumbent and potential entrants, remain bright. The government’s desire to attract foreign firms is likely to remain for years to come. In addition, the implementation of the new Companies Act 2016 has further strengthened the regulatory environment. Despite higher business costs, this strong legal framework makes Malaysia an attractive alternative to some of its weaker regulated neighbors.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in ASEAN 2016

An Introduction to Doing Business in ASEAN 2016

An Introduction to Doing Business in ASEAN 2016 introduces the fundamentals of investing in the 10-nation ASEAN bloc, concentrating on economics, trade, corporate establishment and taxation. We also include the latest development news in our “Important Updates” section for each country, with the intent to provide an executive assessment of the varying component parts of ASEAN, assessing each member state and providing the most up-to-date economic and demographic data on each. Human Resources in ASEAN

Human Resources in ASEAN

In this issue of ASEAN Briefing, we discuss the prevailing structure of ASEAN’s labor markets and outline key considerations regarding wages and compliance at all levels of the value chain. We highlight comparative sentiment on labor markets within the region, showcase differences in cost and compliance between markets, and provide insight on the state of statutory social insurance obligations throughout the bloc.