The Guide to Corporate Establishment in Indonesia

By: Dezan Shira & Associates

Editor: Fernando Vidaurri

Indonesia is the largest economy in Southeast Asia and has the fourth largest population in the world, thus presenting a very attractive market for foreign companies looking to expand their operations. However, doing business in Indonesia can prove challenging. For their 2016 Doing Business Report Indonesia was ranked 109 out 189 economies, climbing up eleven spots from its 2015 ranking.

Furthermore, when measuring ease of starting up a business, Indonesia dropped ten places from 163 down to 173. However, with a GDP of US $888.5 billion in 2014, the implementation of ASEAN Economic Community at the end of the year and projected growth of six percent for 2016, Indonesia is likely to remain an attractive investment destination. In this article we will look at the different options and requirements for setting up a business in Indonesia.

Different Investment Options

Foreigners are allowed to set up two different types of legal entities in Indonesia:

- Limited Liability Company (PMA), and

- Representative Office

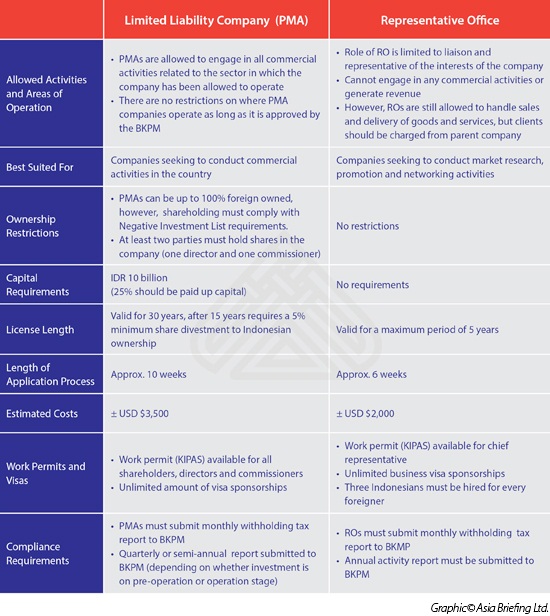

Setting up a PMA or representative office presents different benefits and challenges and depends largely on the kind of enterprise the foreign investors seek to establish. While a representative office has no capital requirements and takes less time to establish, it cannot engage in in commercial activities. The role of representative offices is limited to liaison and representative of the interest of the parent company.

RELATED: Pre-Investment Services from Dezan Shira & Associates

RELATED: Pre-Investment Services from Dezan Shira & Associates

Meanwhile, PMAs can operate as a limited liability company and are the most common form of foreign investment. PMA licenses are obtained through the Indonesian Investment Coordinating Board (BKPM), but require a large capital investment and take longer to process. However, a PMA gives investors full control over the direction of the company and reduces the need and risks of finding a suitable local partner. The following chart can help to better illustrate the different advantages each option offers:

There are some additional challenges and advantages that may be considered when choosing whether PMA is the right option to set up a business in Indonesia. For example, depending on the intended activity PMAs may need to obtain multiple operating licenses from different government bodies that could delay the process and add costs. However, new investors qualify for import tax exemptions on any capital goods needed for production within the first two years of operation.

How to Set Up a Limited Liability Company (PMA) in Indonesia

Setting up a limited liability company is a complex process that involves three different stages: preparation, pre-operation and commercial operation. Each one of these stages is further divided into different individual steps that must be processed through multiple agencies, including the Indonesian Investment Coordinating Board (BKPM):

Step 1 – Preparation:

- Before setting up operations investors must research about the sectors open for investment under the Negative Investment List

- Once it has been determined the sector is open for investment to foreigners, investors can obtain a Principal License from the Indonesian Investment Coordinating Board (BKPM)

- The next step is establishing the Limited Liability Company through the Ministry of Law with the help of a public notary

RELATED: Corporate Establishment Services from Dezan Shira & Associates

RELATED: Corporate Establishment Services from Dezan Shira & Associates

Step 2 – Pre-operation: Once the PMA has been established, companies will need to follow the procedures mentioned below to obtain the necessary permits and licenses:

- Obtain import identification number for manufacturing companies if needed from BKPM

- During the pre-operation stage companies would need to submit a quarterly investment activities report to the BKPM

- Apply for machinery import duty exemption and approval of tax facilities from the Directorate General of Taxation under the Ministry of Finance

- Obtain licenses from the local government, such as building permit and domicile certificate

- Obtain permits from sectoral ministries relevant to the sector in which investment is being made, for example plantation permits

Step 3 – Commercial Operation:

- Before the start of business, commercial operation investors must obtain a business license

- Finally, companies must obtain a general import identification number and material import duty exemption, if needed through the Indonesian Investment Coordinating Board (BKPM)

- During the commercial operation stage, companies must submit a semi-annual investment activities report to the BKPM for the length of the business operations in the country

- Any other periodical permits needed while the investment is fully operational can be obtained from sectoral ministries, for example a construction services permit

How to Set Up a Representative Office in Indonesia

In order to set up a representative office (KPPA), foreign investors must obtain the following permits and licenses:

- Letter of Approval from Indonesia Investment Coordinating Board (BKPM)

- Domicile Letter from the local government

- Tax Payer Registration Number from Taxation Office

- Registration Certificate from the Company Registration Ministry

RELATED: Indonesia’s Growing Special Economic Zones – Opportunities and Challenges

RELATED: Indonesia’s Growing Special Economic Zones – Opportunities and Challenges

Additionally, companies also need to provide the following documents:

- Letter of Appointment from the parent company

- Power of Attorney to sign the application, if the applicant is being represented by another party

- Articles of Association of the parent company, including any amendments

- Copy of valid passport (for foreigner) or copy of identification card number (for Indonesian) proposed as Representative Office Executive

- Letter of Statement concerning intent to work only in Representative Office Executive position, without engaging in any other commercial activities in the country

Further Support from Dezan Shira & Associates

Corporate establishment can prove a complex and challenging procedure, especially in a country with such a varied legal and bureaucratic system, such as Indonesia. With decades of experience helping companies set up business operations in the region, the specialists at Dezan Shira & Associates are well placed to help companies overcome these challenges. For more information, please get in touch with our specialists at asean@dezshira.com.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

Manufacturing Hubs Across Emerging Asia In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

Manufacturing Hubs Across Emerging Asia In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.