Made in ASEAN: Vietnam Cuts Import Taxes for ASEAN-made Vehicles

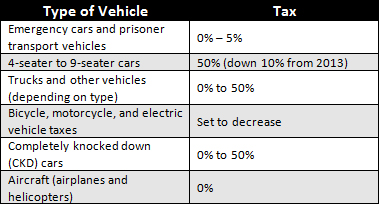

Ho Chi Minh City – As of January 1, 2014, vehicles imported from other ASEAN countries to Vietnam are eligible to receive a 10-50 percent tax cut following the 2008 ASEAN Trade in Goods Agreement (ATIGA). The new tax rate for vehicles imported into Vietnam from ASEAN nations is displayed in the following chart:

ASEAN Economic Integration

The realization of the ASEAN Economic Community (AEC) by 2015 will enable the free mobility of goods, services, skilled labor and investment. Vietnam continues to enact several measures in order to prepare itself for regional competition in a market that encompasses over 600 million people and US$2 trillion in production.

According to Vietnam’s Customs Office, 8,826 cars, worth nearly US$150 million, were imported into Vietnam from Thailand and Indonesia in the first 11 months of 2013 – more than double compared with the same period in 2012.

While Vietnam, in accordance with ATIGA, has reduced import duties to 0-5 percent on more than 10,000 tariff lines, Brunei, Indonesia, Malaysia, the Philippines, Singapore and Thailand have also cut tariffs to as low as zero percent on 99.65 percent of trade imported from ASEAN countries since 2010.

The AEC is expected to raise ASEAN’s real income by US$69.4 billion, and Vietnam’s real income by US$2.4 billion. These advantages could increase as the domestic economy matures and economic integration develops.

You can stay up to date with the latest business and investment trends across ASEAN by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

- Previous Article January 2014 ASEAN Regional Meetings

- Next Article Philippine Ports Authority set to Upgrade Infrastructure for ASEAN 2015