Vietnam’s Automobile Industry and Opportunities for EU Investors

- Vietnam’s automobile industry has grown significantly in recent years thanks to the country’s fast-growing middle class.

- While car ownership remains low compared to regional peers, families have increasingly upgraded to cars from motorbikes in the past five years.

- With the upcoming EVFTA, the Vietnamese automotive market will be fully opened to major automotive production centers of the EU by 2030.

Vietnam’s automobile industry has grown significantly in recent years. The average growth rate of domestically assembled vehicles was approximately 10 percent per year in the 2015-2018 period. With major manufacturers such as Toyota, Honda, Ford, Nissan, and Kia in the Vietnamese market, the number of spare parts suppliers has also invested in the industry giving the sector a much-needed boost.

The motorbike is ubiquitous in Vietnam, but with the country’s fast-growing middle class, car ownership is steadily rising. This growth, however, is likely to be stunted in the short term due to the COVID-19 pandemic but expected to resume in the long run as Vietnam reopens its economy.

Vietnam’s Industrial Policy and Strategy Institute predict 750,000 to 800,000 vehicles will be sold annually by 2025 up from 288,683 in 2018.

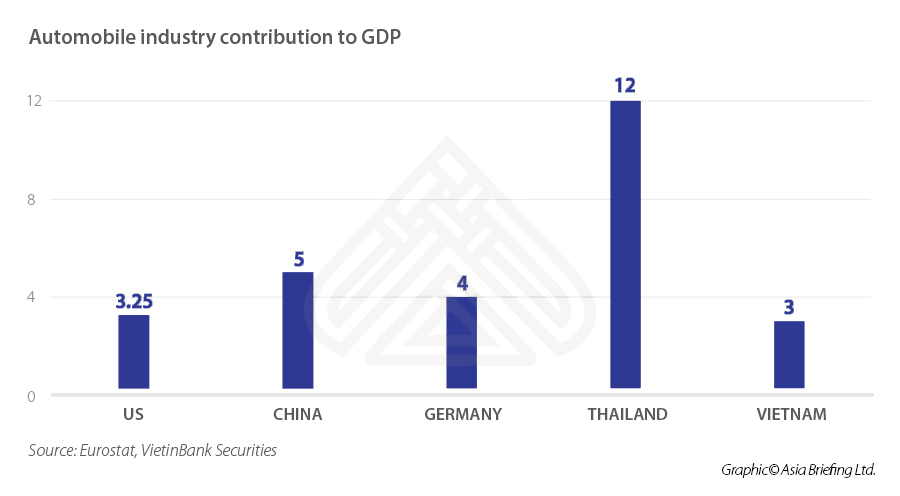

The automotive industry is a major contributor to the GDP of many countries in the world:

As displayed above, with such a high share in Vietnam’s GDP, the automotive industry has always received special attention from the government. There are currently many large automotive assembly and production projects in Vietnam with the aim of not only meeting domestic demand but also tapping into the regional market.

Local conglomerate Vingroup officially inaugurated its Vinfast factory on June 14, 2019, making it the first domestic automobile factory in Vietnam. The factory is not only state-of-the-art but also in line with Industry 4.0 standards.

However, the Vietnamese automotive industry faces stiff competition. Part of the reason for this is the zero-tariff policy between ASEAN countries that Vietnam is part of. Thus imports are cheaper than domestically produced vehicles.

Although Vietnam is one of the four largest automobile manufacturers in Southeast Asia, it has one of the lowest average localization rates in this region (only around 10-15 percent, and is still far behind Thailand, Indonesia, and Malaysia).

In addition, the local automobile industry has not been able to invest in core and high technology products such as engine production and transmission systems. Localized parts are mostly of low-technology products such as tires, seats, mirrors, glasses, cable harnesses, batteries, and plastic products.

About 80-90 percent of the main raw materials used to manufacture components are still imported. As a result, companies are required to import approximately US$2 billion to US$3.5 billion in components and parts for vehicle manufacturing, assembly, and repair each year.

For this reason, domestic automobile production costs are 10-20 percent higher than in other countries in Southeast Asia. As a result, the cost of cars produced domestically is at a disadvantage compared to completely build units (CBUs) that are imported.

Increasing car ownership

Vietnam imported more than 109,000 CBUs in the first nine months of 2019 with a turnover of US$2.4 billion as per official statistics. Compared to the same period in 2018, imported cars increased by 267 percent in volume and 257 percent in value.

Cars with less than nine seats led imports – with about 75,848 vehicles valued at US$1.5 billion. This shows the increasing purchasing power and the changing demands of customers. In addition, the vehicles imported from the EU mainly come from Germany. As per the General Department of Vietnam Customs in 2018, 1,197 imported cars from Germany were registered in Vietnam. Germany’s ZF Friedrichshafen inaugurated its first plant producing chassis modules for cars in Haiphong in November 2019.

Furthermore, according to the Vietnamese Automobile Manufacturers Association (VAMA), in the first nine months of 2019, the sales of VAMA members reached 219,205 cars for all types. This corresponds to an increase of 18 percent compared to the same period last year. In addition, the private car segment has recorded increased growth, specifically by 30 percent over the same period in 2019.

A CTS report stated that the reason for rising car consumption is Vietnam’s strong GDP growth. Vietnam is still at the beginning of a growth cycle. When compared with the GDP per capita of other countries in the region, the reasonable growth rate of car ownership in Vietnam is about 10.5 percent a year. If GDP per person increases by 1 percent, then car consumption per person should increase by 1.5 percent.

In addition, car prices are expected to fall in the future as economic stimulus measures such as the ban on motorcycles in the inner city are likely to take effect. This means that the growth rate of car consumption could also be higher and reach about 12-15 percent per year in the next 10 years.

EVFTA: Opportunities for EU investors

The European Union Vietnam Free Trade Agreement (EVFTA) is a comprehensive and ambitious agreement and presents significant opportunities for both Vietnam and the EU.

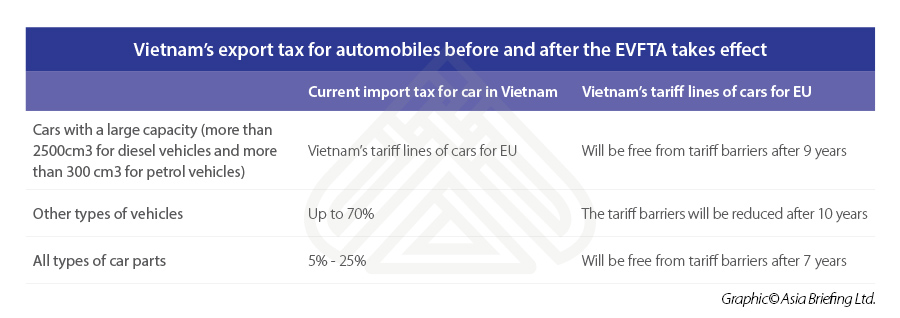

One of the most significant contents in this agreement is the commitment by Vietnam to eliminate tariffs on EU exports once the agreement comes into force. For cars and auto parts exported from the EU, Vietnam has guaranteed to reduce the import tax to zero percent after seven to 10 years, once the EVFTA takes effect.

The EVFTA is expected to take effect once the National Assembly of Vietnam ratifies the agreement. As a result, the Vietnamese automotive market is expected to be fully open to major automotive manufacturing centers in the EU by 2030. In addition, it is also forecast that the Vietnamese automotive market will reach a production capacity of one million vehicles per year by 2030.

As middle-class incomes continue to grow and Vietnam’s motorization landscape transforms, the country’s automobile industry is expected to remain on an upward trajectory.

However, with disruption to supply chains and less demand, the automobile industry will likely suffer short-term declines as it goes through a period of adjustment. Nevertheless, government incentives and Vietnam’s free trade agreements such as the EVFTA are likely to bolster the industry in the long term aided by a growing middle class.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.