Indonesia Ratifies RCEP Trade Agreement

Indonesia’s parliament has approved the country’s membership in the Regional Comprehensive Economic Partnership (RCEP) trade pact and becomes the latest country in ASEAN to join in what is the world’s largest free trade agreement. The RCEP is estimated to cover 30 percent of the global GDP of US$25.8 trillion, and comprise 30 percent of the world’s population.

While Indonesian exports will benefit from the reduction in tariffs between RCEP members, the country’s downstream industries are also well poised to receive greater investments. Supported by an abundance of natural resources, Indonesia is actively seeking to climb up the global value chain – transitioning from an exporter of raw commodities to a producer of high-value products.

Indonesia, Southeast Asia’s largest economy, ratified its membership in the Regional Comprehensive Economic Partnership (RCEP) on August 30, 2022, and becomes the latest country in ASEAN to ratify this trade agreement. The RCEP is estimated to cover 30 percent of the global GDP of US$25.8 trillion, and comprise 30 percent of the world’s population.

With the RCEP set to eliminate 92 percent of tariffs on goods traded among its 15 members, Indonesian lawmakers have expressed concerns that this could trigger an influx of imported goods and thus impact the competitiveness of local businesses, particularly micro and small medium enterprises (MSME). However, with President Joko Widodo’s coalition controlling 80 percent of parliament, ratification of the RCEP is only a matter of time.

Indonesia’s Chief Economics Minister, Airlangga Hartarto, expects the country to book a trade deficit in the early period after implementation, but by 2040, the RCEP could boost the country’s trade surplus by US$979 million, more than double the current trade surplus of US$383 million. Further, Indonesia could see GDP growth by 0.07 percentage points and an increase in exports and imports by US$5 billion and US$4 billion, respectively.

The country’s protectionist policies have made it difficult for foreign investments to enter the country. Indonesia struggled to capture a significant share of the investment and production from businesses moving out of China due to the US-China trade war.

The government has since introduced the Omnibus Law in late 2020 which removes bureaucratic inefficiencies, simplifies business licensing requirements, and liberalized more industries to attract foreign investments.

Investments in Indonesia’s downstream industries

Importantly for Indonesia, the RCEP presents an opportunity to better integrate Indonesia into regional value chains and attract investments into its industries, especially manufacturing, which accounts for 20 percent of GDP. The government aims for Indonesia to become a manufacturing hub that rivals Germany and South Korea.

Indonesia’s main areas of production are textiles and garments, electronics, automotive, footwear, food and beverages, and chemicals. The country’s trade-to-GDP ratio is 40 percent, lower than the global average of 55 to 60 percent, highlighting that Indonesia is poorly integrated with global supply and value chains.

Indonesia’s strength lies in its extensive natural resources and the processing industries associated with them. Membership in the RCEP can incentivize new investments and partnerships to obtain the technology and resources for expanding industrial capabilities and promoting innovation, besides enabling the climb up the value chain.

Incubating emerging value chains

Indonesia is keen to diversify its manufacturing sector and the RCEP can help transform the country into a producer of high-value products. Incubating new and emerging value chains will be vital if the country wants to increase the contribution of the manufacturing sector to GDP to 25 percent from 20 percent by 2030.

One such example of an emerging value chain the country is exploring is the establishment of an electric vehicle battery plant – the first in Southeast Asia — and marking a milestone in the country’s drive to becoming a global EV battery supplier and establishing a comprehensive EV supply chain.

Indonesia has significant nickel reserves – approximately 24 percent of the world’s reserves – and is a vital component of EV batteries. Moreover, the country’s Grasberg mine located in Papua province, has the second-largest reserve of copper in the world, another key component of EV batteries. When fully operational in 2023, the plant is expected to produce 10-gigawatt hours of lithium-ion battery cells for 150,000 EVs.

The digital economy

Another emerging value chain is the digital economy, which saw a growth of 49 percent in gross merchandise value (GMV) between 2020 and 2021 due to the pandemic. A report by Bain & Company, Google, and Temasek predicts that Indonesia’s digital economy will have a GMV of US$146 billion by 2025, the largest in ASEAN.

Since the start of the pandemic, the country saw 21 million new digital consumers and 72 percent were from non-metro areas, showcasing the growing penetration of the digital economy. E-commerce remains the main growth driver showcasing a growth of 52 percent from GMV of US$35 billion in 2020 to US$53 billion in 2021.

Webinar – Diversify Your Business to Indonesia – The Ins and Outs of Set Up

5:00 PM China Time / 4:00 PM Vietnam / 10:00 AM CET

Oct. 20, 2022, | 10:00 AM Los Angeles / 1:00 PM New York Discover why, where, and how to set up in Indonesia, as well as what type of investment is permitted along with taxes and other costs involved with operating a business in Indonesia.

Join us in this free webinar!

The country is also home to nine tech unicorns, with GoTo — one of the largest — listed on the Indonesian Stock Exchange, raising some US$1.1 billion in April 2022. By the day’s end, GoTo’s market capitalization was US$32 billion.

Commodities are still of huge importance to the economy

Indonesia hopes that the RCEP will allow for greater investments into its downstream industries, particularly in commodities processing. Oil and gas and minerals play a significant role in Indonesia’s economy and constitute a major source of revenue for the government.

The government is planning to ‘hit the brakes’ on the exports of almost all commodities. Unprocessed nickel was banned from being exported since January 2021 and the ban on raw bauxite shipments will begin in 2023, followed by raw tin exports in 2024.

To put in perspective, in addition to having the world’s largest nickel reserves, Indonesia is the second-largest producer of tin, the third-largest producer of coal, and the fifth-largest producer of bauxite. In January 2022, the government imposed a one-month ban on thermal coal exports to avail of a domestic shortage. The ban caused market prices in Asia to jump to US$160 per ton, but it did protect Indonesian consumers from a surge in energy prices.

Further, the government recently stopped the exports of crude palm oil and palm oil products to rein in high domestic prices. Indonesia is the world’s largest producer of crude palm oil, accounting for 60 percent of the global share.

The President believes that preventing raw material exports until 2024 will triple Indonesia’s GDP by 2030. In terms of Purchasing Power Parity (PPP), the country is already ranked seventh behind Germany and Russia, but ahead of France, the UK, and Brazil.

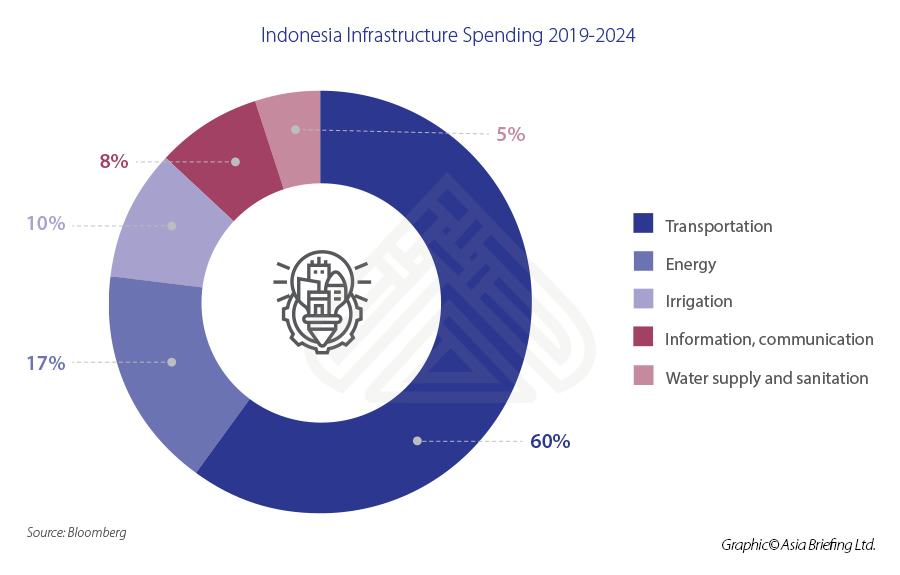

Infrastructure spending

To fully benefit from the RCEP, Indonesia must continue its infrastructure spending as connectivity issues still plague businesses in the country. Indonesia’s non-tariff trade costs with China are higher compared to its peers Malaysia and Vietnam.

One of President Joko Widodo’s signature campaign promises has been to improve the country’s infrastructure. When he won his second term in 2019, the President announced a raft of infrastructure projects worth US$400 billion, comprising 25 new airports and the development of over 2,000km of new highways, among others. In addition, the government is building a new US$35 billion capital city.

These initiatives will require major investments, presenting ample opportunities for RCEP member countries.

Benefitting from Indonesia’s huge domestic market

RCEP members can benefit from exporting to Indonesia’s huge domestic market of over 270 million people. Coupled with 70 million middle-class consumers, some 60 percent of GDP is derived from domestic consumption.

Foreign investors will find potential growth in numerous sectors from modern retail to food and beverages to fashion. Growing purchasing power has seen multinationals such as McDonald’s, KFC, Burger King, and Coca-Cola have a foothold in the country while modern retail outlets have expanded from Greater Jakarta to second-tier cities like Bandung and Surabaya.Many multinationals have also benefited from having a first-mover advantage in staying compliant with Indonesia’s Halal certification laws. The country is the world’s largest Halal consumer market with Indonesian Muslims expected to spend US$247 billion on Halal food and beverages alone by 2025.

Other beneficiaries of this spending include Australia’s cattle industry. Indonesia imports 500,000 heads of cattle from Australia annually, which comprises of 62 percent Australia’s total live cattle exports.

The Omnibus Law

At the heart of Indonesia’s ongoing reforms is the Omnibus Law. Launched in 2020, the law amends over 70 existing laws with its primary aim to stimulate domestic and foreign investment by simplifying business licensing requirements, liberalizing industries, and streamlining the labor law, among others.

The Law has liberalized over 245 business lines including sectors such as healthcare, aviation, energy, and telecommunications through a positive investment list. Moreover, to maximize tax revenue collection, the Law has overhauled Indonesia’s existing tax structure in which local tax residents will only need to use their national identity card as their tax number.

Further Reading

- An Introduction to Doing Business in Indonesia 2022 – New Publication from Dezan Shira & Associates

- Indonesia’s GoTo Goes Public, Market Capitalization of US$32bn

- Indonesia Bans the Export of Palm Oil, Impacting Global Food Prices

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.