Planning Your 2021 Investment Budgets: Opportunities in ASEAN

- Businesses planning their 2021 investment budgets should see ASEAN as having the best growth potential for the medium and long-term.

- ASEAN already has a vast single market comprising of 600 million people and the world’s third-largest labor force, behind India and China.

- The bloc is projected to become the fourth-largest economy by 2030 with domestic consumption doubling to US$4 trillion.

ASEAN presents opportunities in diverse sectors for small and large investors who are in the midst of planning their 2021 investment budgets.

As the bloc becomes better integrated, foreign investors will benefit from its vast single market comprising of 600 million people and third-largest labor market behind India and China. Investors can also benefit from ASEAN’s trade agreements that are on par with international best practices as well as being more responsive to regional changes and realities.

ASEAN countries have seen increasing investments due to the fallout of the US-China trade war, as businesses move all or part of their production lines into Southeast Asia.

Vietnam and Malaysia were notable winners with the former recording more than 81 percent in newly registered investments in 2019 and an increase of 215 percent in capital contributions for new facilities. For Malaysia, the country has seen a surge in investment in its electronics industry, which accounts for the largest share of Malaysian exports.This article analyzes the investment opportunities for selected ASEAN countries by highlighting sectors and sub-sectors that have the potential for growth in 2021.

Taking advantage of ASEAN’s free trade agreements

ASEAN has ratified several free trade agreements (FTAs). ASEAN has entered into a number of free trade agreements with other Asian nations that are now radically altering the global sourcing and manufacturing landscape. It has a treaty with China, for example, that has effectively done away with reduced tariffs on nearly 8,000 product categories, or 90 percent of imported goods, to zero.

These FTAs are:

ASEAN Free Trade Area

The ASEAN Free Trade Area (AFTA) was signed in 1992 with the aim to be a catalyst to help ASEAN become a production base for global markets. Under the agreement, goods originating in ASEAN have applied a 0-5 percent tariff rate.

ASEAN-Australia and New Zealand FTA

The ASEAN-Australia and New Zealand Free Trade Area (AANZFTA) came into force in January 2010. Through the AANZFTA, 90 percent of tariffs were eliminated and barriers to trade in services have been progressively liberalized following increased market access.

ASEAN-People’s Republic of China FTA

This agreement was signed in 2002 and by 2004, Indonesian exports were open to the Chinese market. Some 90 percent of tariffs on imported goods have been reduced or eliminated.

ASEAN-Hong Kong, China FTA (AHKFTA)

This trade agreement came into force in June 2019. Indonesia will eliminate duties for 75 percent of its products within 10 years and another 10 percent of its tariff lines within 14 years.

ASEAN-India FTA

The ASEAN-India Free Trade Area (AIFTA) was signed in 2009, resulting in one of the world’s largest FTAs. The agreement has seen tariffs eliminated for 90 percent of products traded between the two regions, which includes products such as palm oil, pepper, tea, and coffee.

ASEAN-Japan Comprehensive Economic Partnership

The ASEAN-Japan Comprehensive Economic Partnership (AJCEP) was enforced in 2008. AJCEP liberalizes trade in goods between Japan and the bloc, particularly in areas such as intellectual property, agriculture, fisheries, and forestry.

ASEAN-Republic of Korea Comprehensive Economic Cooperation Agreement

The ASEAN-Republic of Korea Free Trade Agreement (AKFTA) was signed in 2005 and has eliminated more than 90 percent of tariffs between ASEAN and the Republic of Korea. Additionally, the agreement has also liberalized the investment process and there has been enhanced cooperation in trade services.

Indonesia

Indonesia shows strong growth potential for foreign investors looking at long-term commitments in ASEAN.

The country has ASEAN’s largest workforce with over 130 million workers and some 60 percent of the population is under the age of 40. The government predicts that by 2045, Indonesia will be the world’s fourth-largest economy with a GDP of US$9.1 trillion.

What industries show the greatest potential for foreign investors?

Manufacturing

The government is pledging to transform Indonesia’s low-value manufacturing capabilities into a sector that can produce complex products and new technologies. The sector annually contributes to 20 percent of GDP and employs 15 percent of the total workforce.

By upgrading this sector, the government hopes to turn Indonesia into a manufacturing hub in ASEAN, rivaling those of Germany and South Korea by 2030. To achieve this goal, the Making Indonesia 4.0 roadmap was launched in 2018, an integrated plan to implement automation, digital technology, and artificial intelligence across the manufacturing spectrum in the country.

Indonesia’s main areas of production are in electronics, automotive, textiles and garments, footwear, food and beverages, and chemicals.

Digital-based economy

Indonesia’s digital-based economy is predicted to be valued at US$130 billion by 2025, making it the largest in Southeast Asia.

The e-commerce sector will play a vital role in this industry, with over 170 million people already engaging in some form of online shopping. The government has recently issued legislation to collect VAT from trade conducted through electronic systems as well as for foreign digital service providers.

The digital economy is also set to impact the growth of new sub-sectors within this sector, such as telemedicine, online education, and electronic payment systems.

Fast-moving consumer goods

With a middle-class comprising of over 70 million people, Indonesia’s fast-moving consumer goods (FMCGs) sector is considered one of the most attractive investment potentials for foreign businesses.

Prior to the pandemic, the sector regularly annual sales of over US$10 billion. This has been supported by the spread of modern retail to second and third-tier cities across the country.

Furthermore, retailers are catering to an increasingly Halal conscious consumer market, in particular for F&B products, cosmetics, and pharmaceuticals. Businesses that can cater to these needs have an opportunity to capture one of the world’s largest Halal markets.

Thailand

Before the onset of COVID-19, Thailand had one of the fastest-growing economies in the Indochina and Greater Mekong subregion.

Driven by both the abundant natural resources and cost-effective labor force, the country is consistently one of the most popular FDI destinations in the region. Its economy is export-heavy, accounting for two-thirds of GDP.

The country issued ‘Thailand Plus’ in 2019, containing a wide variety of measures to attract foreign investment, including the introduction of new tax incentives and deductions as well as reforms and initiatives designed to improve the ease of doing business.

What industries show the greatest potential for foreign investors?

Manufacturing

The manufacturing sector constitutes 30 percent of Thailand’s total GDP, covering a variety of goods, such as textiles and garments, footwear, electronics, automobiles and parts, and integrated circuits.

The government is looking to new technologies, such as cloud computing, the Internet of Things (IoT), and robotic automation to upgrade this sector and attract foreign investments.

Thailand already manufactures 40 percent of the world’s hard disk drives, and the world’s second-largest exporter of washing machines and air conditioners. Some 70 percent of electrical appliances made in Thailand are bound for export, valued at US$32 billion in 2019.

Automotive, and their parts, had an export value of US$27.8 billion in 2019, with the country exporting more than half of the two million car units it produces. Known as the ‘Detroit of Asia’, the country has issued various incentives for investments in eco-friendly vehicles as a means to maintain its competitive edge among ASEAN’s automobile industry.

On November 4, 2020, Thailand issued its latest tax holidays for its electric vehicle industry, which will be advantageous for producers of battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs).

Thailand is also known for its gem and jewelry industry, annually exporting US$16 billion of these products and employing over 1 million people. Exports are predicted to increase five to 10 percent and could increase further once local manufacturers upgrade their production lines, as well as marketing as import tariffs on raw materials, are close to zero.

Healthcare

The government has earmarked the healthcare industry as a priority sector and is looking to transform the country into a medical hub in ASEAN.

In 2019, US magazine CEOWORLD stated that Thailand had the sixth-best healthcare system in the world, beating Spain (7th), France (8th), Belgium (9th), and Australia (10th). Moreover, the country earned some US$589 million in 2019 from medical tourism.

International patients are attracted by the competitive prices as well as first-class facilities. The country has over 12 Joint Commission International (JCI) accredited healthcare centers — Being JCI certified is considered the gold standard for patient healthcare and safety.

Thailand’s medical devices industry is valued at over US$6 billion and 80 percent of local production are exported.

In late April 2020, the government provided incentives in the form of corporate income tax reductions and exemption of import duties for businesses that produce medical devices or parts, such as PPEs, diagnostic testing kits, active pharmaceutical ingredients, the use of non-woven fabrics for masks, and biotechnological production for vaccines, among others

Malaysia

Malaysia has been a popular destination for foreign companies based in China looking to alternative locations to supplement their Chinese operations.

The country’s GDP is outranked only by Thailand and Indonesia, supported by decades of industrial growth and political stability. The country has shifted from an agricultural and commodities-based economy to one driven by services and manufacturing. Oil and gas still contribute to some 20 percent of GDP.

What industries show the greatest potential for foreign investors?

Manufacturing

Malaysia is increasing mechanization in its manufacturing sector to maintain productivity growth.

The government has provided grants to encourage businesses to implement automation. These include:

- Accelerated capital allowance and automation capital allowance on the first two million ringgit (US$484,000) and four million ringgit (US$968,000) on qualifying capital expenditure. This will be extended to the year 2023 for companies in the manufacturing sector; and

- The incentive is extended to companies in the services sector on the first 2 million Ringgit (US$484,000) on qualifying capital expenditure from 2020-2023.

Investors in the electronics and electrical (E&E) sector are also eligible for a 10-year tax exemption. Exports from this sector account for 44.7 percent of total manufactured goods exports in 2019, valued at over US$90 billion.

The country already produces over eight percent of global back-end semiconductor output. Local players are hoping to move up the value chain to be better able to compete globally and are looking to foreign investors to help facilitate this goal. Foreign investors are needed in specialty areas, such as artificial intelligence, training of the local workforces, and developing new E&E sub-sectors.Healthcare

The country is competing with Thailand and Singapore to become a medical hub in ASEAN, especially in the field of medical tourism.

The healthcare industry is expected to be valued at US$30 billion by 2027, fueled by increasing domestic demand from an increasingly affluent and aging population.

Medical tourism will also play an important role, with the country attracting more than one million medical tourists in 2019, generating US$433 million in revenues. This was an increase from the US$361 million garnered in 2018.

The country is developing a reputation as a provider of specialized treatments, such as cardiology and fertility treatments. There are over 30 advanced heart centers in the country and the success rate of in vitro fertilization (IVF) in Malaysia is high around 55 to 60 percent.

Further, tourists are attracted by the affordability of the treatment, as prices are much cheaper than those in Singapore. Bypass surgery in Malaysia costs US$14,000 in 2019, compared to US$23,000 in Singapore.

Medical device manufacturing is also an important industry with huge potential for growth. There are already more than 200 manufacturers, of which 30 are international firms who have chosen Malaysia as their production base.

Malaysia exported over US$5 billion of medical devices in 2019, and over 50 percent of these to Japan, the US, Germany, and China.

The main products the country makes are:

- Surgical tools;

- Syringes and needles;

- Orthopedic products;

- Optical lenses;

- Hospital furniture;

- Blood transfusion sets;

- Dental dams; and

- First aid kits.

Digital economy

Malaysia’s digital economy now contributes to one-fifth of GDP, valued at over 270 billion ringgit (US$65 billion), making the country among the most digitally mature in the region.

COVID-19 has accelerated the industry’s share of GDP due to the increase in online shopping, online education, and telemedicine. The digital economy is forecasted to reach 20 percent of GDP by the end of 2020.

Despite this, six out of 10 companies are only at the basic digitalization stage, highlighting the future capabilities of this sector. As a sign of improving the investment landscape, the government introduced a digital service tax (DST) of six percent in January 2020.

The government hopes to gain as much as US$36 billion in tax revenues from this latest measure. Foreign digital service providers who have reached 500,000 ringgit (US$121,000) in annual turnover must register to collect and remit the service tax.

Examples of digital services covered under the tax include:

- Online licensing of software;

- Firewalls;

- Mobile applications and video games;

- Provision of e-books, films, music, streaming services, subscription-based media;

- Search engines and social networks;

- Website hosting services, cloud storage services;

- Online advertising platforms;

- Internet-based communications; and

- Online learning services.

Cambodia

Cambodia’s economy is in the process of moving away from agriculture and moving towards manufacturing and services.

The country is seen as an industry-specific investment destination, specifically for businesses in the textile and garment industry. The industry employs 86 percent of all factory workers and accounts for 16 percent of GDP and 80 percent of total exports.

The shift to a manufacturing-driven economy has been slow due to the labor force’s skills deficit in addition to its small population.

In the wake of the European Union partially withdrawing Cambodia’s ‘Everything but Arms’ (EBA) in early 2020, the government issued new regulations to help businesses (mainly in garment production) impacted by this measure.

The EBA status gives 49 of the world’s poorest nations duty-free access to EU markets and Cambodian exporters will now have to pay full tariffs for more than 30 products. In response, the government became more lenient in facilitating the import of raw materials, parts, and accessories used in the textile and garment industry.

American brands have helped pick up the excess capacity left over by European customers, giving the country temporary relief. It has since revised its GDP forecast from four percent to 5.5 percent for 2020.

In the first seven months of 2020, the country exported US$3.4 billion worth of goods to the US, an increase from US$2.7 billion in the same period of 2019. The top three exports to the US were garments, travel goods, and footwear.

Myanmar

Myanmar’s economy is expected to rebound in 2021 with economic growth forecasted at six percent.

The country is expected to increase fiscal spending in 2021 and continue reforms to grow the manufacturing sector and improve overall business sentiment.

What industries show the greatest potential for foreign investors?

Tourism

This is a developing sector in Myanmar and is one of the prioritized areas of the government’s national economic policy. Over four million tourists visited the country in 2019, an increase of 23 percent from 2018, with the aim to attract over seven million by 2021.

In January 2020, the country extended its visa-on-arrival scheme (VoA) to five more countries, Austria, Hungary, New Zealand, Czech Republic, and Luxemburg. Myanmar has already extended VoA access to nationals of Australia, Germany, Italy, Russia, Spain, and Switzerland, in October 2019.

Despite the new VoA extension, a priority of the Myanmar government has been to increase the number of Chinese visitors, and investments.

Chinese nationals have been granted VoA access since 2018 and visitor numbers increased by 33 percent to more than 500,000 in 2019. Furthermore, there are more than 150 direct flights between the two countries every week, signifying Myanmar’s growing ties with China.

Digital payments

Myanmar’s digital payments industry is expected to rapidly grow in 2021, as private consumption increases.

Earlier this year, the central bank launched the Myanmar Quick Response Code (MMQR) to allow digital payments using QR codes. The MMQR code will be integrated with domestic international payment systems, providing the foundation to develop e-wallets and other forms of cashless technologies.

Laos

Despite being one of the least developed countries in ASEAN, Laos has experienced significant economic growth in the last decade, with the country dependent on external demand for its natural resources. Mining and hydropower account for 95 percent of FDI in the country.

Thailand, China, and Vietnam play dominant investment roles in the Lao economy, with the majority of exports coming from electrical energy, mineral fuels, mineral oils, ores, and copper.

What industry shows the greatest potential for foreign investors?

Hydropower

Laos has a theoretical hydropower potential of 26.5 GW, making the country one of the richest in ASEAN in terms of hydropower resources.

The country’s low population density, high average annual precipitations, and hilly terrain mean that 18 GW is technically exploitable. In addition, 35 percent of the Mekong river’s total inflows travels through Laos.

Since the government opened the hydropower sector to foreign investment in 1993, the country has experienced rapid growth in hydropower capacity, and can now export two-thirds of its hydropower mainly to Thailand and to a lesser extent, Vietnam. The industry also accounts for 30 percent of all exports and the government wants to make hydropower the largest source of state revenue by 2025.

Laos also signed an agreement to supply 7,000 MW of electricity to Thailand, 5,000 MW to Vietnam, and 200 MW to Cambodia.

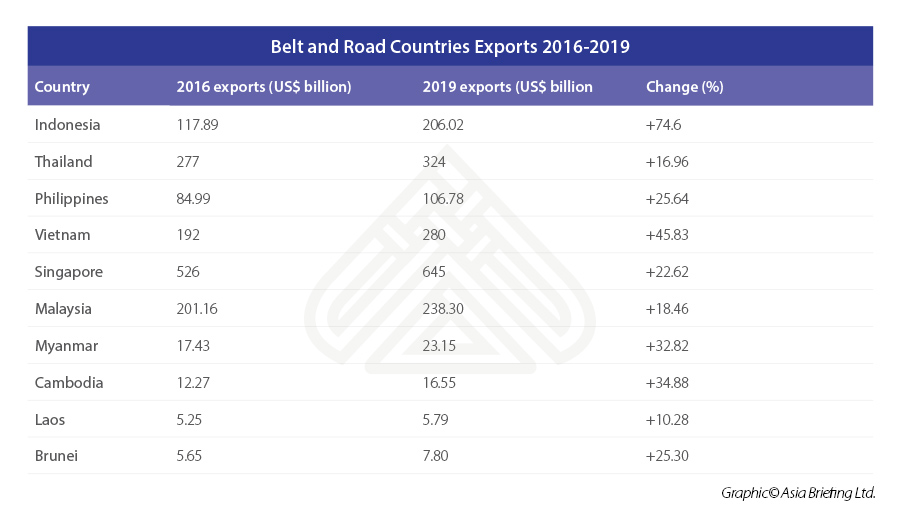

ASEAN and the Belt and Road Initiative: Exports increase

China’s Belt and Road Initiative (BRI), launched in 2013, as part of the Chinese government’s infrastructure development strategy to invest in over 100 countries.

BRI member states have seen exports increase, including those in ASEAN, and data from the World Bank’s TDC360 show that ASEAN’s exports increased by 30.7 percent. Although this cannot be fully attributed to the BRI, the BRI has helped accelerate the shift in global supply chains.

Furthermore, concerns that BRI members would be swamped with cheap Chinese products have not materialized.

ASEAN 2021 Opportunities and Foreign Investment Issues

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.