Relocating Your Business from China to ASEAN – Latest Issue of ASEAN Briefing Magazine

In this issue of the ASEAN Briefing magazine, we examine whether ASEAN can be an alluring investment destination for Chinese-based businesses.

Understanding the 13th Month Pay and Christmas Bonuses in the Philippines

Confusion over how the 13th month pay and Christmas bonuses differ in the Philippines is common. We look at the differences between the two types of bonus payments, how they are taxed, and who is eligible.

Indonesia’s Income Tax Incentives: Opportunities in Specific Sectors and Regions

The government introduced Regulation 78 of 2019 offering a variety of income tax incentives for investment in specific industries and provinces. Read on to learn more.

Vietnam-Russia Trade & Tourism Continues to Grow as ASEAN Nations Eye EAEU Free Trade Agreements

Chris Devonshire-Ellis writes on the continuing growth of Vietnam-Russia trade amidst the ASEAN bloc eyeing an agreement with the EAEU.

Philippines and China Sign Six Agreements

On October 24, 2019, the Philippines and China signed six bilateral agreements covering infrastructure, trade, communications, and customs. Read on to learn more.

Opportunities for Singaporean Businesses in Eurasian Economic Union

Chris Devonshire-Ellis writes on the Singapore-EAEU FTA, which is poised to provide new trade opportunities for Singaporean businesses. Read on to learn more.

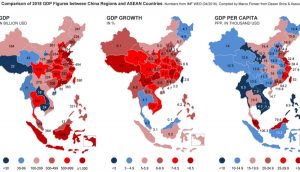

A New Perspective: How do ASEAN Economies Stand Against China’s Regions?

Amidst the US-China trade war and China’s slowing growth, the option of ASEAN as a China+1 destination is fast becoming the most appealing option. Read on to learn more.

Setting Up in Indonesia – Latest Issue of ASEAN Briefing Magazine

In this issue of ASEAN Briefing magazine, we examine Indonesia’s business environment, tax incentives for investments, and corporate establishments. Read on to learn more.

Corporate Income Tax in Singapore

Singapore’s corporate income tax (CIT) rate of 17 percent is the lowest in ASEAN and has attracted a dynamic investment community of more than 7,000 multinational firms into the country. Read on to learn more.

Singapore’s FTA Network: What are They and How to Apply

Singapore’s extensive free trade agreements (FTA), coupled with a transparent legal system and educated workforce, have made it an attractive destination for investors looking for business opportunities in Asia. Read on to learn more.