Investing in ASEAN’s Digital Landscape: New Opportunities After COVID-19

- COVID-19 has reshaped ASEAN’s digital landscape with many governments and businesses being forced to accelerate towards a digital economy.

- The region has over 400 million internet users, and so its digital landscape presents a unique opportunity for investors.

- Sectors such as telemedicine, e-commerce, and telecommuting are examples of such scalable digital opportunities.

The pandemic has reshaped ASEAN’s digital landscape with many governments and businesses in the region being forced to accelerate the transition towards a digital economy.

With over 400 million internet users in the region, the region’s digital landscape presents a unique opportunity for investors.

Technology will play a leading role in ASEAN in not only improving resilience to disasters, such as COVID-19, but also to increase the uptake of digital services, tools, and solutions.

Online education and telemedicine are examples of new sectors that have proliferated during lockdowns, and there has been an amplification of demand for telecommuting/ remote working and online conferencing software platforms and services, such as Microsoft Teams, Zoom, and Skype, among others.Telemedicine, telecommuting, and online education are scalable digital opportunities for data and artificial intelligence specialists

Telecommuting and 5G

Working remotely might continue to be a new norm in ASEAN with most businesses resorting to flexible work schedules that allows half of the workforce to work from home while the rest work at the office.

Despite the growth of digital nomadism in the West, this notion of working from home was relatively unheard of in ASEAN. The region’s young and tech-savvy workforce have had to brave some of the worst commutes in the world to get to their office.

Given the increasing reliance on remote work connectivity during the pandemic and the need for ASEAN countries to improve their existing telecommunications infrastructure, this will be an industry requiring major foreign investment.

5G networks, for example, can transform the world of remote work in the region as it promises to deliver internet speed that’s 50 times faster than 4G. ASEAN is expected to need some US$11-US$18 billion in investments to roll out 5G networks in the region, with a view to reaching some 200 million people by 2025.

Singapore is leading 5G developments in ASEAN and is launching 5G in 2020; by 2025, it is expected to have nationwide 5G network capabilities. The country will be closely followed by Vietnam, Thailand, Malaysia, and the Philippines who have the same ambitions.

Indonesia has the highest value potential for 5G with more than 100 million potential subscriptions. However, the country currently lacks a clear roadmap on spectrum allocation of 5G, thus delaying the growth and expansion of its US$10 billion telecommunications industry.

Telemedicine

The integration of information and communication technology (ICT ) into healthcare will also accelerate the sector’s reforms. The use of healthcare apps, for instance, could transform the way hospitals and doctors store their records, collect, and share patient data.

Telehealth offerings will become the new norm in the region post-COVID-19. Singapore-based telehealth company Doctor Anywhere raised US$27 million in investments for its expansion while Indonesian-based healthcare app Alodokter recorded more than 30 million active users since March 2020 (one and a half times higher than pre-COVID-19 traffic).

Singapore will continue to be an attractive location for health tech startups due to its strong legal framework and government support whereas Indonesia’s large consumer market could prove lucrative for investors.

Online education opportunities

ASEAN’s education sector is transforming to deliver education that is keeping pace with the requirements by businesses for graduates who have the technical and, in particular, English language skills.

2016-2020 – which aims to strengthen the region’s higher education sector – is improving access and use of digital learning initiatives in member states, opening up major investment opportunities for providers of new educational technologies.

E-commerce on the rise

The pandemic has changed the behavior, attitude, and purchasing habits of consumers and many of these are set to remain post-pandemic. Although purchases are currently centered around basic needs, a growing number of these transactions are done through digital commerce.

Traffic on e-commerce platforms has surged during the pandemic. E-commerce was previously factored by many retailers and producers in ASEAN as an ‘option’ rather than being an ‘essential’ business initiative. The region’s most popular shopping apps, such as Shopee and Lazada, saw an increase of more than 60 percent in weekly downloads in Thailand alone during the first weeks of lockdown.

Indonesia, Vietnam, and Singapore saw traffic increase by more than 10 percent on apps, such as Shopee, Lazada, Tokopedia, and ShopBack, among others.

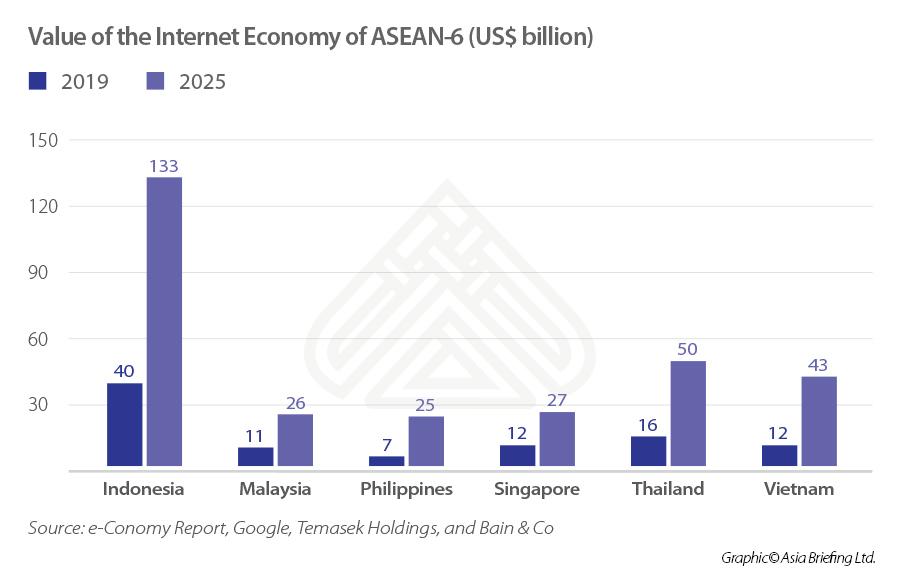

The region’s internet economy was valued at US$100 billion in 2019 in a report conducted by Google, Temasek Holdings, and Bain & Co. This is expected to rise to US$300 billion by 2025, spurned by the region’s young demographic using the internet for everything from purchasing games to banking.

Indonesia, the largest market in ASEAN, is predicted to have an internet economy close to US$130 billion by 2025. The other predicted growth will be from Thailand and Vietnam whose internet economies will be valued at US$50 billion and US$43 billion, respectively.

A version of this article appeared in the ASEAN Briefing magazine Business Recovery in ASEAN After COVID-19.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.