Indonesia Temporarily Eases Payments of Social Security Premiums for Businesses

- Indonesia issued Government Regulation 49 of 2020 (GR 49/2020) on August 31, 2020, which provides reductions in and postponement of the social security payments made by businesses.

- To be eligible for a postponement in the premium payments, businesses will need to prove the COVID-19 pandemic has reduced sales/profit by at least 30 percent since February 2020.

- These incentives are only applicable between August 2020 to January 2021.

On August 31, 2020, Indonesia’s government issued Government Regulation 49 of 2020 (GR 49/2020), which provides reductions and postponement in the mandatory payments of the Workers Social Security premiums (BPJS Ketenagakerjaan) by businesses.

This is part of the government’s ongoing efforts to assist businesses to mitigate the economic impact caused by the pandemic.

There are two types of social security programs in Indonesia — the Social Security Administrator for Health (BPJS Kesehatan) for healthcare and the Workers Social Security (BPJS Ketenagakerjaan) for pensions.

GR 49/2020 impacts the four programs covered under the Workers Social Security scheme:

- Work compensation (jaminan kecelakaan kerja, JKK) – provides protection for accidents occurring during or as a result of work;

- Old age benefits (jaminan hari tua, JHT) – provides protection for participants that are in retirement, laid off;

- Pension benefits (jaminan pension, JP) – provides guaranteed income in retirement; and

- Life insurance (jaminan kematian, JKM) – upon the death of the participant, their heirs can claim the benefits.

The required rate of contribution for each program is different for the employer and employee. For instance, employers contribute two percent of the monthly wage towards pensions (JP) whereas the employee contributes one percent.

The new adjustments provided under GR 49/2020 are:

- Deadline extension for the monthly contributions to the JKK, JKM, JHT, and JP programs;

- Reduction in the monthly contributions to the JKK and JKM programs; and

- Postponement of the monthly contributions to the JP

These incentives are only applicable between August 2020 to January 2021.

Deadline extension for payment of premiums

Under GR 49/2020, the government has extended the deadline for the payment of JKK, JKM, JHT, and JP programs by employers from the 15th of every month, to the 30th of every month. This extension also applies to non-employees (informal workers).

If the 30th falls on a national holiday, then the payments must be made on the nearest day before the 30th.

Contributors who are late in paying their social security premiums will be subject to a penalty of 0.5 percent of the total value of the premiums, per month.

Reduction in the JKK and JKM premiums

GR 49/2020 provides relief in the form of a reduction in the JKK and JKM payments by 99 percent from the regular rate.

Normally, the employer contributes between 0.24 and 1.74 percent of the employees’ monthly salary towards the JKK premium, depending on the occupational risk associated with the type of work. Employees do not contribute towards the JKK program.

The new rates under GR 49/2020 will therefore be:

- Very low risk level – (one percent x 0.24 percent) x monthly wages = 0024 percent x monthly wages;

- Low risk level – (one percent x 0.54 percent) x monthly wages = 0054 percent x monthly wages;

- Medium risk level – (one percent x 0.89 percent) x monthly wages = 0089 percent x monthly wages;

- High risk level – (one percent x 1.27 percent) x monthly wages = 0.0127 percent x monthly wages; and

- Very high risk level – (one percent x 1.74 percent ) x monthly wages = 0174 percent x monthly wages.

The new JKM rate for employers is calculated as:

(one percent x 0.30 percent x monthly wage) = 0.003 percent x monthly wage.

To be eligible, employers will need to have made regular payments to the JKK and JKM programs up until July 2020. Participants who registered with the JKK and JKM schemes after July 2020, will need to pay the normal rates for the next two months before the reduced rate is applied on the third month.

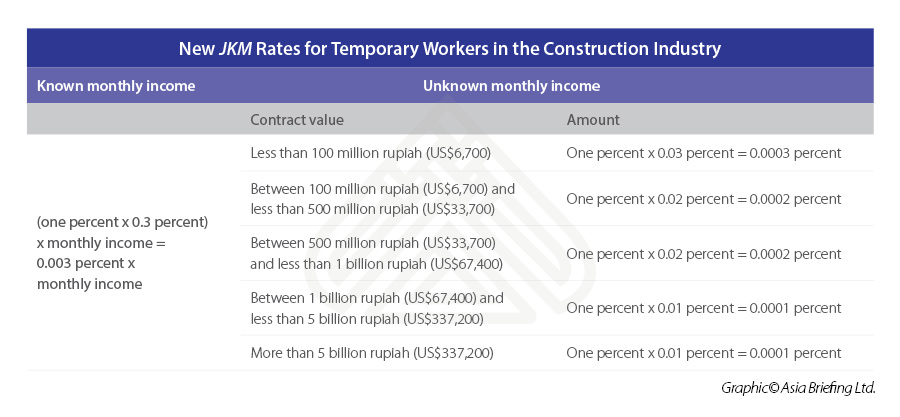

In the case of freelancer’s or temporary workers employed in the construction industry, the 99 percent relief also applies to their JKK and JKM payments. The rates are dependent on whether their salaries are recorded (known) or not recorded (unknown). If their monthly income component is not recorded, then the premiums are based on any relevant contract value.

Their new rates are as follows:

For freelancers and temporary workers in the construction industry, the new JKM rates provided under GR 49/2020 are:

Postponement of the monthly contributions to the JP program

GR 49/2020 allows for the postponement of monthly contributions to the JP program until January 2021. The regular rates for this scheme are that the employer contributes the equivalent of two percent of the employees’ monthly wage, and the employee contributes one percent.

Under GR 49/2020, employers can postpone 99 percent of the monthly payment, which can then be paid in full or in phases from May 15, 2021 to April 15, 2022. The remaining one percent needs to be paid each month as normal.

There are several requirements businesses must comply with.

Medium and large-sized businesses will need to seek approval from the BPJS organization by providing proof that the pandemic has negatively impacted their business operations. This should be supported by financial statements showcasing a decrease in sales/profits of more than 30 percent starting from February 2020.

Businesses must also have made regular contributions to the social security schemes at their normal rates up to July 2020.

Micro and small businesses do not have to obtain approval from the BPJS organization but must have made regular payments to the social security schemes up to July 2020.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com

- Previous Article Singapore Establishes Green Lane with Japan for Essential Travel

- Next Article Thailand Issues Special Tourist Visas to Help Revive Economy