Individual Income Tax Amendments in Malaysia for 2021

- Malaysia’s government has introduced several income tax amendments that will impact individual taxpayers for 2021.

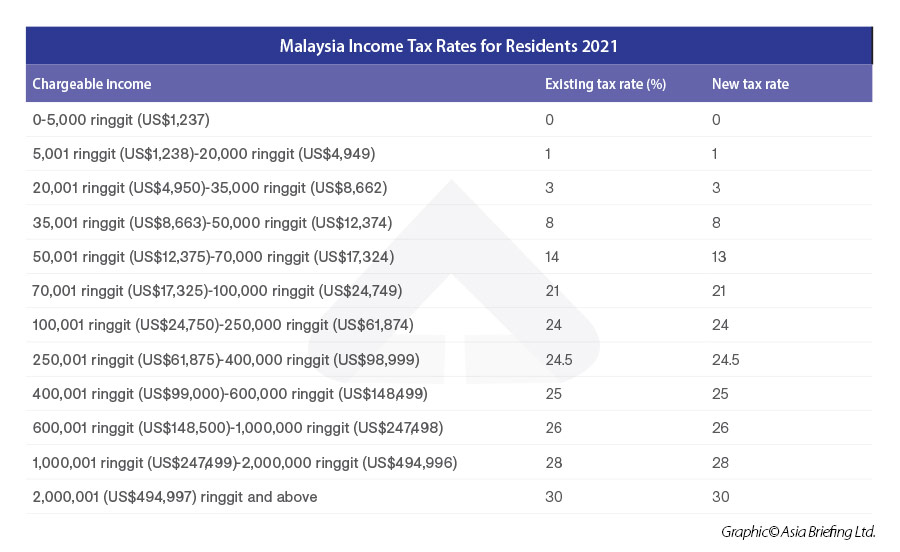

- The individual income tax has been reduced from 14 to 13 percent for resident taxpayers in the 50,000 ringgit (US$12,375) to 70,000 ringgit band (US$17,325).

- Further, there are several tax relief schemes that residential taxpayers can benefit from for this year and beyond.

Malaysia’s government introduced a slight reduction in individual tax as part of its 2021 budget proposals. Furthermore, the government has increased, expanded, and extended the scope of the individual tax relief schemes introduced in 2020.

The government has extended the reduction in the Employment Provident Fund (EPF) as well as the income tax relief on the Private Retirement Scheme (PRS). There are also tax deductions for individuals pursuing reskilling courses and tax breaks for the purchases of computers, smartphones, and tablets for personal use in 2021.

In addition to individual taxes, the government has provided an array of tax incentives for businesses. This can be read in our previous article here.

Income tax rate amendments

Under Budget 2021, the government has reduced the income tax rate by one percentage point for resident taxpayers in the 50,000 ringgit (US$12,375) to 70,000 ringgit band (US$17,325) from 14 percent to 13 percent.

Special income tax rates for non-citizens holding key positions in companies

Non-citizen individuals who hold C-suite positions in companies looking to relocate to Malaysia can receive a flat income tax rate of 15 percent. To qualify, the individual must:

- Receive a monthly salary of not less than 25,000 ringgit (US$6,187);

- Hold the C-suite position for a period of five consecutive years; and

- Be a Malaysian tax resident for each year of assessment throughout the flat tax rate treatment.

MIDA is receiving applications until December 31, 2021, for this incentive.

Extension of tax incentives for the Returning Expert Program

Under the Returning Expert Program (REP), Malaysian citizens who return to work in Malaysia and are classified as citizens are eligible for a flat income tax rate of 15 percent for a period of five consecutive years.

In addition, they are also eligible for exemptions on import and excise duties for the purchase of a complete built-up (CBU) vehicle or excise duty exemption for the purchase of a complete knocked-down (CKD) vehicle, limited to 100,000 ringgit (US$24,749).

Applications are open from January 1, 2021 to December 31, 2023.

Reduction of employees’ contributions to the Provident Fund

From January 1 to December 31, 2021, an employees’ contribution to the EPF has been reduced from 11 percent to nine percent.

The EPF is a compulsory saving and retirement plan for private-sector workers in Malaysia. Employees usually contribute between 11 percent to seven percent from their monthly salary.

Tax relief on lifestyle expenses

Individual taxpayers can claim income tax relief of up to 2,500 ringgit (US$618) on lifestyle expenses, such as the purchase of computers, smartphones, tablets, and reading materials. This has now been increased to 3,000 ringgit (US$742), where the additional 500 ringgit (US$123) is allocated for the purchase of sports equipment, entry/rental fees for sports facilities as well as participation fees in competitions.

Moreover, the scope of the relief has been expanded to include the subscription of electronic newspapers.

Income tax exemption on compensation for loss of employment

The Income Tax Act of 1967 states that any compensation received due to the loss of employment is taxable for individuals. However, such individuals can claim income tax exemptions under the following circumstances:

- 100 percent tax exemption for loss of employment due to ill health; or

- A 20,000 ringgit (US$4,949) a income tax exemption for each full year of employment with the same employer or companies from the same group.

This is effective for the 2020-2021 year of assessment.

Tax relief for education expenses

An individual taxpayer pursuing a Bachelor’s, Master’s, or Doctorate in fields recognized by the government or Minister of Finance are eligible for a maximum 7,000 ringgit (US$1,732) tax relief on fees.

The government has expanded the scope of this relief to include fees for attending upskilling courses or self-enhancement studies, recognized by the Department of Skills and Development. The tax relief, however, is limited to 1,000 ringgit (US$247) for each year of assessment.

Tax relief on Private Retirement Scheme

The income tax relief on the contribution to the Private Retirement Scheme (PRS) of up to 3,000 ringgit has been extended until 2025.

The PRS is a voluntary long-term investment scheme that seeks to enhance choices for Malaysians seeking to supplement their retirement savings.

Extension of income tax relief for the National Education Savings Scheme

The government has extended the tax relief of up to 8,000 ringgit (US$1,980) under the National Education Savings Scheme (SSPN) on net savings until 2022.

This is a savings scheme established by the National Higher Education Fund Corporation (PTPTN) to help parents and guardians save money for their children’s higher education. More importantly, the SSPN scheme enables children to continue their studies should anything happen to their parents or guardians. It is estimated that the PTPTN will receive some 1.8 billion ringgit (US$445 million) in deposits through the SSPN scheme.

Income tax relief on medical expenses for medical expenses

The income tax relief incurred on one’s self/spouse/children for serious illnesses has increased from 6,000 ringgit (US$1,485) to 8,000 ringgit (US$1,980) for 2021.

This includes an increase from 500 ringgit (US$523) to 1,000 ringgit (US$247) for medical examination expenses, in addition to an expansion on the tax relief to include vaccination expenses of up to 1,000 ringgit (US$247).

The eligible vaccines are as follows:

- Human Papillomavirus (HPV);

- Influenza;

- Pneumococcal;

- Varicella;

- Rotavirus;

- Meningococcal;

- Combination of tetanus, diphtheria, and acellular pertussis; and

- COVID-19.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Tax Identification Numbers in Laos: Compliance by June 2021

- Next Article Indirect Tax and Stamp Duty Measures in Malaysia for 2021