Electrifying Laos: Opportunities for FDI in 2017

By Zolzaya Erdenebileg

While Laos is still one of the poorest members in ASEAN, the country has posted strong growth rates for the past ten years, typically oscillating between seven and eight percent. This places Laos among the fastest-growing economies in ASEAN. The country is rich in resources, particularly agriculture, forestry, hydropower, and minerals. However, infrastructure is still underdeveloped and poverty rates are high. Efficient management of national resources is key to unlocking Lao’s development potentials, and any instability in governance will pose higher risk for potential investors.

Economy snapshot

Laos is forecasted to have reached a growth rate of 6.8 percent in 2016. In 2017, the economy is expected to improve at a slightly faster rate with seven percent. This will make Laos the third fastest growing economy in ASEAN, behind Myanmar and Cambodia. Inflation remains steady at a projected 1.6 percent and 2.3 percent in 2016 and 2017, respectively. Laos runs a negative current account balance, at about 16 percent of GDP in 2016.

Exports

According to data from the International Trade Centre (ITC), Laos’ exported value in 2015 was US$4.05 billion. Wood, articles of wood, and wood charcoal was the most exported good by value, followed by mineral fuels, mineral oils, and products of their distillation, and copper and articles thereof.

Imports

Laos’ major export markets include Thailand, China, and Vietnam. In 2015, Thailand’s share of Laos’ exports was 36.21 percent; China’s share was 32.53 percent; and Vietnam’s share was 14.5 percent.

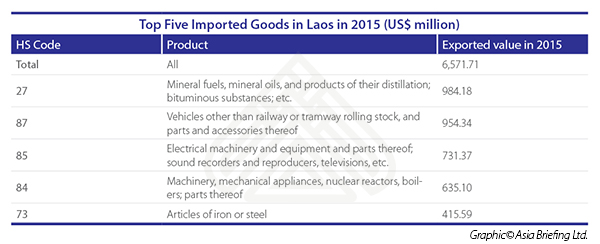

In 2015, Laos imported US$6.57 billion of goods, a decrease of over 10 percent from 2014, a result of slow overall global growth. Its most imported good by value was mineral fuels, mineral oils, and products of their distillation; followed by vehicles and vehicle parts; and electrical machinery and parts, including sound recorders, reproducers and televisions.

Like its export markets, Laos’ major import markets include Thailand, China, and Vietnam. In 2015, Thailand’s share of Laos’ exports was 63.43 percent; China’s share was 18.45 percent; and Vietnam’s share was 7.96 percent.

![]() RELATED: Pre-Investment and Market Entry Advisory from Dezan Shira & Associates

RELATED: Pre-Investment and Market Entry Advisory from Dezan Shira & Associates

Key Industries

Laos continues its gradual shift away from agriculture, which traditionally made up the base of its economy, towards industry and services which now composed the majority of value add. In 2014, the latest year for which statistics are available, services made up the greatest share of GDP at 35.95 percent. Industry followed, making up 32.7 percent, and agriculture made up 21.8 percent.

Power generation

While Laos still manufactures textiles and garments, nonmanufacturing industries – such as mining, construction, electricity, water, and gas – make most of industry value add. Laos has a wealth of natural resources, and uses these resources to fuel its economic ascent. In particular, Laos is becoming a power generating country, and the country’s capabilities have grown quickly due to the Hongsa Lignite power project, which outputs 1,878 MW of power. Theoretically, Laos has the capability to generate about 26,500 MW of hydropower. Under Thailand’s 20-year electricity sustainability plan, the country will buy 7,000 MW of electricity from Laos between 2015 and 2026. Other ASEAN countries, such as Myanmar and Malaysia have also announced intentions to import electricity from Laos.

Forestry

Laos is well known for its rich endowment of forests, and logging is a critical industry. However, illegal and excessive logging has led to deforestation and environmental degradation. In the 1950s, 70 percent of Laos was covered with forests; however, it is now estimated that less than 40 percent of the country still has cover. In May 2016, Laos Prime Minister Thongloun Sisoulith issued a moratorium on the export of logs and timber in order to decrease the pervasive shipments of illegally obtained logs, timber, processed wood, roots, branches, and trees from natural forests.

Despite the moratorium, illegal timber sales continue with the support of local governments in Laos. An unnamed civil society organization has raised allegations that provincial governors are profiting through the management of sawmills and trade with neighboring Vietnam.

Minerals

Having identified minerals as a key industry, Laos produces a number of mineral commodities, including barite, copper, gold, iron ore, lead, and silver. From 2011 to 2015, about 20 different types of minerals were extracted, with total output averaging US$7.7 billion. Out of this total, the government received about US$1.2 billion in taxes paid by miners.

However, the industry’s future remains unclear as the negative environmental effects of mining activity worsen. In 2012, the government issued a moratorium on new mining ventures, and announced in November 2016 that it was considering a permanent ban on the sector. It is unlikely that this will be the case as Laos is heavily dependent on rents from the industry, but potential investors should expect increased regulatory oversight.

Agriculture

There is a country-wide shift away from agriculture, and the sector’s share of GDP has steadily decreased in recent years. However, agriculture is still a critical industry for the Laotian people. About 75 percent of the total workforce is involved primarily in agriculture. 33 percent of farmers sell their crops, but about 80 percent of the rural population are subsistence farmers, relying on crops for food.

Rice is a major staple, making up 72 percent of total cultivated area. Other important crops include maize, coffee, sugarcane, cassava, sweet potato, and industrial tree crops (rubber, eucalyptus, acacia, etc.).

Presently, Laos is largely unable to export its crops due to high food standards by importing countries. Moreover, forest depletion and land degradation, as well as the country’s vulnerability to natural disasters, present challenges for the industry’s commercialization.

![]() RELATED: Investing in the Philippines: What to Expect in 2017

RELATED: Investing in the Philippines: What to Expect in 2017

Growth prospects

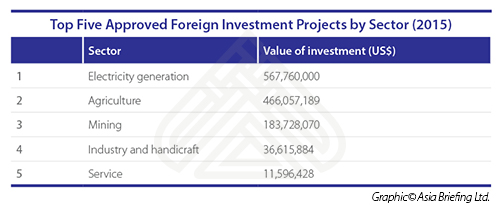

Despite industry challenges, Laos’ growth prospects are high. In 2015, the country attracted a total of US$1.26 billion in foreign direct investment (FDI). The most popular sector was electricity generation, attracting US$567.76 million in FDI. This was followed by agriculture, which attracted US$466.06 million in FDI.

The most popular investment type was joint ventures, followed closely by 100 percent foreign investment. Domestic business was the least popular investment type.

Poverty

Poverty present a major challenge to the Laos’ growth prospects. While poverty rates have dramatically decreased, from 33.5 percent in 2003 to 23.2 percent in 2013, many households are still vulnerable to drifting back into poverty. In addition, inequality has increased. Laos’ Gini coefficient, a measure of income inequality, rose to about 36.7 in the 2000s, an increase from the 1990s when it was about 30.

Poverty and inequality presents a human resources challenge to the country, which needs a healthy, educated, and skilled population to achieve its development goals. High inequality can also hamper growth by misallocating human capital, as those with little wealth are unable to escape the poverty cycle.

Key Takeaways

Laos’ future economic development looks bright as the electricity generation industry takes off, and it is able to export to neighboring countries and beyond. However, several challenges lay ahead, in particular, corruption and environmental pollution which act as destabilizing forces. In addition, as Laos grows, it should invest more heavily in its population to reduce poverty and increase the quality of human capital.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in ASEAN 2016

An Introduction to Doing Business in ASEAN 2016

An Introduction to Doing Business in ASEAN 2016 introduces the fundamentals of investing in the 10-nation ASEAN bloc, concentrating on economics, trade, corporate establishment and taxation. We also include the latest development news in our “Important Updates” section for each country, with the intent to provide an executive assessment of the varying component parts of ASEAN, assessing each member state and providing the most up-to-date economic and demographic data on each.

Human Resources in ASEAN

Human Resources in ASEAN

In this issue of ASEAN Briefing, we discuss the prevailing structure of ASEAN’s labor markets and outline key considerations regarding wages and compliance at all levels of the value chain. We highlight comparative sentiment on labor markets within the region, showcase differences in cost and compliance between markets, and provide insight on the state of statutory social insurance obligations throughout the bloc.