Cambodia Issues Decree on Tax for E-Commerce Transactions: How Can Businesses Comply?

- Cambodia issued Sub-decree 65 on the implementation of value-added tax (VAT) on e-commerce transactions made by non-resident entities that do not have a permanent establishment (PE) in the country.

- Non-resident entities that do not have a PE in Cambodia must register for VAT with the Cambodian tax authority (if they meet the specific revenue threshold).

- These entities must also file a monthly VAT return and pay the 10 percent VAT rate on the value of their online transactions if they provide digital goods and services to end-user consumers (B2C).

- Sub-decree 65 implements the reverse charge mechanism in the business-to-business (B2B) scenario.

On April 8, 2021, Cambodia issued Sub-decree 65 on the implementation of value-added tax (VAT) on e-commerce transactions made by non-resident entities that do not have a permanent establishment (PE) in the country.

Cambodia’s digital startups have helped blunt the economic impact as its garment manufacturing industry — which accounts for 80 percent of exports — has faced serious financial problems because clothing brands have either canceled orders or stopped placing new ones due to the COVID-19 pandemic.

E-commerce revenues reached US$183 million and are predicted to reach US$222 million in 2021 and US$313 million by 2025. The government has sought to better prepare the soft and hard infrastructure to support Cambodia’s digital economy through the issuance of the Law on Electronic Commerce, which was introduced in 2019.In addition, the government established a national e-commerce strategy in November 2020, which focuses on strengthening 10 sub-sectors:

- Strategy and policy focus and institutional coordination;

- Legal and regulatory frameworks;

- SME regulations;

- Information and communications technology (ICT) infrastructure;

- Digital knowledge/skills infrastructure;

- Payment systems;

- Domestic e-commerce/trade logistics;

- Cross-border trade;

- Access to finance; and

- Trade information and in-market support.

Other measures implemented by the government include the launch of Cambodia’s first digital currency in 2020, named Bekong, which supports transactions in riel and dollars through its mobile app. The primary objective of Bekong is to increase financial inclusion to the country’s large and unbanked population and provide consumers with a centralized infrastructure that allows for more than one payment type.

What are the obligations for non-resident entities?

Non-resident entities that do not have a PE in Cambodia must first register for VAT with the Cambodian tax authority – if their estimated revenue meets the threshold to register as a taxpayer.

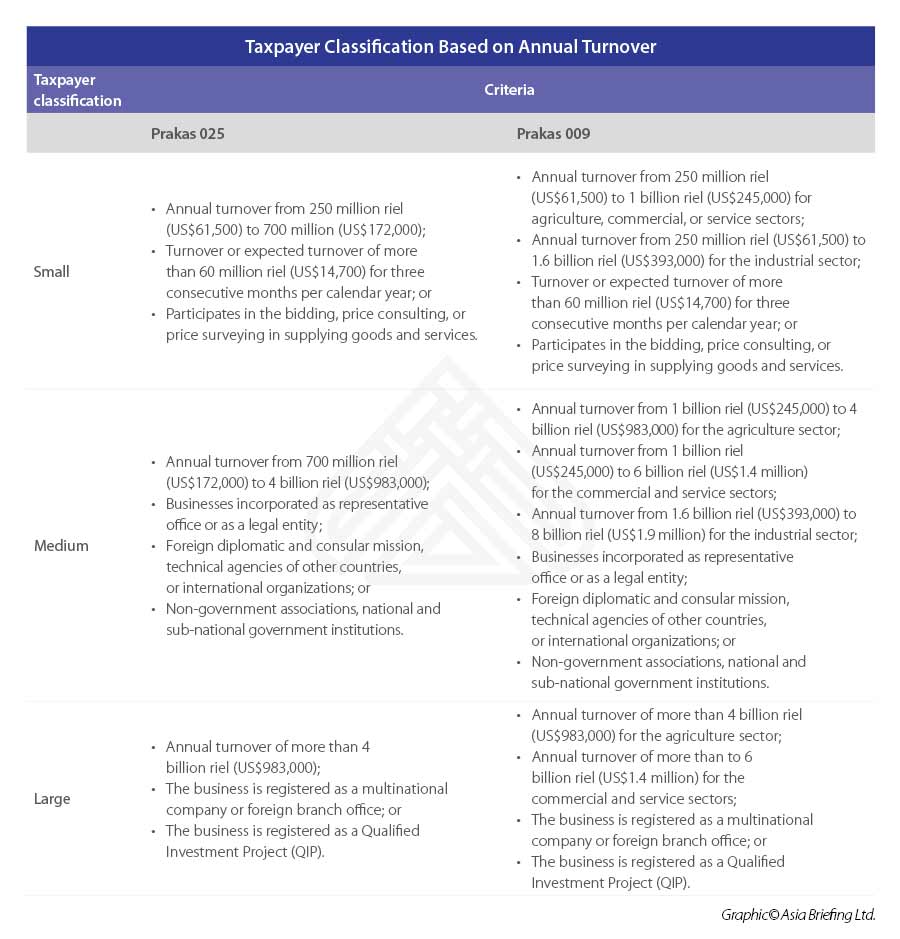

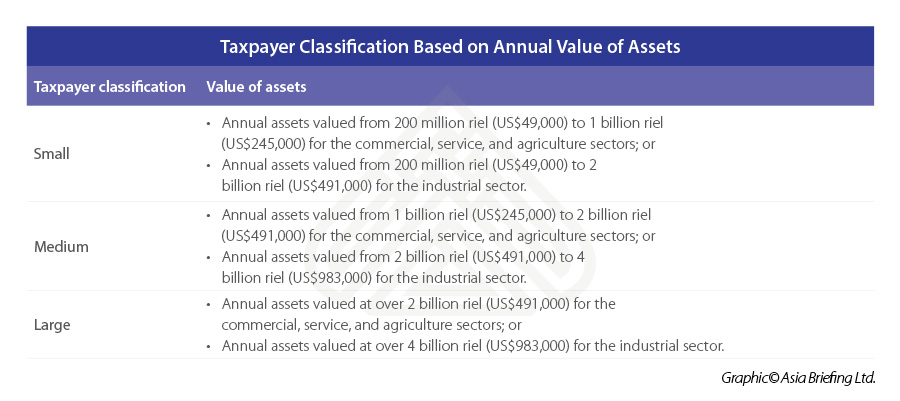

In January 2021, the tax authority issued new criteria to classify taxpayers under Prakas 009, which replaces Prakas 025. Taxpayers are assessed on their annual turnover or the value of their assets. They are then classified into small, medium, or large taxpayers.

If the declared turnover does not reflect actual turnover, then the General Department of Taxation has the authority to re-determine the classification of the taxpayer based on the value of their assets.

Non-resident e-commerce entities that provide digital products or services directly to consumers (B2C) are obliged to register for VAT (if they meet the revenue threshold), file a monthly VAT return, and pay the 10 percent VAT rate on the value of their online transactions. This must be done on the 20th day of the following month from the month the payment was made.

Under the business-to-business (B2B) scenario, resident taxpayers who purchase digital goods or services from non-resident entities must collect the 10 percent VAT output based on the reverse charge mechanism. This is done by paying the tax to the tax administration.

What is the penalty for non-compliance?

Non-resident e-commerce providers that fail to comply with Sub-decree 65, such as failing to register with the tax authority, will be liable for any tax that it is due to pay. Further, the entity may be liable for a fine of up to 5 million riel (US$1,234) or imprisonment between one month to one year.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.