A Guide to Withholding Taxes in Singapore

Companies, individuals, and other entities in Singapore must pay a withholding tax when making payments to non-resident entities.

A withholding tax is a common form of tax that most countries impose on cross-border transactions and other payments involving non-residents. It is called a withholding tax because it is levied on the payer rather than the recipient, meaning the taxable amount is withheld from the recipient.

Withholding taxes differ based on location and income type. Withholding taxes in Singapore are low by global standards, in line with the city-state’s reputation for business-friendly policies.Here, we overview the withholding tax types and rates in Singapore, and what companies should consider when planning for them.

Resident vs. non-resident companies

Companies, individuals, and other Singapore-based entities must pay withholding tax when making a payment to a non-resident.

In Singapore, a company is either a resident or a non-resident. The Inland Revenue Authority of Singapore (IRAS) determines residency by where the company is controlled and managed, or in other words, where it makes decisions on strategic matters. This means that a company’s residency is not necessarily the location of where it is incorporated.

For example, a company might be incorporated in Singapore, but be considered a non-resident if decisions are de facto made in another jurisdiction, such as Hong Kong or London. One factor in determining residency – but not necessarily the only one – is where the company holds its Board of Directors meeting.

Non-resident individuals

The IRAS classifies non-resident individuals into three different categories: foreign professionals, public entertainers, and board directors. Residency for all three categories depends on whether they spend less than 183 days in a calendar year in Singapore, but they have different obligations for tax purposes.

A professional is a non-resident if they are in Singapore for less than 183 days in a calendar year. Examples of foreign professionals include foreign experts or consultants invited to Singapore to share knowledge or expertise with an organization, an academic attending a seminar or workshop, or an individual operating via a foreign company.

Foreign public entertainers are those who visit Singapore to perform, such as musicians, dancers, actors, and athletes, and spend less than 183 days in the country, are classified as public entertainers regardless of whether they are working as individuals or as employees. The IRAS does not include individuals who assist public entertainers with their performances in this category, such as audio crewmembers, choreographers, coaches, and personal trainers.

Finally, board directors, or company directors, are non-residents if they spend less than 183 in a calendar year in Singapore. A board director may also hold another role within a company, such as a chief executive officer or managing director, but they are only considered a board director for income derived in that role.

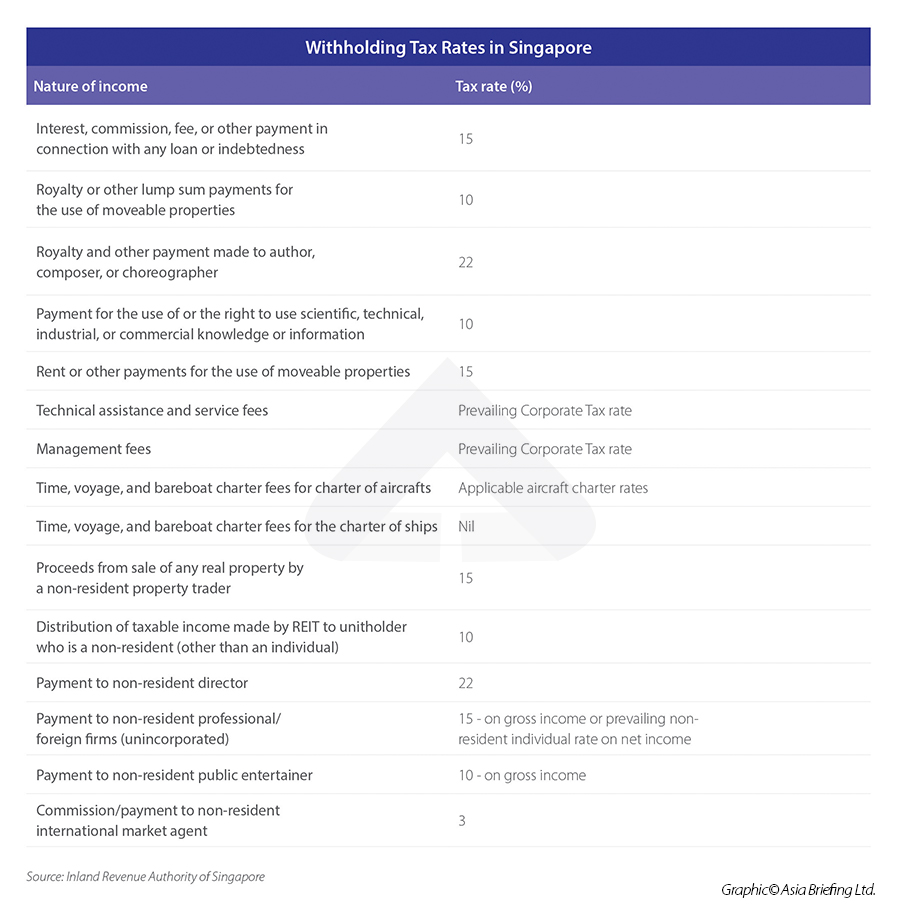

Withholding tax rates

Payments that require withholding taxes in Singapore include payments for services, interest, royalties, rentals of movable properties, and direct payments to non-residents.

Payers do not need to pay any withholding taxes to resident individuals and corporations. Singapore’s standard non-treaty withholding tax rates are zero for dividends, 15 percent for interest, and 10 percent for royalties.

Singapore has tax treaties with several countries, many of which lower withholding tax rates. For example, its agreement with Malaysia lowers the withholding tax rate on interest from 15 percent to 10 percent, and the rate for royalties from 10 percent to 8 percent.

The IRAS applies the prevailing corporate income tax (CIT) rate for technical assistance and service fees and management fees. Currently, Singapore’s headline CIT rate is 17 percent.

Besides the standard rates for dividends, interest, and royalties, the IRAS imposes different rates for more granular types of activities. The IRAS delineates withholding tax rates as follows:

Filing withholding taxes

Payers subject to a withholding tax must file and pay the tax to the IRAS by the 15th of the second month following when the payment was made. The payment timeframe is based on the earliest date of the contract, invoice, payment, or when the recipient was credited.

Payers that miss the filing and payment deadline will be subject to an additional five percent penalty in the form of a late payment penalty notice. Further penalties apply if the payer still has not paid within 30 days of the notice’s issuance.

Individual taxpayers must use the online platform SingPass to e-file withholding taxes. Individuals filing on behalf of an entity, such as a company or trust, must first be authorized on the CorpPass platform.

Tax planning in Singapore

Singapore’s withholding tax rates are low by global standards. For example, Singapore does not impose any withholding taxes on dividends, while Thailand charges 10 percent, Indonesia 20 percent, and the Philippines 15 or 25 percent. Additionally, Singapore offers a number of tax credits and incentives that taxpayers can use to further lower their tax burden.

Singapore’s low tax rates, along with other advantages like its efficient business environment, independent legal system, and educated workforce, make it a strategic location for foreign investors to base their Southeast Asian operations. Foreign investors active in multiple jurisdictions in the ASEAN region should therefore take Singapore’s advantageous withholding tax policies in mind when structuring their operations.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City, and Da Nang in Vietnam, Munich, and Esen in Germany, Boston, and Salt Lake City in the United States, Milan, Conegliano, and Udine in Italy, in addition to Jakarta, and Batam in Indonesia. We also have partner firms in Malaysia, Bangladesh, the Philippines, and Thailand as well as our practices in China and India. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article The UK Starts Talks to Join CPTPP, Seeking Access to ASEAN

- Next Article Due Diligence in ASEAN