Tax Compliance in ASEAN in 2018

Businesses are affected not only by tax rates but also by the ease with which taxes are paid in a jurisdiction. Therefore, it is advisable for business and tax payers to consider aspects like time taken to calculate taxes, to file tax returns, and effectiveness of a government’s tax policies in a particular jurisdiction – more than tax rates – while determining the place of doing business. For many of the ASEAN’s developing markets, slight differences in tax rates can be more than offset by difference in time taken to comply with tax-related procedures.

![]() RELATED: Tax Services from Dezan Shira & Associates

RELATED: Tax Services from Dezan Shira & Associates

Further, the definition of taxation also plays a key role in a given investment’s exposure to taxation within ASEAN. In some countries, despite high levels of taxations, businesses may find that their overall tax burden is far lower as a result of the structure of their operations.

To give an overview of these considerations to our readers, we compare the hours required to file taxes, the number of documents required for proper filing, and the international ease of paying tax rankings of each of the 10 ASEAN states, in the figure below.

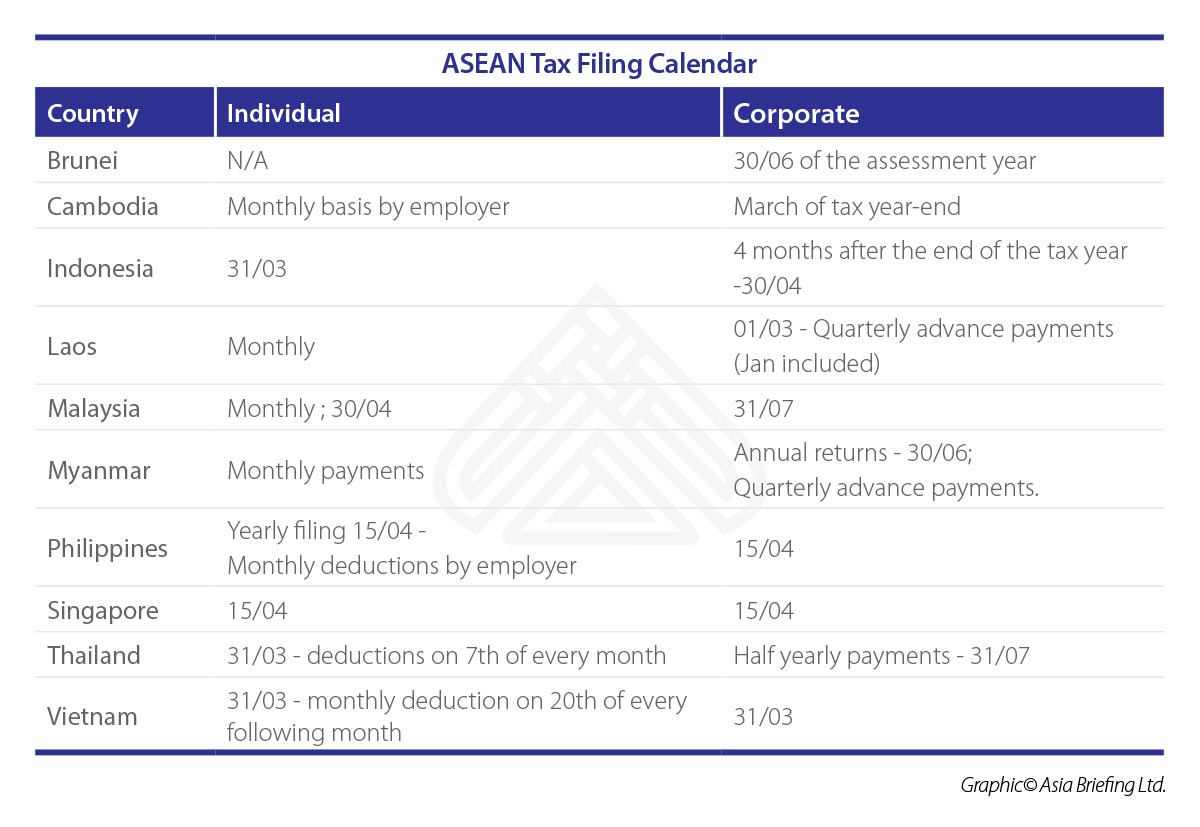

Below, the chart highlights key filing deadlines for those investing in ASEAN countries – each of the ASEAN countries require taxpayers to file their taxes differently. While in some countries such as Singapore filing is limited to a single date per year, countries like Vietnam requires monthly, quarterly, and annual declarations.

This article is an excerpt from the March 2018 issue of ASEAN Briefing magazine, titled “The 2018/19 ASEAN Tax Comparator“. In this issue, we discuss both the continuity and change in ASEAN’s tax landscape and what it means for foreign investors. We begin by highlighting the salient features of the taxation regimes of the individual member states of ASEAN. We examine the various forms of taxation within ASEAN while highlighting their regional variations. We then provide an inter-country comparison of tax rates, including in relation to PIT, CIT, VAT and GST, which is essential for making informed FDI decisions. Finally, we analyze the ease or burden of tax compliance in ASEAN in 2018 and beyond.

This article is an excerpt from the March 2018 issue of ASEAN Briefing magazine, titled “The 2018/19 ASEAN Tax Comparator“. In this issue, we discuss both the continuity and change in ASEAN’s tax landscape and what it means for foreign investors. We begin by highlighting the salient features of the taxation regimes of the individual member states of ASEAN. We examine the various forms of taxation within ASEAN while highlighting their regional variations. We then provide an inter-country comparison of tax rates, including in relation to PIT, CIT, VAT and GST, which is essential for making informed FDI decisions. Finally, we analyze the ease or burden of tax compliance in ASEAN in 2018 and beyond.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article IP Protection in Indonesia’s Food and Beverage Industry

- Next Article Singapore-Australia FTA: Impact of Recent Updates