Philippine Labor Contracts: What You Need to Know

By Dezan Shira & Associates

Editor: Vasundhara Rastogi

The Labor Code of the Philippines is the general labor law that regulates the relationship between the employee and the employer, and all employment-related matters in the country. The law applies to all Philippines’ enterprises and joint ventures, as well as to all employment relationships between Filipino nationals and foreign enterprises in the country.

There are several other special laws specifying statutory minimum employment benefits and standards that an employer must legally comply with. These include the Social Security Law, the National Health Insurance Act, the Sexual Harassment Law, and the Comprehensive Dangerous Drugs Act among others.

The Philippines’ Department of Labor and Employment (DOLE) is the principal government agency responsible for enforcing employment laws in the country. DOLE monitors and administers companies’ compliance with labor standards, and addresses labor-related issues through the office of the secretary of labor and employment, or through its regional offices.

![]() RELATED: Payroll and Human Resources Services from Dezan Shira & Associates

RELATED: Payroll and Human Resources Services from Dezan Shira & Associates

Types of employment contracts

The Philippine labor law recognizes following five categories of employment arrangements based on the nature of the employment.

- Regular employment, where the employee renders work for an indefinite period;

- Probationary employment, wherein the employment is subject to a period of observation and evaluation with an aim to assess the worker’s suitability for permanent employment;

- Project-based employment; fixed period or term-based employment; or seasonal employment where the arrangement pre-determines the expiration of the project, term, season or incidental activity.

An employment contract is concluded for each of the employment types. It may be oral or written so long it satisfies the essential requirements and the minimum statutory standards prescribed by the labor code. Any part of an employment contract that does not meet the standards is considered invalid.

In general, the employment contracts are arranged in English, however, an employer must provide a dual language contract in Filipino if an employee is a Philippine national – to communicate correctly the exact terms of the contract. Further, the contract must clearly state the terms of employment suitable to the employee type to avoid confusion or future disputes.

Following are some of the usual parts of an employment contract.

- Job position and status

- Job description

- Pay

- Employee benefits

- Length and condition of probationary period, if any

- Periods of notice

- Code of conduct

- Employee grievance mechanism

- Company policies

Working hours and overtime

Maximum working hours are generally eight hours per day or 48 hours per week. Employees are entitled to a daily unpaid meal break of at least one hour or a paid meal break of 20 minutes. Employees who work in excess of eight hours per day are entitled to overtime pay equivalent to the applicable wage rate plus at least 25 percent thereof. For work rendered on a rest day, the additional wage rate may apply.

Entitlement to overtime pay, however, depends on the nature of duties and responsibilities held by an employee. Following employees are not entitled to overtime pay, or for that matter, any other minimum conditions of employment laid down by the labor code.

- Government employees;

- Managerial employees;

- Officers or members of the managerial staff;

- Field personnel;

- Members of the family of the employer dependent on him for support;

- Domestic helpers and persons in the personal service of another; and

- Employees who are paid by results, as determined by the Secretary of the Philippines’ DOLE.

Leave

Employees are entitled to 12 paid regular holidays each year. If required to work on these holidays, they are entitled to a double of their regular pay. Additionally, there are three special non-working unpaid holidays.

As per the law, employees are not entitled to statutory sick leave. However, in practice, employees are granted sick leave through a voluntary employer policy or collective bargaining agreements.

Further, the Philippines labor law grants up to 78 days of paid maternity leave to female employees, and seven days of paid paternity leave to male employees – guaranteeing equal rights to all.

Social security

The Philippines’ social legislation requires both employees and employers to contribute to the Social Security System (SSS), National Health Insurance Program and the Home Development Mutual Fund that covers sickness, maternity, disability, retirement, deaths and funerals, health insurance and housing loans. The contribution rates are set based on the employee’s monthly compensation. The employer cannot deduct its share of contribution from the employee’s monthly contribution. The failure to make a contribution within the stipulated period may result in not just monetary liability but also criminal sanctions against the employer.

The current SSS contribution rate is 11 percent of the monthly compensation not exceeding ₱16,000 (US$318), with employer’s contribution rate being 7.37 percent and employee’s contribution rate being 3.63 percent.

Personal income tax rate

Foreign nationals working in the Philippines are classified as “resident aliens” based on the duration of their stay and employment period in the country. Income earned by such individuals is treated the same way as those of Filipino nationals and is taxed at source by the employer. In some case, income tax is deducted at source from foreign worker’s gross income at a rate of 15 percent before any other deduction is made.

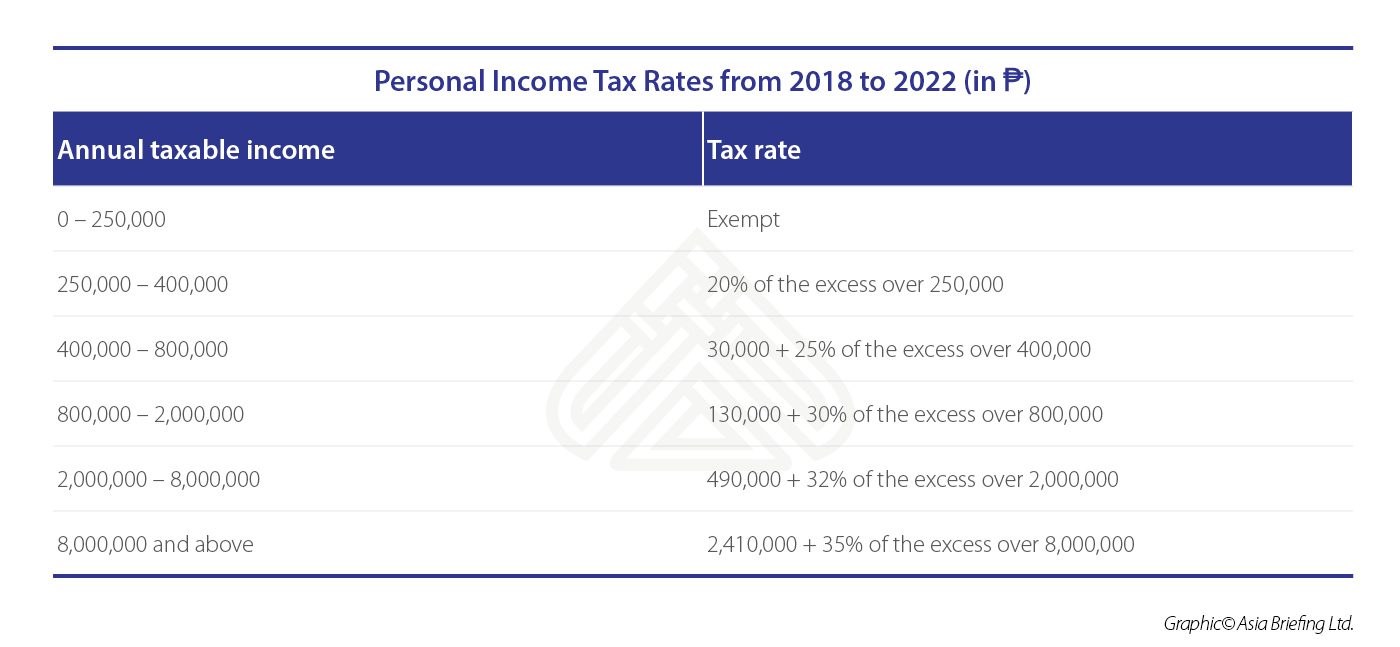

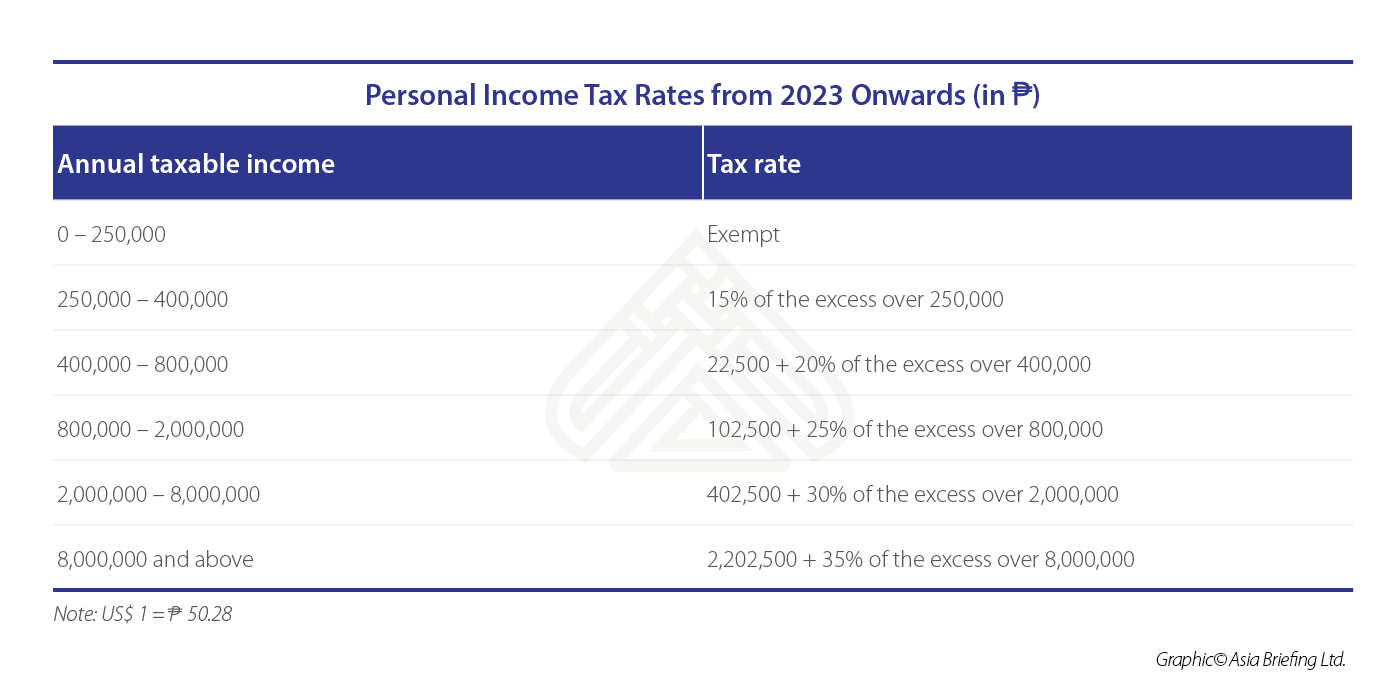

As per the Philippines’ new tax reform, the income tax rates for the year 2018 to 2022 are given in the table below. After 2022, the income tax rates will further be reduced for all taxpayers, except those earning an annual income above ₱8 million.

Termination of contract and severance pay

The Philippines’ laws recognize two categories of “cause”: Just cause and authorized cause on grounds of which an employee’s contract may be terminated. An employee dismissed for a “just cause” is not entitled to severance or termination pay, whereas those dismissed for authorized cause receive a severance pay equivalent to at least one-half month’s or one month’s pay every year of service, depending on the reason for termination.

RELATED: Thai Labor Contracts: What You Need to Know

RELATED: Thai Labor Contracts: What You Need to Know

Conclusion

Employment contracts form an essential part of doing business in the Philippines and establishes the rights and obligations of both employer and the employees.

With a surplus of low-cost labor available in the Philippines, an employment contract can help private companies hire workers as per their business requirements, and ensure better talent acquisition. However, employers must ensure that the drafted contract conforms to all the legal requirements laid down by the Philippines’ labor laws to avoid any monetary or criminal liability.

Further, to ensure a legally complying and well-drafted employment contract employers must seek legal assistance about clauses to include and avoid in the contract.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Gestión de nóminas en Singapur: Preguntas y respuestas

- Next Article Malaysia’s Investment Outlook for 2018