ASEAN Regulatory Brief: CIT Incentives, PIT Changes, Export Management Fees, VAT on E-commerce, and More

In this ASEAN Regulatory Brief, we look at some of the important regulatory changes taking place in Thailand, Cambodia, Malaysia, Indonesia, and Indonesia during the months of January and February.

Thailand:

- Tax Incentives used to entice MNCS, large market players to Thailand.

To promote the establishment of international headquarters (IHQ) and international trading centers in Thailand, the Government is providing several tax incentives to entice market players to the country.

An IHQ qualified company is defined as a Thai incorporated company that provides management, technical, and support services or treasury center services to its associated enterprises or branch offices either in overseas or Thailand.

Those companies qualifying for the IHQ incentives will be eligible to receive the following incentives:

- An exemption from corporate income tax on service income received from overseas enterprise or sales income from outside transactions

- A lower CIT rate of 10 percent on outside income

- An exemption from withholding tax on dividend and interest paid to an overseas entity

![]() RELATED: Dezan Shira & Associates’ Tax and Compliance Services

RELATED: Dezan Shira & Associates’ Tax and Compliance Services

Cambodia:

- Adjustment to Series of Public Services of the Annex Table Attached with the Joint Prakas № 985 Shv. Br.K, Dated 28 December 2012, on Provision of Public Services of the Ministry of Commerce, Joint Prakas № 1643 Shv.Br.K (MEF), 16 December 2014

Among the changes laid out in this Joint Prakas details, a key detail for businesses is that the Export Management Fee (EMF) for goods to be exported to foreign countries will be determined by price in accordance with the type and items of goods as stated in the annex table of this Joint Prakas. The EMF will be exempted for the following exported goods:

- Goods which have a total price of under EUR 6,000

- Goods exported to the EU

- Goods under the price of USD 800 and which are intended for export to other destinations (non-EU)

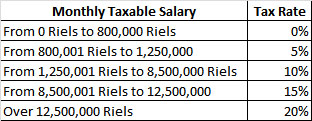

- Tax on Salary update in 2015

The General Department of Taxation (GDT) has issued Circular 048 dated January 6, 2015 (“Circular 048”) which raises the value of the tax-exempt threshold for the purposes of calculating an employee’s Tax on Salary (TOS). This new tax-exemption threshold became effective for declaring the Tax on Salary for January 2015 onward.

The new TOS rates are below:

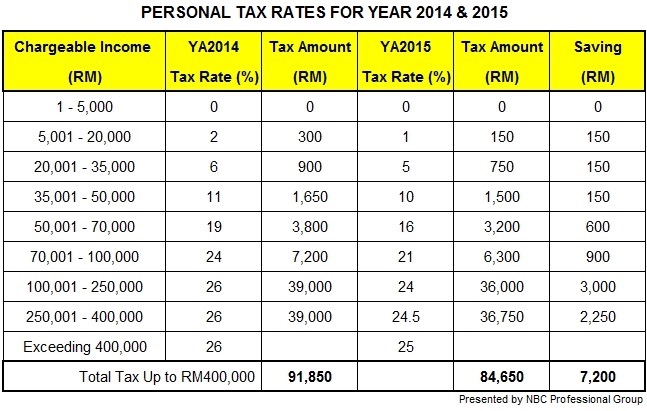

- Reduction in personal income tax rates from January 1, 2015

The chargeable income subject to the maximum tax rate will be increased from exceeding RM100,000 to exceeding RM400,000. The current maximum tax rate of 26 percent will be reduced to 24 percent, 24.5 percent, and 25 percent. Non-resident individuals are now subject to an income tax at a fixed rate of 25 percent, this has been reduced by one percent from the original 26 percent.

- VAT on E-COMMERCE

Indonesia’s Minister for Finance has stated that the Ministry of Communications and Information Technology has been instructed to prepare regulations which will impose a VAT take rate of 10 percent on online shopping.

- Indonesia cancels land tax on oil and gas exploration

Indonesia has announced that it will no longer impose a 0.5 percent “land and building tax” tax on companies while they are exploring for oil and gas. The government hopes that this might spur further exploration during the current low global oil prices. The change became effective on January 1, 2015.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

The 2014 Asia Tax Comparator

The 2014 Asia Tax Comparator

In this issue of Asia Briefing Magazine, we examine the different tax rates in 13 Asian jurisdictions – the 10 countries of ASEAN, plus China, India and Hong Kong. We examine the on-the-ground tax rates that each of these countries levy, including corporate income tax, individual income tax, indirect tax and withholding tax. We also examine residency triggers, as well as available tax incentives for the foreign investor and important compliance issues.