Gaming Industry in the Philippines Part I – Casinos

Op-ed by Bob Shead

In the first part of this two-part article on the Philippine Gaming Industry, I will focus on the country’s casino industry. Together with the online gaming sector, which will be the focus of the second part of this article, the casino industry is of enormous importance to the Philippine economy, and is intricately linked to the country’s tourism industry. In this article, I will also identify possible investment opportunities in this rather complicated and sensitive industry.

The Philippine Amusement and Gaming Corporation (PAGCOR) is the Philippine Government body, founded in 1976, that has the responsibility for governing the casino industry. PAGCOR is 100% owned by the Philippine government, and is a controlled corporation under the Office of the President of the Republic of the Philippines. The funds generated by PAGCOR augment the government’s budget for infrastructure and socio-civic projects.

RELATED: Corporate Establishment Services from Dezan Shira & Associates

RELATED: Corporate Establishment Services from Dezan Shira & Associates

Under its Charter, PAGCOR has a three pronged mandate:

- Regulate, operate, authorize and license games of chance, games of cards and games of numbers, particularly casino gaming in the Philippines;

- Generate revenues for the Philippine Government’s socio-civic and national development programs;

- Help promote the Philippine tourism industry.

In June 20017, the following amendments were added to the PAGCOR Charter:

- Allowed to enter into agreements, including joint ventures, with any person, firm, association or corporation;

- Have a requirement to obtain consent of the local government authority, that has territorial jurisdiction over the area chosen as a site for any of PAGCOR’s operations;

- Delimitation of regulatory authority and power over gaming activities covered by other existing franchises, regulatory bodies or special laws.

PAGCOR operates 13 casinos across the country, all located in in popular tourist destination areas:

METRO MANILA – Casino Filipino Midas, Casino Filipino Malate, Casino Filipino Pavilion.

LUZON – Casino Filipino Angeles, Casino Filipino Ilocos Norte, Casino Filipino Mimosa, Casino Filipino Olongapo, Casino Filipino Tagaytay.

VISAYAS & MINDANAO – Casino Filipino Bacolod, Casino Filipino Cebu, Casino Filipino Davao, Casino Filipino Iloilo, Casino Filipino Mactan.

However in 2008, the government of the day decided to open up the Philippine gambling market to international bidders, essentially removing PAGCOR’s monopoly of running its own casinos. PAGCOR still retains its Philippine government authority in regulating all casinos in the Philippines. This decision meant that the Philippines began to compete head to head with established gaming sites in Macau, Malaysia and Singapore, as well as Las Vegas and Australia. This led to a rapid rise of integrated casino/entertainment resorts in and around Manila, and has now resulted in the rapid development of areas such as Newport City, adjacent to Manila International Airport (NAIA), and the sprawling Entertainment City complex, which is part of reclaimed land in Manila Bay.

This decision, made in 2008, has been highly profitable to the Philippine Economy. For example, in the first nine months of 2016, the Philippine gaming industry was worth Peso118 billion (US$2.3 billion), in terms of Gross Gaming Revenue (GGR). In comparison, the GGR in 2012 was Peso56 billion (US$1.09 billion). The casino/entertainment complexes in Entertainment City have been, and will continue to be the main money makers and tourist draws for the foreseeable future. The investment bank, Credit Suisse has projected that the country’s gambling industry can earn gaming revenues of US$6 billion by 2018. This potentially will promote the Philippines into the top four gaming countries globally.

There are about 18 privately owned casinos currently operating in the Philippines, most are in Metro Manila. However Clark Airport (part of Angeles City) also hosts the following casinos – Fontana Resort, Royce Casino, Widus Resort and Midori Casino. Thunderbird Resorts Philippines also has two operations in North Luzon. However, casinos outside of Manila, account for only 327 gaming tables, or less than 18% of the 1,845 total as of September 2016. PAGCOR operated casinos have a combined 565 gaming tables, or equivalent to 31%. The vast majority of gaming tables are focused at Entertainment City, Manila.

The combined total investment costs in the Entertainment City gaming complex is estimated to be at least US$1 billion on facilities and are also required to follow a certain ratio of gaming tables to hotel rooms. These facilities and resorts then additionally attract not only gamblers but also high end tourists and business visitors who chose 5 star hotel accommodation with the related luxury lifestyle. These Manila based gaming establishments are also located close to Manila International Airport (NAIA) for ease of access, and avoiding the serious existing traffic issues.

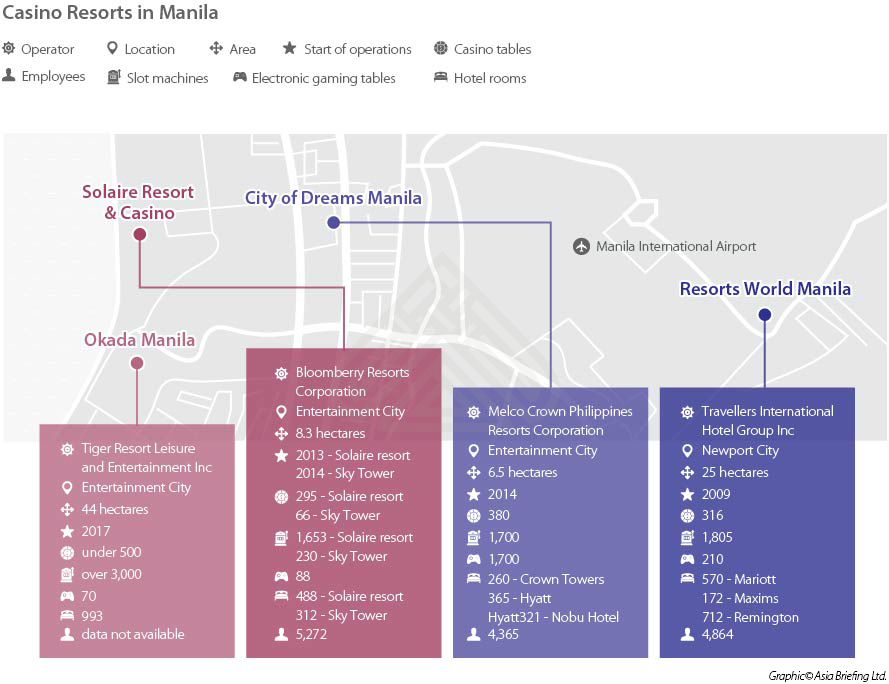

Currently, there are four operational and integrated casino/entertainment complexes in Manila, of which three are in Entertainment City, and one in Newport City. The first one, with a four year head start, is Resorts World Manila, which is in Newport City. Resorts World Manila is located opposite Terminal 3 of Manila International Airport.

Filipinos and foreigners had the first taste of the four promised Las Vegas- or Macau-styled glitzy casinos in Entertainment City when Solaire Resort & Casino was launched. It is operated by Bloomberry Resorts Corporation.

Almost a year after, City of Dreams also opened to the public. The second mega casino in the Entertainment City gaming strip is operated by Melco Resorts & Entertainment Limited in collaboration with the Philippines’ Belle Corporation. Melco Crown is a major Macau casino-resort operator.

The most recently opened Casino is Okada Manila, which, like Solaire, is next to the bay, offering its guests a view of the iconic Manila Bay sunset. In March this year, it unveiled a major attraction – the world’s biggest multicolour dancing fountain. It is operated by Tiger Resort Leisure and Entertainment Incorporated.

The fifth casino resort in Manila (and the last of the four in Entertainment City complex) is the Resorts World Bayshore. It is due to open in 2020. It will be the second integrated resort in Manila of Travellers International, which also operates Resorts World.

According to Fitch Ratings, the initial results of the first 3 casinos (Resorts World Manila, City of Dreams, and Solaire) are encouraging, relative to the size of the initial investment. But with increased competition in the industry, earlier developments have taken a hit. Various economic reports have said that the greater Manila market is showing signs of maturation with Resorts World Manila, the first privately-owned resort, currently showing a decline, due to the opening and operations of the newer resorts. However, it is expected that, driven by the opening of the US$2.4 billion Okada Manila Resort, a higher gross gaming revenue is forecast for 2017, along with the continued economic growth in the Philippines. Additionally, Credit Suisse has reported a decline in market share of gross gaming revenues from Resorts World Manila from 50% in 2012 to 19% by the end of this year. However, Credit Suisse have also predicted that Solaire Resorts will dominate the casino market share with 36% in 2017.

Latest data from PAGCOR showed junket-sourced VIP business makes up a third of the private casinos’ gross gaming revenue. VIP gamblers are foreign nationals flown into the Philippines by independent entrepreneurs or junket operators, who arrange credit lines and luxury accommodation for their clients. These gamblers don’t play along with the general and mass market clients, but are ushered into special rooms reserved for them. Growth in the VIP segments has also increased due to proxy betting (illegal in Macau and other casino cities). Proxy betting is a platform by which a person outside the casino gives betting instructions to an agent inside. The VIP junket sector is currently dominated by Korean visitors, as far as overseas visitors are concerned.

However, for the Philippine Government owned PAGCOR casinos, Electronic Gaming Machines (EGMs) or the slot machine market segment makes up the bulk of their gross gaming revenue. PAGCOR data records that nearly 6 out of every 10 EGMs nationwide are owned by the gaming regulator. PAGCOR operated 565 gaming tables, and 10,271 EGMs at Casino Filipino venues, as of the end of September 2016. In the first nine months of 2016, PAGCOR operated casinos recorded gross gaming revenue of Peso23.88 billion (US$ 467,703,000), although this was much lower than the licensed private casinos revenue of Peso79.89 billion (US$1.54 billion).

The Philippine Government has said that it will sell PAGCOR owned casinos to private bidders in the near future, as these can no longer compete with the licensed private casinos. As mentioned earlier, PAGCOR operates 11 casinos nationwide, two of which are in Metro Manila. Currently, under PAGCOR’s charter and national law, 5% of PAGCOR’s winnings is paid to the Bureau of Internal Revenue as franchise tax, while 50% of the remaining 95% is paid to the Philippine Treasury. Currently, other beneficiaries of PAGCOR’s revenue, include the Philippine Sports Commission, the Philippine Board of Claims, Philippine cities that host PAGCOR casinos, as well as the Office of the President’s Project for Social Funds.

RELATED: Tourism Industry in the Philippines: Part I

RELATED: Tourism Industry in the Philippines: Part I

Conclusion

Despite the catastrophic fire at Resorts World Manila earlier this year that caused 39 deaths, the casino industry is predicted to rise with the added investments in new casino resorts, and the improvements to airports, infrastructure etc, especially in the new skyway access roads that lead into the Manila Entertainment Complex on Manila Bay. Additionally, the fact that PAGCOR is preparing for the sale of its existing Philippine Government owned casinos, does present a good opportunity for international companies with an interest in this industry. As mentioned earlier, it has been predicted that casino revenues will increase to US$6 billion in 2018, making the Philippines the fourth biggest gaming center in the world.

Editor’s Note: We had erroneously mentioned in an earlier version of this article that the catastrophic fire had occurred at Solaire Resort & Casino. We deeply regret and sincerely apologize to our readers and the Solaire Resort & Casino management for this inadvertent error.

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in ASEAN 2017

An Introduction to Doing Business in ASEAN 2017

An Introduction to Doing Business in ASEAN 2017 introduces the fundamentals of investing in the 10-nation ASEAN bloc, concentrating on economics, trade, corporate establishment, and taxation. We also include the latest development news for each country, with the intent to provide an executive assessment of the varying component parts of ASEAN, assessing each member state and providing the most up-to-date economic and demographic data on each.

How to Set Up in the Philippines

How to Set Up in the Philippines

In this issue of ASEAN Briefing magazine, we provide an introduction to the Philippines as well as analyze the various market entry options available for investors interested in expanding to the island nation. We also discuss the step-by-step process for setting up a business entity in the Philippines, highlighting the various statutory requirements for overseas investors. Finally, we explore the potential for Singapore to serve as a viable base to administer investors’ Philippine operations.

- Previous Article India-Myanmar Relations: Growing Multifaceted Bilateral Ties

- Next Article The Guide to Employment Permits for Foreign Workers in Laos