Salary, Individual Income Tax, and Social Security in Singapore

By Dezan Shira & Associates

Editor: Vasundhara Rastogi

It is important for companies operating and hiring employees in Singapore to understand the key elements of the country’s payroll process and stay updated on the latest regulatory changes when computing salary and social security contributions.

Salary

Salary Definition

The Employment Act of Singapore defines ‘salary’ as all remuneration including allowances, base salary, bonuses, commissions and incentives, payable to an employee for work done under the contract of service. Salary does not include:

- Any reimbursement made for expenses incurred by the employee during work;

- Allowances for travelling, food, housing, medical and other amenities;

- Goodwill payment or gratuity payable on retirement;

- Retrenchment benefits payable; or

- Pension or provident fund contributions paid by the employer.

![]() RELATED: International Payroll & HR Solutions from Dezan Shira & Associates

RELATED: International Payroll & HR Solutions from Dezan Shira & Associates

Salary is subject to mutual agreement between the employer and the employee. An employer in Singapore is not bound by any statutory requirements on minimum salary. However, while hiring foreign employees, the employer must consider the minimum salary requirements relevant to obtain various employment passes. The most commonly applied work passes are illustrated below:

Salary Computation

Salary is calculated on the basis of a complete calendar month, irrespective of the total number of days in a month. An incomplete month would refer to a month in which an employee

- starts employment after the first working day of the month

- leaves employment before the end of the month

- takes any unpaid leave during the month

- is on national service reservist training during the month

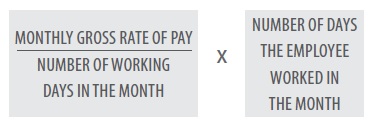

The formula for calculating salary for an incomplete month is as below:

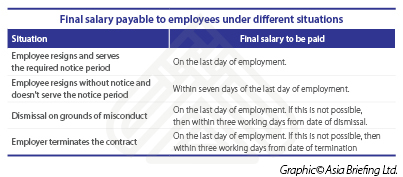

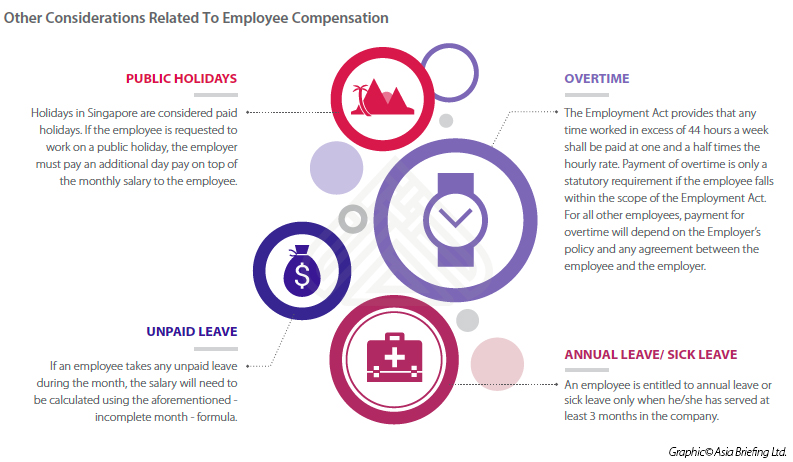

Under the Employment Act, an employer must pay salary to his employees at least once a month. The employer may also pay the salary at shorter interval if they choose. Salary must be paid within seven days after the end of the salary period. Or, in case of overtime work, within 14 days after the end of the salary period. Under other circumstance, salary payable is given in the table below:

Individual Income Tax

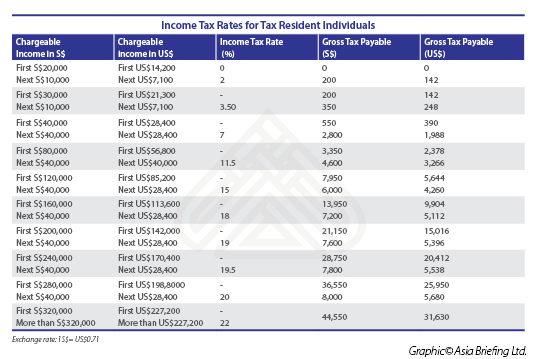

Singapore’s tax system is progressive in nature, which means higher income earners pay a proportionately higher tax, with taxes currently ranging from zero to 22 percent. Individual income tax in Singapore is payable on an annual basis and is imposed only on the income sourced within the country. The income earned outside Singapore is exempt from taxation.

Taxable Persons

The income tax liability of the taxpayer is determined by the taxpayer’s residency status.

An individual is a tax resident in Singapore if they are:

- a Singaporean;

- a Singapore Permanent Resident who resides in Singapore; or,

- a foreigner who has lived or worked in Singapore for 183 days or more in the previous calendar year

If an individual is employed for three consecutive years in Singapore, however, said person will be considered a tax resident for those years – even if such a person was not physically present in Singapore for 183 consecutive days in all three years. Partnerships, including limited liability partnerships, are not liable to tax at the entity level. Instead, each partner is liable to tax on his share of income from the partnership.

Income Tax Rates for Non-Residents

Non-residents are taxed at the flat rate of 15 percent or the progressive resident rates whichever is a higher tax amount. There are 2 types of non-tax residency status:

- If the individual is physically present in Singapore for 61-182 days, his/her employment income is taxed at 15 percent or progressive resident rates, whichever is higher. Director fees and other income at taxed at 22 percent. The individual is not entitled to tax reliefs.

- For individuals who are employed for 60 days or less, their short-term employment income is exempt from tax. If the individual is a director of a company; a public entertainer; or a professional in Singapore, then the employment income is taxable in full at 15 percent or progressive resident rates, whichever is higher.

Withholding Tax

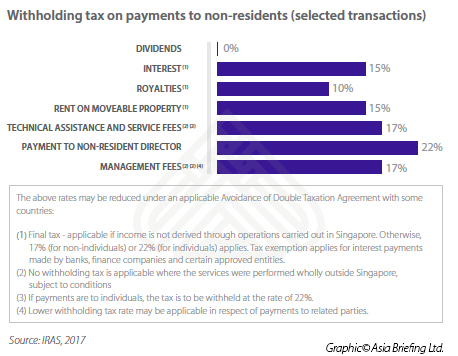

Under the Withholding Tax Act, a tax resident has a legal obligation to withhold a certain percentage of the payment when making payments of a specified nature to a non-resident and pay the amount withheld to IRAS.

Singapore does not have a “pay-as-you-earn” system. However, every employer in Singapore is required to participate in the Auto Inclusion Scheme (AIS), a mechanism through which employers submit their employees’ income information to the Inland Revenue Authority of Singapore (IRAS) electronically i.e. submission of form IR8E by March 1, each year. It is mandatory for all the employers with 10 or more employees, or who have received the “Notice to File Employment Income of Employees Electronically” to submit their employees’ income information to IRAS. The submission must be furnished to IRAS not later than March 1 of each year.

Between March 1 to April 18 each year, individuals may file for their taxes electronically. The information provided under the AIS is pre-filled on the employees’ electronic tax returns, and is included in their respective income tax assessments. In Singapore, the basis period for the year of assessment starts on January 1 and ends on December 31 of the same year.

RELATED: Payroll Processing and Compliance in Singapore – New Issue of ASEAN Briefing Magazine

RELATED: Payroll Processing and Compliance in Singapore – New Issue of ASEAN Briefing Magazine

Social Security

Central Provident Fund (CPF)

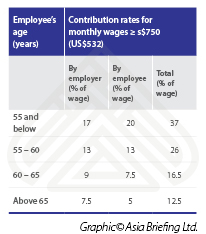

CPF is a comprehensive social security scheme that upholds the financial security of Singapore citizens and permanent residents. It addresses home-ownership, asset enhancement, medical requirements and the protection of dependents. CPF Act makes it mandatory for employers and employees to make CPF contribution based on the rates set by the CPF board (table). CPF contributions payable should be based on the employee’s actual total wages earned for the calendar month; this includes additional payments such as overtime pay, cash incentives, allowances, commissions, bonuses.

CPF contributions are not payable on items such as reimbursements, termination benefits (such as retirement gratuities) and gifts in kind. Employers are exempted from making CPF contributions for foreign employees on Singapore employment/professional visit pass or work permit. However, CPF contributions are required once the foreign employee obtains Singapore permanent resident status. Employers must pay the employer’s and employee’s share of CPF contribution monthly for all employees within a period of 14 days after the end of the month. Employers who fail to do so might face penalties or fines.

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in ASEAN 2017

An Introduction to Doing Business in ASEAN 2017

An Introduction to Doing Business in ASEAN 2017 introduces the fundamentals of investing in the 10-nation ASEAN bloc, concentrating on economics, trade, corporate establishment, and taxation. We also include the latest development news for each country, with the intent to provide an executive assessment of the varying component parts of ASEAN, assessing each member state and providing the most up-to-date economic and demographic data on each.

Payroll Processing and Compliance in Singapore

Payroll Processing and Compliance in Singapore

In this issue of ASEAN Briefing, we discuss payroll processing and reporting in Singapore as well as analyze the options available for foreign companies looking to centralize their ASEAN payroll processes.We begin by discussing the various regulations that impact salary computation, and tax and social security calculation in Singapore. We then explore the potential for Singapore to emerge as a premier payroll processing center in ASEAN. Finally we consider the benefits of outsourcing payroll – both Singapore-based and ASEAN-wide – to a reliable third-party payroll processing provider.

- Previous Article Import and Export Procedures in Myanmar – Best Practices

- Next Article Import and Export Procedures in Malaysia – Best Practices