Sourcing Talent in ASEAN: A Guide to Regional Opportunities

By Dezan Shira & Associates

Editor: Maxfield Vandel Brown

With over 625 million inhabitants spanning 10 member states, ASEAN is endowed with a diverse workforce capable of supporting a multitude of manufacturing and service based investments. For those exploring opportunities or actively investing in the region, the benefits of being able to house entire value chains within the bloc must simultaneously be tempered with an understanding that availability of talent and the regulatory conditions under which staffing takes place are largely determined at the member state level. Navigating the dynamics of individual members is therefore a critical precursor to narrowing a search for opportunity within ASEAN and an integral component of strategic planning and expansion.

Assessing talent hubs in ASEAN

The most immediate staffing consideration for investors regards the type of labor that a given investment will require. While ASEAN can provide a wide range of skillsets to meet all ends of the value chain, the availability of talent is not uniform across the region. Per the World Economic Forum, markets’ ability to attract investment, and thus provide profitable opportunities, hinges on sets of variables unique to the stage of development of the economy in question. Offering investors arguably the most divergent economic conditions of any regional bloc, ASEAN states range from low income jurisdictions to some of the most advanced economies in the world. Broadly speaking, talent within ASEAN can be categorized within three pools outlined by the World Economic Forum’s Global Competitiveness Report of 2016-2017.

![]() RELATED: Payroll and Human Resources Services from Dezan Shira & Associates

RELATED: Payroll and Human Resources Services from Dezan Shira & Associates

Factor driven

Characterized by low levels of education and incomes, factor driven economies in ASEAN are best positioned to provide low cost manpower for the execution of basic manufacturing. Enjoying lower wages than China and many other traditional manufacturing locations, Cambodia, Laos, and Myanmar are rapidly becoming choice locations within ASEAN for China plus one production. Under a China plus one arrangement, ASEAN’s factor based economies would provide the basic components for more complex production lines based in China.

Alternatively, factor based jurisdictions can also effectively serve as low cost production hubs for consumer goods targeting ASEAN’s emerging middle class. Following years of strong FDI inflows, consumer spending is flourishing in Indonesia, and similar trends are expected to hit critical mass in the Philippines and Vietnam by as early as 2018.

Although costs within factor driven economies tend to be extremely competitive, institutions within these states often lack transparency and lag on the enforcement of labor regulation. It is therefore important to conduct thorough due diligence with contractors and to keep an eye on regulatory authorities for upcoming changes.

Efficiency driven

Boasting basic regulatory infrastructure and competitively priced labor, efficiency driven economies make up the bulk of nations within ASEAN. Broadly speaking, ASEAN states at this stage in their development can be utilized for increasingly complicated manufacturing, assembly of multiple components into more complex goods, and the provision of limited value add services. Including ASEAN members such as Vietnam, the Philippines, and Thailand, efficiency based talent hubs are largely characterized by higher levels of education and stronger regulatory infrastructure than found in factor driven economies.

The extent of education, infrastructure, and thus capacity to service differing areas of production is largely dependent on the extent of a country’s development. Those considering investment in economies such as Vietnam – which are in a transitionary phase between factor and efficiency driven competitiveness – may find sourcing high skilled talent for service employment to be difficult compared to more developed jurisdictions such as Thailand.

Innovation driven

At the high end of the value chain are Malaysia and Singapore – ASEAN’s innovation based economies. With technology and tools in place to provide professional services, conduct high value add manufacturing, and assemble complex components, competitiveness of talent within these economies is heavily dependent on education. Fortunately, institutions within both countries are well entrenched and investors should be confident that rule of law and procedures for handling contracts and labor disputes will be firmly observed. It should, however, be noted that concerns over mounting regulation of the labor market have arisen in recent years – particularly in Singapore.

The tradeoff between innovation economies in ASEAN is largely that of optimization for price. While Malaysia is certainly well on its way to foraging the competitiveness necessary to rival more developed competitors, it currently lags behind Singapore regarding hiring and firing practices, as well as flexibility in the determination of wages. Investors seeking a more fluid hiring environment as well as more education and expertise will naturally find Singapore to be a more enticing opportunity, while Malaysia will find appeal for those seeking slightly reduced advantages at a discounted price.

![]() RELATED: Labor Mobility in ASEAN: Current Commitments and Future Limitations

RELATED: Labor Mobility in ASEAN: Current Commitments and Future Limitations

Optimizing the onboarding process

Talent availability

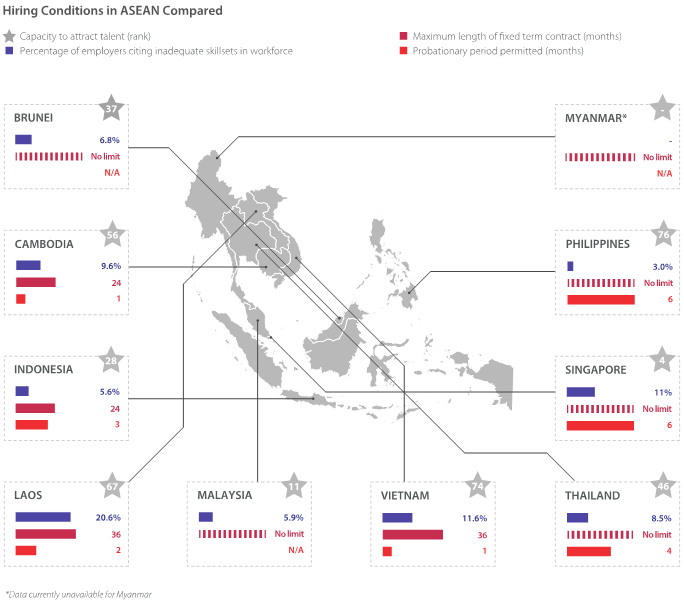

Irrespective of the human resources required for a given operation, availability of qualified workers is an issue of critical importance for every investment. In Singapore, for example, despite being ASEAN’s most advanced economy, more than 11 percent of business leaders interviewed by the World Economic Forum indicate struggles in sourcing qualified workers from domestic labor pools. At the other end of the developmental spectrum, nearly 20 percent of business leaders in Laos report similar concerns about sourcing qualified talent – a clear indication that, while the competitive position of markets may differ, the ability of markets to capitalize on these advantages remains tied to the ability of the workforce to meet external demand.

To mitigate the challenges of limited labor availability, it is highly recommended that thorough premarket entry analysis be conducted between ASEAN countries that provide the competitive advantages needed by a given investment. During this process, it is also worth considering the role that international sourcing of labor can play in managing domestic shortages of talent. The ability to attract and retain foreign personnel can vary significantly between markets, and, in some instances, provides a significant boost to otherwise sparse domestic labor pools.

General hiring considerations

Whether hiring domestic workers or sourcing labor from abroad, the conditions under which hiring takes place must be considered closely. Involving issues such as determination of salaries, social insurance obligations, and the regulation of onboarding – a concern for the sourcing of foreign workers in particular – labor market rules can have a significant impact on the ease with which labor pools in ASEAN can be exploited. While hiring conditions should be factored into decision making at all levels of the value chain, labor market optimization is of heightened importance in more developed markets such as Singapore and Malaysia. In these markets, absent the impediments of corruption and regulatory uncertainty that come to mind in jurisdictions such as Laos and Myanmar, compliance times and complexity of labor regulation often top investors’ lists as the most pressing challenge facing their investments.

Contracting

Upon the selection of markets and workers within them, understanding the structure of contracts is an important asset that can be utilized to the advantage of investments at all ends of the value chain. For low cost manufacturers seeking to fill large orders on short notice, hiring temporary workers can be a significant resource. In this regard, comparing caps on fixed term labor contracts allows for effective planning and can maximize flexibility in investment.

For more complex investments, particularly those where education and intangible skillsets are of great importance, the utilization of probationary periods can be an effective tool to vet employees and to test their abilities in the field. Understanding the limits on these trial periods is thus an important consideration with regards to compliance and planning.

This article is an excerpt from the December issue of ASEAN Briefing Magazine, titled “Human Resources in ASEAN.” In this issue of ASEAN Briefing, we discuss the prevailing structure of ASEAN’s labor markets and outline key considerations regarding wages and compliance at all levels of the value chain. We highlight comparative sentiment on labor markets within the region, showcase differences in cost and compliance between markets, and provide insight on the state of statutory social insurance obligations throughout the bloc. This article is an excerpt from the December issue of ASEAN Briefing Magazine, titled “Human Resources in ASEAN.” In this issue of ASEAN Briefing, we discuss the prevailing structure of ASEAN’s labor markets and outline key considerations regarding wages and compliance at all levels of the value chain. We highlight comparative sentiment on labor markets within the region, showcase differences in cost and compliance between markets, and provide insight on the state of statutory social insurance obligations throughout the bloc. |

![]()

Annual Audit and Compliance in ASEAN

For the first issue of our ASEAN Briefing Magazine, we look at the different audit and compliance regulations of five of the main economies in ASEAN. We firstly focus on the accounting standards, filing processes, and requirements for Indonesia, Malaysia, Thailand and the Philippines. We then provide similar information on Singapore, and offer a closer examination of the city-state’s generous audit exemptions for small-and-medium sized enterprises.

Managing ASEAN Expansion from Singapore

Managing ASEAN Expansion from Singapore

In this issue of ASEAN Briefing Magazine, we look at the benefits of using Singapore a hub for the management of regional operations throughout ASEAN. We firstly focus on the position of Singapore relative to its competitors, such as the Netherlands and Hong Kong. We then provide step-by-step instructions on corporate establishment, and provide expert insight on maximizing returns through the reduction respective tax burdens.

The Guide to Manufacturing in Indonesia

The Guide to Manufacturing in Indonesia

Choosing if, where, and how to establish foreign manufacturing operations in Indonesia can be a significant challenge. While the archipelago’s vast diversity may initially seem daunting, a number of options are available which will allow entry and operations to be conducted in a seamless manner. In this issue of ASEAN Briefing, we discuss Indonesia as a hub for manufacturing within Southeast Asia, and provide guidance on how to select and establish operations within the country.