The Benefits of Regional Management in Thailand

By: Dezan Shira & Associates

By: Dezan Shira & Associates

Editor: Eugenia Lotova

For companies with several offices, whether regionally or globally, it is important to identify a headquarters that provides management, support, financial assistance, and other services to offices and operations. As a variety of Southeast Asian economies continue to experience rapid growth and barriers between nations are reduced, the advantages of multi-jurisdictional supply chains grows ever greater. Establishing a regional headquarters in a Southeast Asian country can prove to be a worthwhile investment because it will allow the company to have access to the massive (Association of Southeast Asian Nations) ASEAN market.

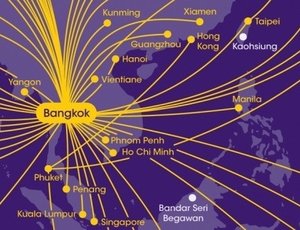

Singapore has been the traditional hub for regional management within the region, but as the ASEAN Economic Community comes into fruition, other countries are looking to increase their share of investment. Thailand has been at the forefront of this endeavor. With its highly developed infrastructure, strategic location, educated and cost effective labor source, Thailand presents itself as a great alternative to Singapore. Furthermore, Thailand’s government is incredibly pro-business and works hard to attract foreign investment. In May of 2015, the government authorized tax incentives for businesses in Thailand operating as an international headquarters (IHQ). This is the third law under the Regional Operating Headquarters (ROH) program. This article will explain the incentives offered under this law and how to qualify.

RELATED: Corporate Establishment Services from Dezan Shira & Associates

RELATED: Corporate Establishment Services from Dezan Shira & Associates

Incentives offered

This section enumerates some of the incentives investors can benefit from by establishing their IHQ in Thailand.

CIT: Companies can take advantage of many CIT exemptions for 15 accounting periods. It includes income from certain services related to overseas affiliates, royalties, dividends from overseas associated enterprises, income related to purchase and sales of goods from other branch offices, and sales income from out-out transactions.

Furthermore, investors may be applicable for a reduced CIT rate of 10 percent for 15 accounting periods on income related to provision of certain services and royalties.

Withholding Tax: Companies may be exempt from withholding tax for dividends sent from the IHQ. Non-treaty withholding rate on dividends is 10 percent and the interest and royalties rates can each be up to 15 percent.

Personal Income Tax: Expatriates employed by IHQs are eligible for reduced Personal Income Tax (PIT) at a 15 percent rate.

RELATED: The Guide to Corporate Establishment in Thailand

RELATED: The Guide to Corporate Establishment in Thailand

Qualifying for Incentives

As incentives are offered to both individuals and corporations, there are naturally slight differences in the requirements that each of these parties are subject to in Vietnam. For a company to qualify for the incentives, they must be incorporated in Thailand and comply with the following requirements:

Capital Requirements: all companies seeking to tap into incentives must have a minimum paid-up capital of THB 10 million (US$300,000). In addition, companies must be able to show and maintain annual operating expenses of a least THB 15 million (US$450,000).

Operational Requirements: Unlike a holding company which may be largely absent from the day to day operations of its subsidiaries, companies seeking to qualify for incentives, must prove that they provide support, management, or technical services to associated branches or companies. Examples of this include:

- Acting as a regional hub for the planning and administration of regional operations

- Acting as a hub for the sourcing of raw materials, components or finished products

- Conducting R&D that is utilized by operations throughout the region.

- Conducting marketing on behalf of regional subsidiaries

- Conducting training of subsidiary staff

- Providing accounting, marketing, and other services to subsidiaries.

- Conducting economic, investment, and other analysis on behalf of regional subsidiaries.

The Application Process: For companies to receive approval from incentives, they must apply with the Director-General of the Revenue Department and comply with other applicable law and regulations.

Qualifying for Incentives as an Individual: to qualify for the reduced PIT rate offered under IHQ incentives, individuals must be working for an IHQ. To prove this, companies must submit an application to the Director-General of the Revenue Department. Once this has been received, incentives will be applied.

Key Things to Watch

While these incentives can prove too tempting of an opportunity to pass up, the entire process can become convoluted and incredibly time consuming. According to the World Bank Group, in 2016, Thailand ranks 49th in ease of doing business and 96th for starting a business. Before applying for incentives, it is important to have a thorough understanding of the application process and the bureaucracy involved.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Annual Audit and Compliance in ASEAN

For the first issue of our ASEAN Briefing Magazine, we look at the different audit and compliance regulations of five of the main economies in ASEAN. We firstly focus on the accounting standards, filing processes, and requirements for Indonesia, Malaysia, Thailand and the Philippines. We then provide similar information on Singapore, and offer a closer examination of the city-state’s generous audit exemptions for small-and-medium sized enterprises.

The Trans-Pacific Partnership and its Impact on Asian Markets

The Trans-Pacific Partnership and its Impact on Asian Markets

The United States backed Trans-Pacific Partnership Agreement (TPP) includes six Asian economies – Australia, Brunei, Japan, Malaysia, Singapore and Vietnam, while Indonesia has expressed a keen willingness to join. However, the agreement’s potential impact will affect many others, not least of all China. In this issue of Asia Briefing magazine, we examine where the TPP agreement stands right now, look at the potential impact of the participating nations, as well as examine how it will affect Asian economies that have not been included.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.