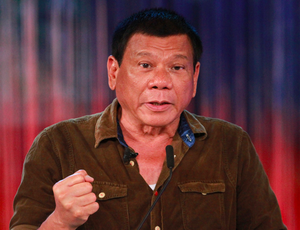

Rodrigo Duterte’s Economic Vision: The Punisher’s Plans for the Philippines

By: Alexander Chipman Koty

By: Alexander Chipman Koty

As Philippine president-elect Rodrigo Duterte prepares to take office on June 30, investors and business people both at home and abroad are wary of how the audacious politician will impact the country’s booming economy. Under President Aquino, the Philippines enacted several liberal macroeconomic reforms and experienced an average GDP growth rate of 6.2 percent, leading the Oxford Business Group to name the country the best economy in South East Asia. However, widespread anger over elitism, corruption, inequality, and crime catapulted the controversial politician to the country’s highest office despite little explanation of his economic policies.

Duterte has made international headlines for his crude and seemingly off-the-cuff anti-establishment remarks, while drawing anxiety from some corners due to his uncompromising tough on crime approach and implicit support for extrajudicial vigilante killings, giving him the monickers “Duterte Harry” and “The Punisher”. His populist campaigning, self-description as a socialist, lack of commitment to the rule of law, and remarks that he does not know much about economics or care about the stock market have unnerved investors who fear a reversal of the previous administration’s liberal economic reforms.

To allay these anxieties, Duterte recently announced an eight-point economic plan setting out his agenda to maintain the Philippines’ vigorous growth. The plan addresses rural development, tax reform, corruption, education, tourism, ease of doing business, foreign investment, and public-private partnerships.

Despite Duterte’s fiery and unpredictable rhetoric, he appears set to continue former president Benigno Aquino’s reforms and further open up the Philippines to foreign investment. While Duterte’s presidency promises to be eventful and campaign pledges may not ultimately be wholly fulfilled, investors can take solace in his reassurances to the business community and commitment to attracting foreign investment.

Law and Order

Duterte’s principal campaign promise to strengthen law and order features prominently in his economic plans. Duterte contends that eliminating gangs and organized crime will reassure investors wary of entering the Philippines due to concerns over their own personal safety. He touts his experience as mayor of Davao, where rampant lawlessness once earned the city the designation the “Nicaragua of Asia”, but now boasts the lowest crime rates in the country and strong foreign investment.

In addition to expunging urban crime, Duterte has pledged to quell ongoing conflicts and insurgencies with Islamist and Communist rebels in the South, principally on the island of Mindanao. While Duterte is notoriously ruthless on crime, even admitting to killing criminals himself, he has signaled his openness to enter peace talks with rebels. If successful, he plans to promote the area – the Philippines’ second largest island and home to over 20 million people – for tourism, agriculture, and infrastructure investment.

RELATED: Pre Investment and Market Entry Advisory from Dezan Shira & Associates

RELATED: Pre Investment and Market Entry Advisory from Dezan Shira & Associates

Corruption and Ease of Doing Business

As part of his efforts to cleanse the Philippines of crime and elite entitlement, Duterte stresses the importance of eliminating government corruption. The Philippines ranks 95th in Transparency International’s Corruption Perception Index, showing the pressing need for reform in this area. Duterte asserts that stamping out corruption will give greater guarantees and predictability to investments while safeguarding investors from unexpected fees and extortion.

Eradicating corruption ties in with his plans to improve the country’s feeble ease of doing business standards, as he says government red tape is “what investors don’t like.” Indeed, the country rates an unimpressive 106th for ease of doing business, according to the World Bank Group. To remedy this, Duterte aims to apply his “Davao model”, which he instilled as mayor of the city. He boasts that in Davao, processing government documents must be done within 72 hours and failure to do so must be justified to the Office of the Mayor. To further reduce corruption and government inefficiencies, he is also reducing the number of signatories required to issue a permit.

Lifting Foreign Investment Restrictions

Many of Duterte’s economic policies follow his well-known campaign commitments to wipe out crime in its various forms. Not to be overshadowed, though, is the potential for significant liberalization of foreign investment. Duterte has expressed interest in granting foreign investors access to sectors currently restricted to Philippine nationals and allowing them to own at least 70 percent and possibly up to 100 percent of companies they establish in the country, up from the current limit of 40 percent. Getting rid of the so-called 60:40 rule should pose a challenge, however, as it requires amending the country’s 1987 constitution.

Sectors that are currently heavily restricted to foreign access include:

- Mass media and broadcasting

- Retail trade

- Domestic shipping

- Pharmaceuticals

- Advertising

- Public services

- Small-scale mining

- Private security

- Utilization of marine resources

While there is no guarantee that all or even many currently restricted industries will be opened to foreign investment if Duterte successfully amends the constitution, there could still be significant opportunities on the horizon in these largely untapped sectors. Further, Duterte has also indicated support for joining the TPP, which in itself could require altering the constitution due to foreign ownership restrictions. However, it appears that he will maintain restrictions on foreign ownership of land, which is currently limited to long-term leasing.

Related: IMF Estimates Philippine Growth to Top 6% in 2016

Related: IMF Estimates Philippine Growth to Top 6% in 2016

Infrastructure Spending and Other Initiatives

Duterte’s team has put forward a variety of other measures to boost the economy, as outlined in the eight-point plan. To address the country’s infamous infrastructural deficits and congestion issues, Duterte has committed 5 percent of annual GDP to infrastructure spending. It is hoped that increased spending will improve tourism through upgraded transportation and stimulate the Philippines’ IT industry by enhancing the nation’s internet connectivity. Additional focus on education and the struggling agricultural sector are other target areas.

Tax reform is another goal, although the specifics remain vague. To wit, Duterte stated that “We need to be aligned with the tax system of our ASEAN neighbors. We need to be competitive. If investors see the tax system here is too punishing, they’re not going to invest here.” Duterte has expressed interest in pursuing a more progressive income tax system and more transparent bank secrecy laws, and these comments potentially open the door to lower corporate income tax as well. However, it remains to be seen what shape tax reform will specifically take.

Going Forward

Despite Duterte’s often incendiary rhetoric, the economic proposals he has put forward are largely a continuation of the previous regime’s liberalizations and are generally pro-business. Many of his proposals ultimately might not succeed: eliminating crime in a nation of over 100 million, ending decades-old insurgencies, and amending the constitution are not tasks that can be done overnight. Further, his economic policies remain vague, and lack timelines and strategies for implementation. Even if he does not attain all his goals during his six year term, however, investors can heed his advice for the business community to “relax” due to the policy continuity he has put forward.

Still, there remains potential for political instability during Duterte’s tenure as president. Although he stresses the importance of law and order and creating a stable environment, he himself has threatened to skirt the rule of law. Reintroducing the death penalty, supporting extrajudicial killings, transitioning the country into a federal parliamentary system, and amending the constitution could all introduce serious political crises. Indeed, Duterte has threatened to dissolve parliament and create a revolutionary government if MPs do not follow his orders, giving credence to his critics’ fears of dictatorial strongman rule. Separating rhetoric from policy, as well as awareness of jokes and cultural references that could be lost in translation, is crucial to decipher Duterte’s proposals. Although it might not be a smooth presidency, Duterte may very well attract foreign investment into his country that, while growing steadily, has traditionally lagged behind its ASEAN peers in that area.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Annual Audit and Compliance in ASEAN

For the first issue of our ASEAN Briefing Magazine, we look at the different audit and compliance regulations of five of the main economies in ASEAN. We firstly focus on the accounting standards, filing processes, and requirements for Indonesia, Malaysia, Thailand and the Philippines. We then provide similar information on Singapore, and offer a closer examination of the city-state’s generous audit exemptions for small-and-medium sized enterprises.

The Trans-Pacific Partnership and its Impact on Asian Markets

The Trans-Pacific Partnership and its Impact on Asian Markets

The United States backed Trans-Pacific Partnership Agreement (TPP) includes six Asian economies – Australia, Brunei, Japan, Malaysia, Singapore and Vietnam, while Indonesia has expressed a keen willingness to join. However, the agreement’s potential impact will affect many others, not least of all China. In this issue of Asia Briefing magazine, we examine where the TPP agreement stands right now, look at the potential impact of the participating nations, as well as examine how it will affect Asian economies that have not been included.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.