Philippine Aviation Industry Sees Strong Growth

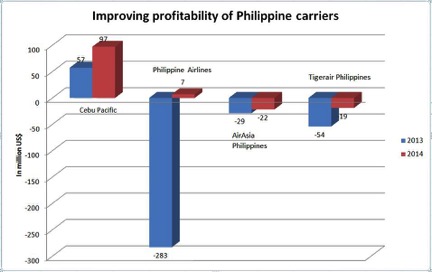

While 2014 was not a particularly good year for the aviation industry in Southeast Asia, the Philippines was an important exception to the wider trend. In a report released by CAPA, a global aviation think-tank, which looked at 18 airlines, it was found that out of the six airlines that were able to generate a profit in 2014, four of them were based in the Philippines: Philippine Airlines (PAL), Cebu Pacific, Tigerair Philippines, and Philippines AirAsia.

Other airlines on CAPA’s list were not so lucky, seeing their profits decline or their operating profits reduced due to challenging market conditions and overcapacity.

RELATED: The Cost of Business in the Philippines Compared With China

RELATED: The Cost of Business in the Philippines Compared With China

According to CAPA, “The Philippine market benefited from consolidation and capacity reductions while overcapacity plagued all the other major markets in Southeast Asia.” Other key reasons for the success of the Philippine airlines included:

- Improved market conditions in the country

- Aircraft delivery deferrals

- Lower fuel prices

M&A action

Mergers and acquisition (M&A) activity in the Philippines has resulted in the country’s airlines becoming much competitive in the region. In years past, the Philippines had numerous independent airlines, however, this number has now been reduced down to just four domestic carriers. One of the most recent of these mergers was the acquirement of the local unit of Tiger Airways by Cebu Pacific in 2014.

RELATED: Entry Strategy Advisory from Dezan Shira & Associates

RELATED: Entry Strategy Advisory from Dezan Shira & Associates

The M&A activity has had the dual benefit of reducing capacity and improving the bottom line of the remaining airlines. According to CAPA’s data, in 2014, Philippine Airlines saw the largest improvement both in the Philippines and in Southeast Asia, finally becoming profitable after suffering four years of losses. Philippines Airlines is also expanding the number of routes that it travels, in December the airline will start offering flights to Auckland, New Zealand, with a short stopover in Cairns, Australia.

In recent years, New Zealand has seen an influx of tourists from the Philippines, seeing a 9.4 percent increase in the annual number of arrivals in each of the past five years. Additionally, it is estimated that around 40,000 Filipinos currently live in the southwestern Pacific Ocean country. It is expected that the new flight route from the Philippines will bring 65,000 tourists a year to New Zealand.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email asean@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Tax, Accounting, and Audit in Vietnam 2014-2015

Tax, Accounting, and Audit in Vietnam 2014-2015

The first edition of Tax, Accounting, and Audit in Vietnam, published in 2014, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in Vietnam, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in Vietnam in order to effectively manage and strategically plan their Vietnam operations.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

The 2015 Asia Tax Comparator

In this issue, we compare and contrast the most relevant tax laws applicable for businesses with a presence in Asia. We analyze the different tax rates of 13 jurisdictions in the region, including India, China, Hong Kong, and the 10 member states of ASEAN. We also take a look at some of the most important compliance issues that businesses should be aware of, and conclude by discussing some of the most important tax and finance concerns companies will face when entering Asia.

- Previous Article Indonesia Extends Tax Holiday in Bid to Attract More Foreign Investment

- Next Article State by State: ASEAN and Texas Trade