Philippines Poised for Foreign Investment Sweet Spot

Op-Ed Commentary: Chris Devonshire-Ellis

The Philippines is set to be the new darling of emerging Asia as its national demographics, partnered with a liberal government reform policy, is beginning to attract a new wave of foreign investors. With GDP growth in 2013 at 7.2 percent despite the travails of Typhoon Yolanda, the nation is expected to maintain growth of between 7 to 8 percent, per annum, for the next ten to fifteen years.

The country is falling into the ‘demographic sweet spot’ – where a young generation of workers comes into effect with the lowest number of dependents, exactly the situation that empowered China for the past twenty years. This, together with a broad array of reforms enacted by the current government, have seen the Philippines have its debt upgraded to “investment grade,” a situation that allows institutional investors to include the country in their investment portfolios.

RELATED: Indonesia Prepares for Demographic Changes

Within ASEAN, the Philippines is the bloc’s second most populous nation, has a large domestic economy (the Philippines has a larger GDP than either Sweden, Switzerland or Austria), a large English-speaking and well educated workforce, and a burgeoning tourism industry. Gaming is also becoming an important part of the Philippines investment portfolio, with the casinos in Manila expected to be generating more gaming revenues than Las Vegas by 2018.

That said, the Philippines in the past has been prone to natural disasters, of which last year’s Typhoon Yolanda was a prime example. It also appears the nation dodged a bullet. As it was, the Typhoon hit northern areas, and devastated what were essentially coconut plantations. As a result, the disaster probably cost the nation a 1 percent drop in its overall GDP numbers. Yet had Yolanda hit Manila, the situation would have been far worse – the city provides about 30 percent of all Philippine growth and wealth. The Yolanda case has affected government policy as concerns investment in the Philippines in two main areas:

Climate Change is the New Normal

The Philippines’ government is now of the firm belief that climate change is occurring and that the strong weather patterns now emerging are the new normal state of affairs. To deal with this, infrastructure developments and all other plans need to take into account the new impact of strong weather systems developing. Typhoon Yolanda (also called Typhoon Haiyan in some countries), for example, was the strongest typhoon thus far ever recorded to have made landfall. Consequently, the government has introduced a “Build Back Better” scheme, in which areas damaged will be rebuilt, but using stronger materials and even have their economies changed.

RELATED: Typhoon Haiyan: Mitigating Natural Disaster Risk

For example, the area that Yolanda hit, Eastern Samar, has traditionally been a coconut growing area. With large swathes of the plantations now destroyed, and with the coco crop taking several years to reach maturity, alternative agricultural products are being looked at for the area. The government is identifying “high risk” zones and putting into place flood and water management systems to better deal with extreme weather.

Geographical Diversification

As mentioned, Manila represents some 30 percent of all Philippines’ GDP. The Government, having recently achieved what looks like lasting peace in the Southern island of Mindanao, now wish to diversify the Philippines’ economy in two factors.

Firstly, to establish trade and development hot spots in other areas of the country. Mindanao is the largest land mass in the Philippines and also closest in proximity to the rest of ASEAN. Cebu is also primed to be developed as a financial services area. Additionally, while some 30 percent of all Filipinos are engaged in the agricultural industry, they produce just 4 percent of the national GDP. Divesting into manufacturing and away from traditional industries most affected by severe weather will be a driver for reforms and attracting foreign investment.

In terms of the nation’s overall fiscal strength, the Asian Development Bank stated that Philippines foreign currency reserves were strong and “equivalent to 12 month’s worth of imports”. A bottleneck, it was noted, in the Philippines is energy. The nation is at a crossroads of whether to solve this by investing in coal power – which is cheap but polluting (as China is now finding out its cost) or to go for natural gas, which the Philippines has plenty of, is environmentally easier, but more expensive. That decision has yet to be made.

It was noted that the Philippines has also begun attracting business back from China, where wage rises and pollution are causing re-thinking amongst foreign manufacturers looking for global export markets. While some businesses “left” the Philippines twenty-to-thirty years ago to take advantage of the then-low China tax rates and labour costs, these businesses are now coming back to the Philippines. Some of this is heavy engineering – the Philippines for example is now the world’s fifth largest shipbuilder.

Tourism is another bright spot for the country, with 3.4 million tourists in 2013, expected to rise to 10.2 million by 2020, many from China. When asked whether the Chinese assertiveness over the South China Sea would have an impact on the Philippines’ trade, the Financial Secretary, Cesar Purisma stated that bi-lateral trade with China was in fact growing and that economic relations between the two neighbours were “unlikely” to be affected by the dispute.

RELATED: Competition Set to Take Off in ASEAN as Open Skies Policy Looms

Another major push for the Philippines is via ASEAN. ASEAN has a Free Trade Agreement with China that has reduced import-export tariffs on 90 percent of all traded goods between ASEAN nations and China to practically zero. As production costs in China increase, it makes sense to start building capacity in nearby countries that have lower operational overheads. The Philippines, along with Vietnam, is the closest to China (Hong Kong to Manila is less than two hours) and this is a trend that is likely to increase – manufacturing in the Philippines for export to China and elsewhere.

An average working salary in Manila is about US$500, compared with US$760 in Guangzhou, plus a further 50 percent welfare cost on top of that in China. The net effect being that Filipino total worker overheads are about 50 percent of those now in China.

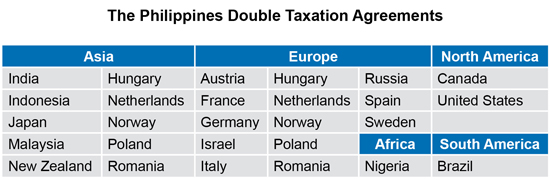

The Philippines also has a Double Tax Treaty with China, which can additionally reduce some operational costs when trading and investing between the two countries. There are significant treaties also with the United States, India and numerous European and Asian nations.

In summary, the Philippines is now emerging as a confident, wealthy nation now able to provide an educated, young and largely English speaking workforce at competitive rates. With improving fiscal performance, a stable and energetic democracy and foreign investment laws and the future direction of the country being well thought out, the Philippines can now be regarded as an alternative to China for export manufacturing. As the global ratings agencies have identified, the Philippines is now investment grade status and must now be regarded as one of the ASEAN pillars for foreign investment and growth.

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates – a specialist foreign direct investment practice providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Are You Ready for ASEAN 2015?

Are You Ready for ASEAN 2015?

ASEAN integration in 2015, and the Free Trade Agreements China has signed with ASEAN and its members states, will change the nature of China and Asia focused manufacturing and exports. In this important issue of Asia Briefing we discuss these developments and how they will impact upon China and the Global Supply Chain.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

FDI and Infrastructure Development in the Philippines

Work Visa Procedures in the Philippines

- Previous Article Malaysia’s 2013 FDI Soars to Record High

- Next Article Why ASEAN is Appealing for Manufacturing as Costs in China Keep Rising